Evan Frazier, CFA, CAIA

Senior Research Analyst

The S&P 500 Index pulled back by more than 2% yesterday in a move that is not unprecedented based on the history of the benchmark. Specifically, the bellwether equity index has averaged a return of roughly -0.7% in the month of September dating back to 1928, which is particularly striking given that average performance of the benchmark has been positive in every other month of the year. There are several possible explanations for the potential anomaly that some have dubbed the “September Effect.” First, sales by investors returning from summer vacations aiming to lock in taxable gains or losses prior to the end of the year could be a driving force behind lackluster September returns. Additionally, September could see higher levels of equity sales due to market participants seeking to fund tuition costs for their children prior to a new academic year. The September Effect could also be seen as a self-fulfilling prophecy, as expectations for poor near-term equity returns could lead to widespread investor selling.

It is important to highlight a few points related to the September Effect that may assuage concerns related to equity performance over the coming weeks. First, many economists chalk the September Effect up to pure chance, given that any persistent market anomaly would be exploited by investors, causing it to disappear over time. It is also important to remember that the S&P 500 Index has actually notched a positive return in roughly 52% of September months dating back to 1928, meaning that the average figure cited in the first paragraph is skewed by a few negative observations of significant magnitude. As it relates to this year, several factors could buoy equity prices in the near term, including resilient corporate earnings, moderating inflation, and a high probability of a reduction in interest rates by the Federal Reserve at its meeting later this month. While challenges also face equity markets at present, market participants should remain disciplined as it relates to portfolio allocation and adhere to long-term investment policy objectives. Indeed, while the September Effect may serve as a notable phenomenon worthy of additional study, it ultimately should not factor into the investor decision making process.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

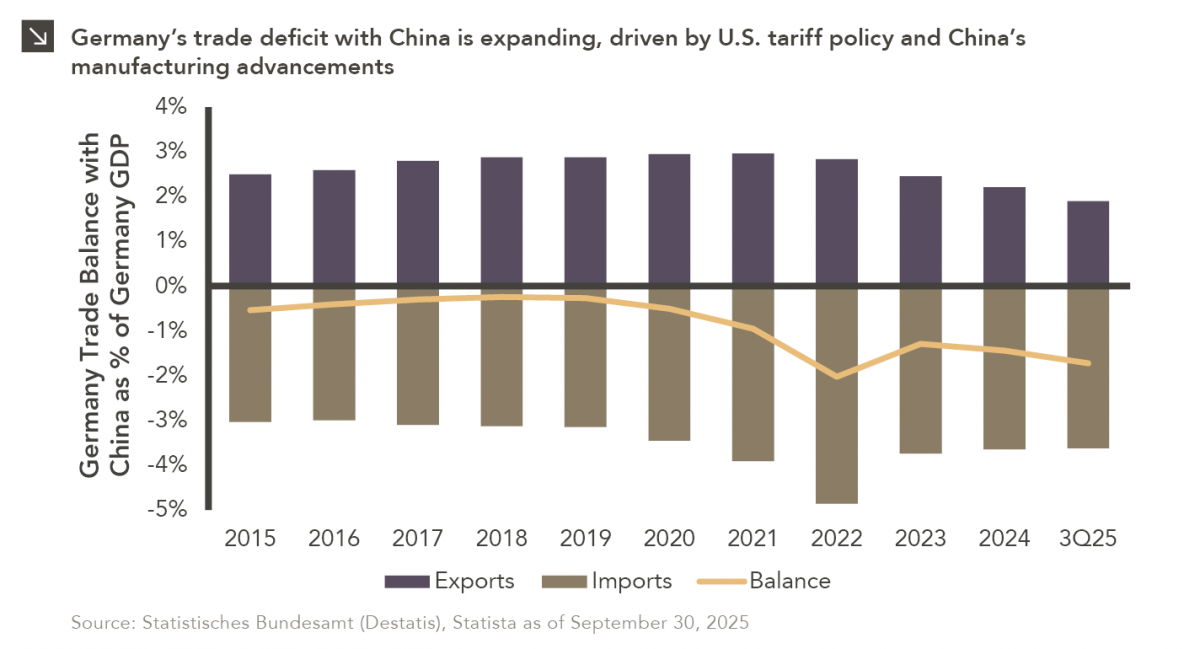

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

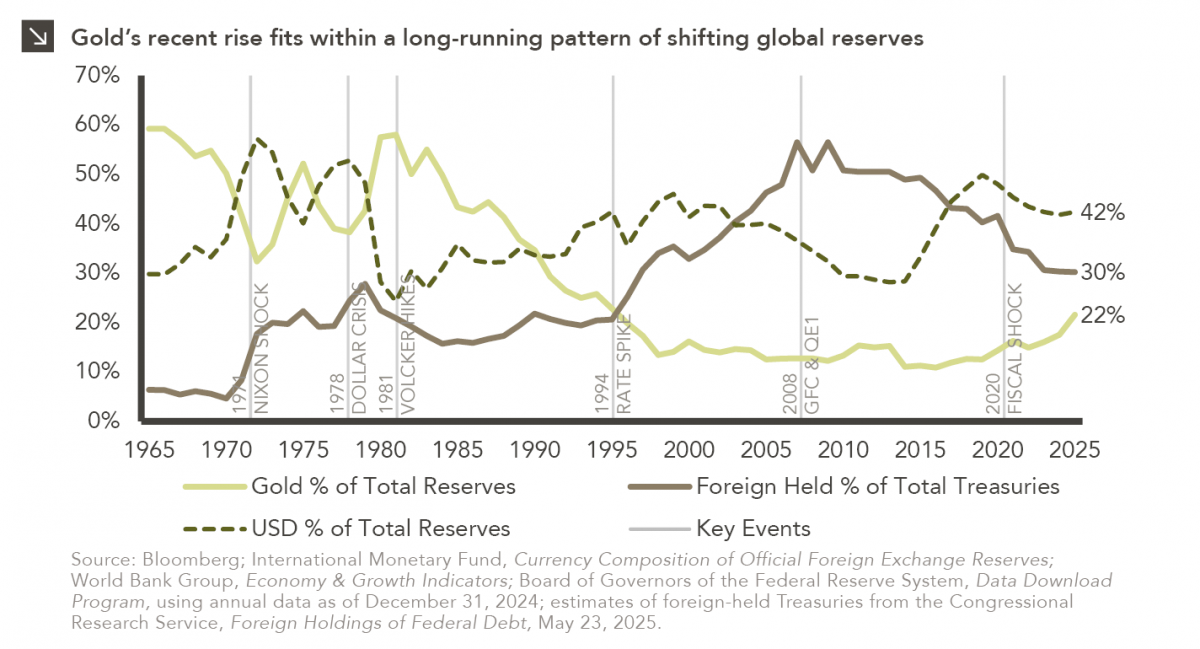

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >