Greg Leonberger, FSA, EA, MAAA, FCA

Partner, Director of Research

This summer’s unusually hot weather combined with little rain is shaping up to have a profound impact on corn yields for 2012. At the close of trading on Monday, corn futures settled at $7.75, up 40% since June 1, and 12% since July 1. These radical increases in price are a clear reflection of small yields for corn, and thus lower supply to meet both domestic and foreign demand. Further compounding the corn outlook is weather forecasts, which continue to predict below average rainfall for the next few weeks. As a result, we are likely to see further increases in corn prices.

What does it all mean for investors? If one is long corn via a futures contract or commodities fund, this news is likely accretive. However, for companies that rely on corn as a key input for production, this represents an added cost of production and a drag on profitability. For consumers, higher corn prices will probably equate to higher grocery bills.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

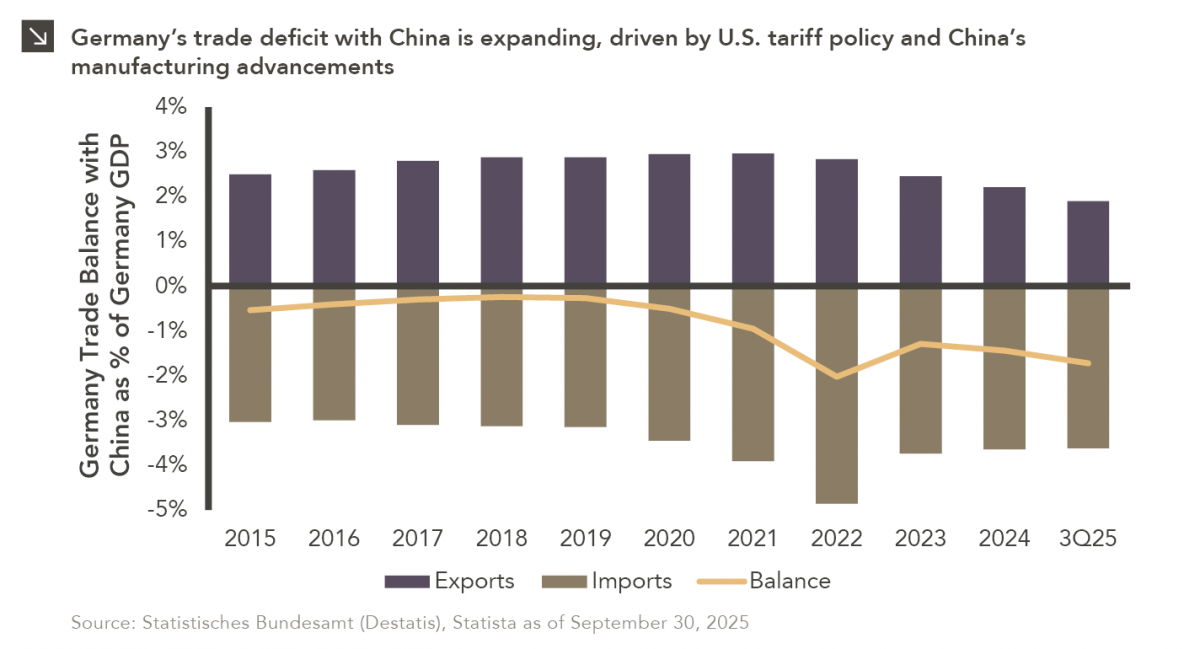

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

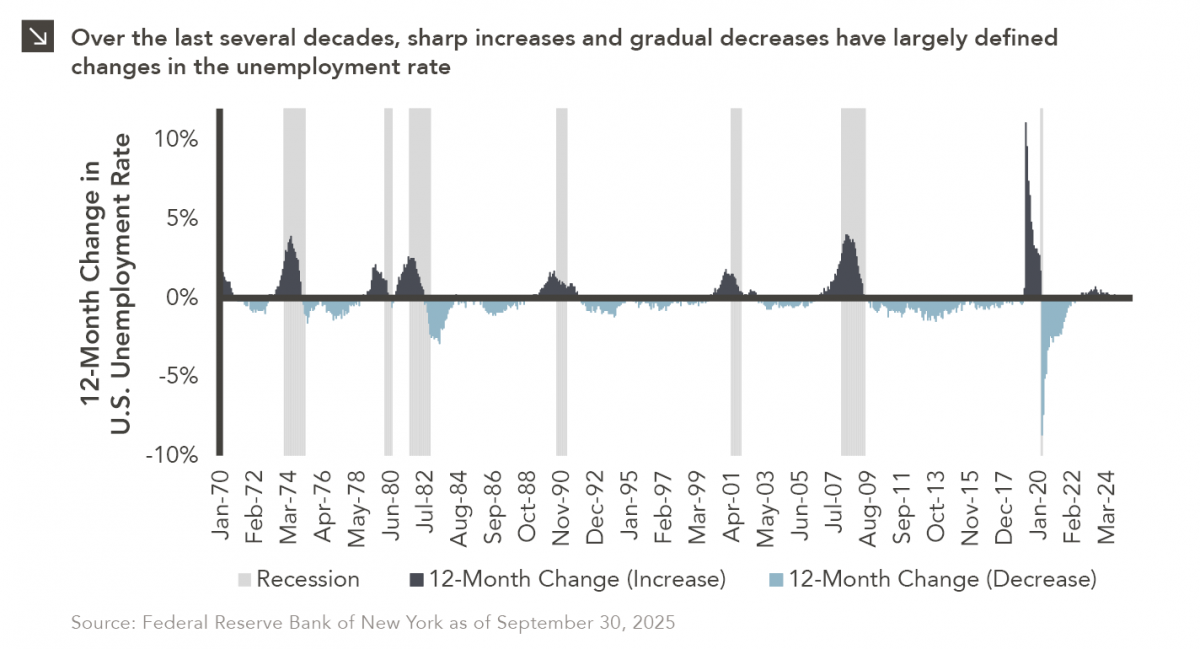

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

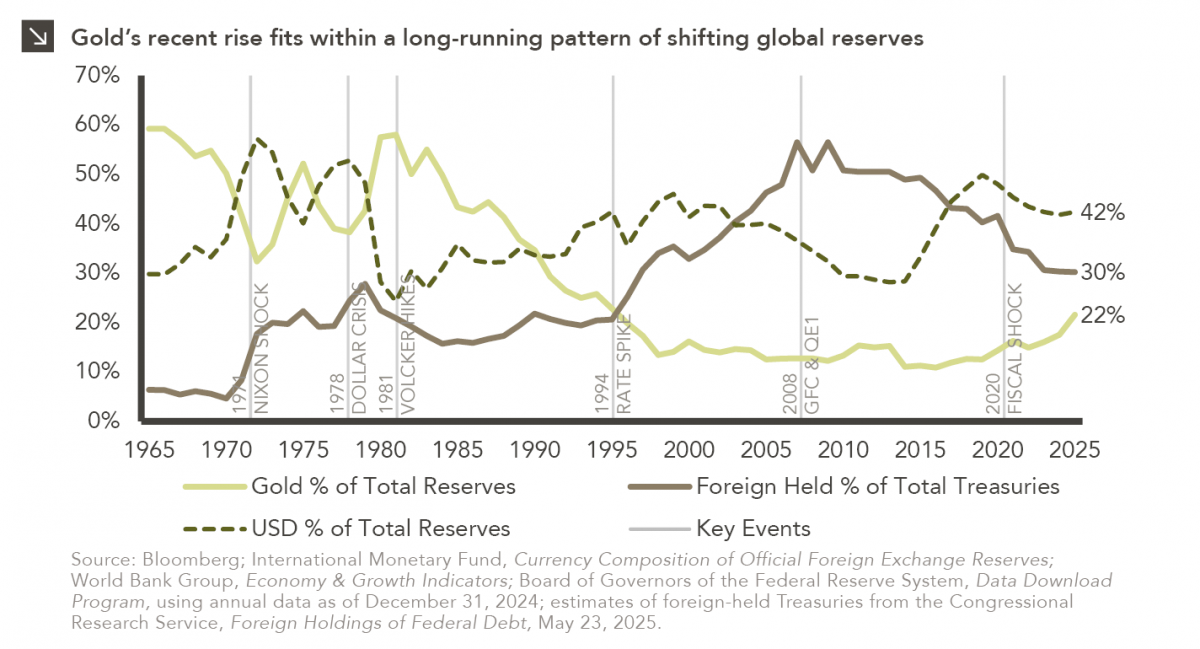

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

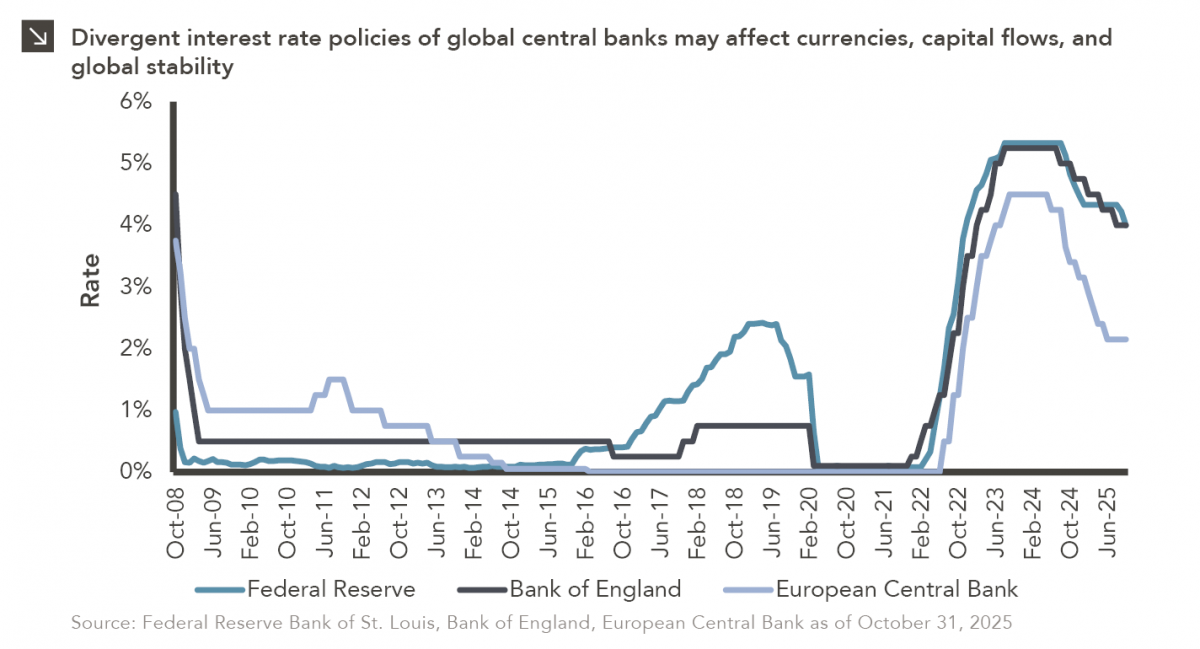

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >