Neil S. Capps, CAIA, FDP

Partner, Director of Client Service

Given the volatility of the global markets in recent years, foreign currencies have become a substantial factor to consider when investing in non-U.S. securities. The BRICs (Brazil, Russia, India, and China), generally known as the most influential emerging markets, are experiencing various situations that have had a negative effect on their respective currencies. Brazil has seen a resurgence in its consumer default rate as previous bad loans are manifesting themselves. Many analysts believe that this is similar to the recent subprime loan collapse in the United States, as the consumer debt default rate reached 7.6% in April. India is in danger of losing its investment grade rating due to trade and budget deficits. Russia’s main export of crude oil has suffered a 26% drop in price this quarter alone, driving investors to more stable nations. China has avoided the major drops that other currencies have versus the dollar, and the economic policies have thus far kept the currency value at a secure value, though it dropped over 1% in the second quarter. Furthermore, home prices fell in 54 of 70 cities tracked in China during the month of May. China has also reduced its annual growth target to 7.5% from 8.0% due to the slowing of demand for its exports as consumer demand in other nations has been sluggish.

The weakening currencies could present an opportunity for investors looking to enter emerging markets, as it may increase the competitiveness of the emerging markets countries affected, and hurt corporations based in developed countries with strong presence in the BRICs. For example, analysts believe the currency effect in Brazil will be a significant headwind this quarter for Coca-Cola Co., which has been investing heavily in South America and has experienced substantial growth in the region.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

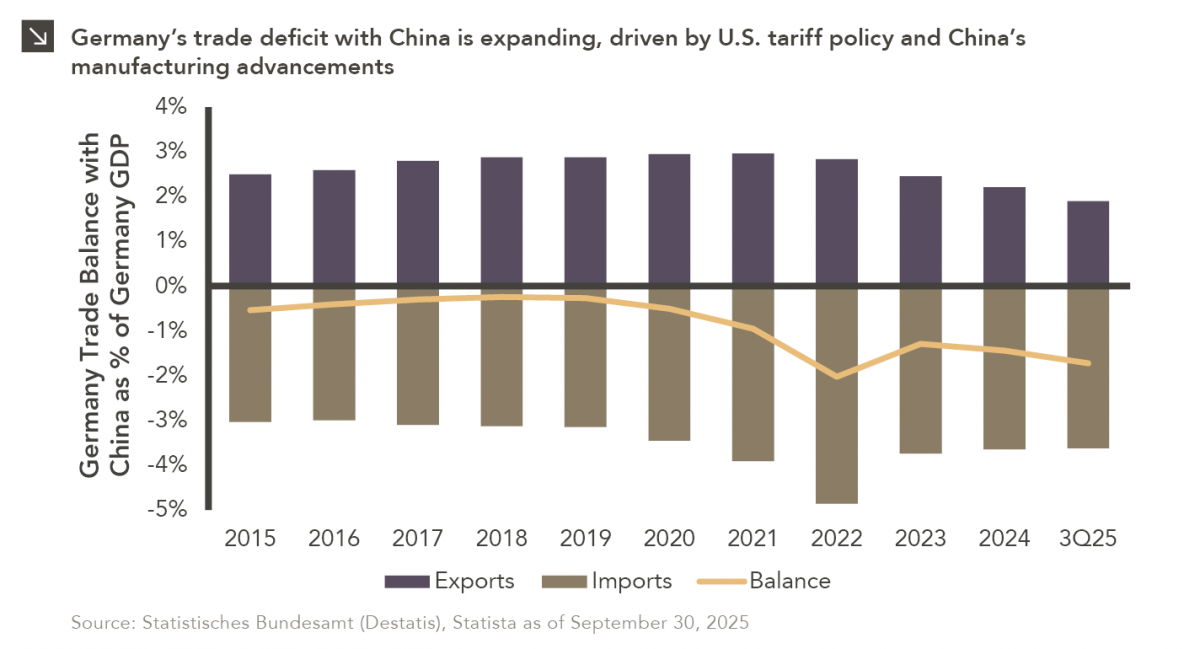

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

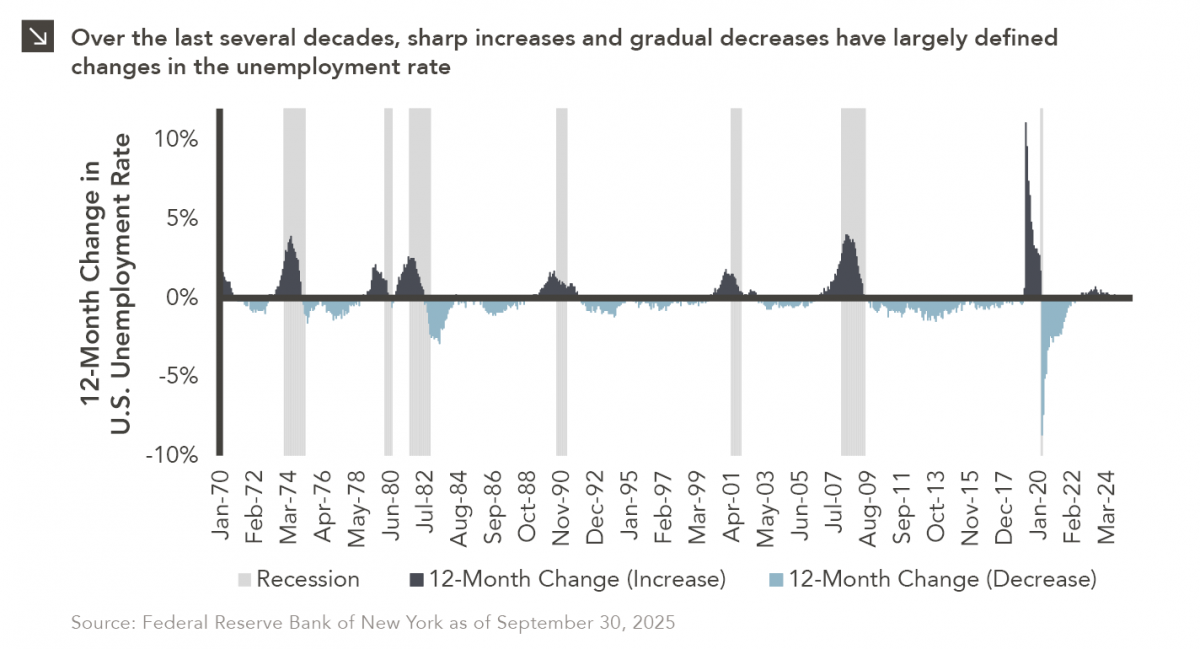

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

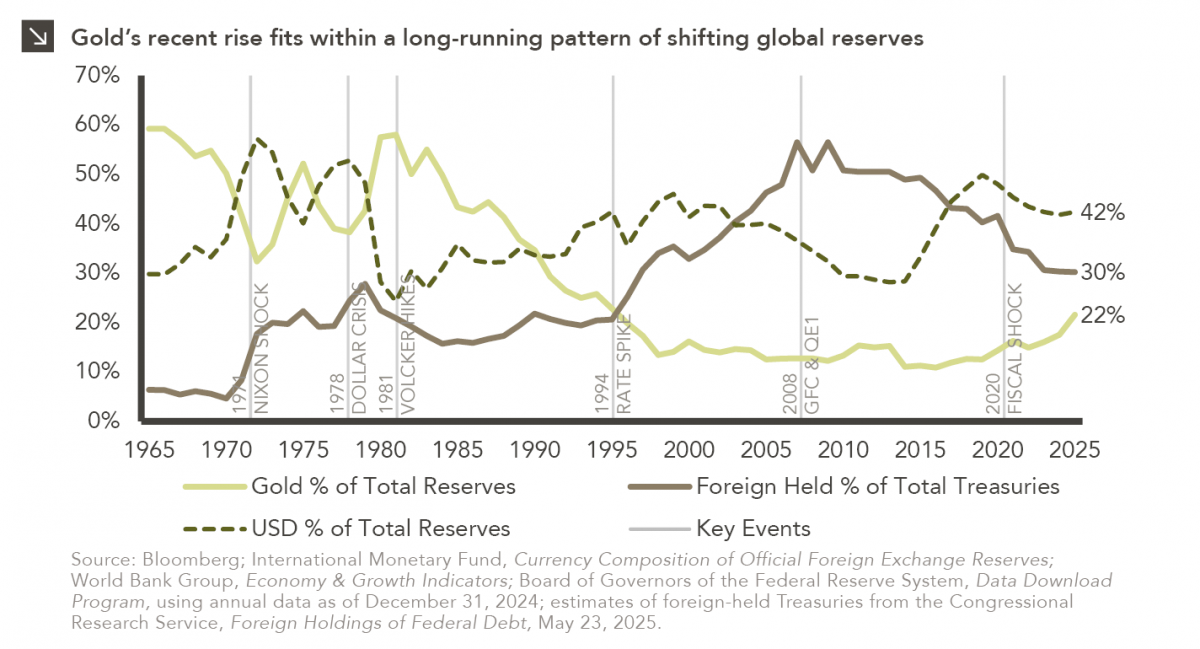

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

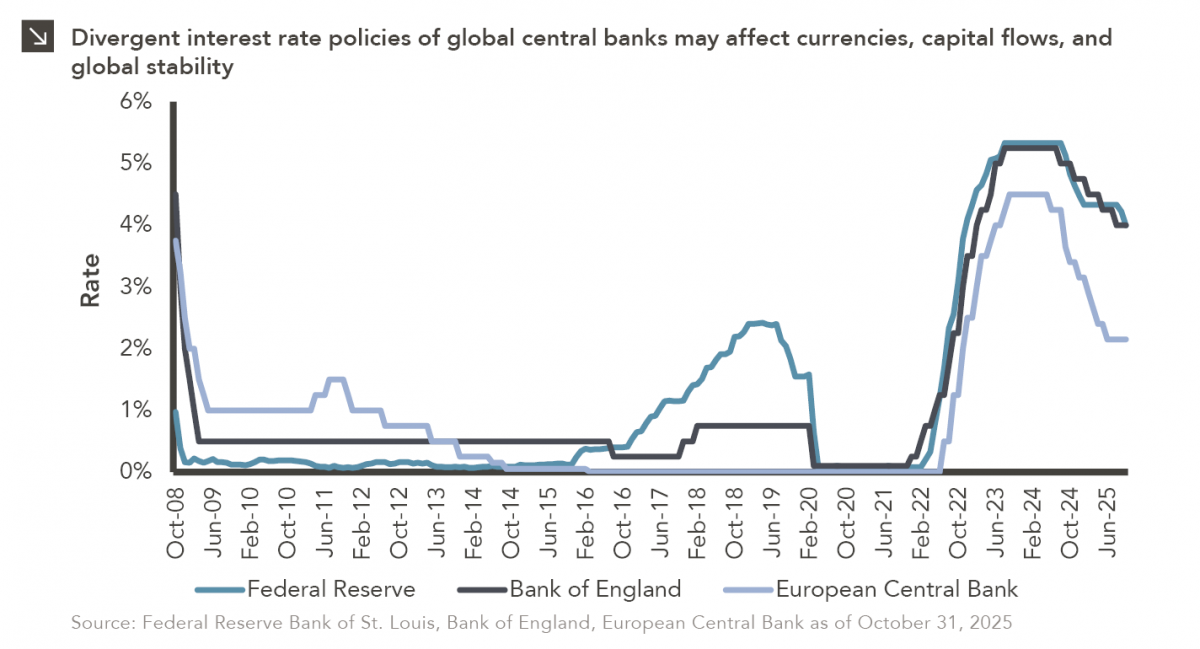

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >