Greg Leonberger, FSA, EA, MAAA, FCA

Partner, Director of Research

For all the press coverage of rising gold and oil prices, commodity prices during the first half of 2011 showed a tremendous degree of dispersion across different sectors. Silver saw the greatest increase in value as it rose by more than 12%, but wheat fell by more than 26%, thus creating a spread between best and worst of almost 40%. Despite hitting a price of $1,600 / ounce earlier this week, gold rose by less than 6% through the first 6 months of 2011; in fact, only 6 of the 14 commodities on the chart actually increased in price. The main take away from this chart? Commodity investors must have a keen understanding of their underlying exposures, as the large dispersions of individual commodity returns can lead to vastly different results across products and strategies.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

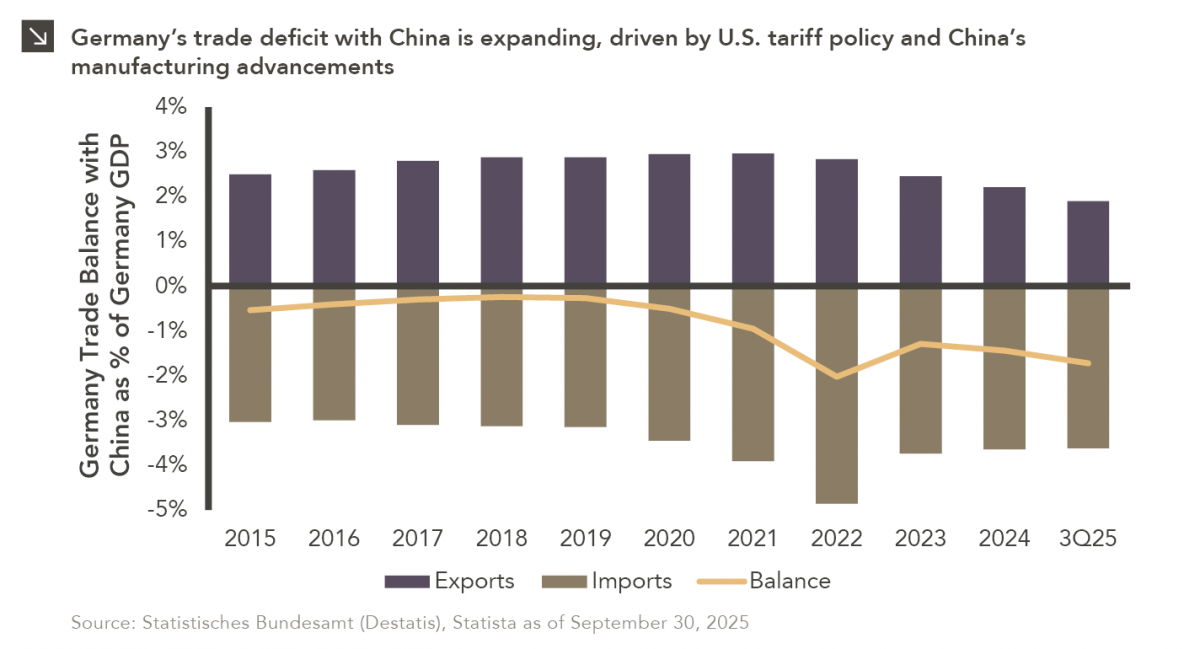

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

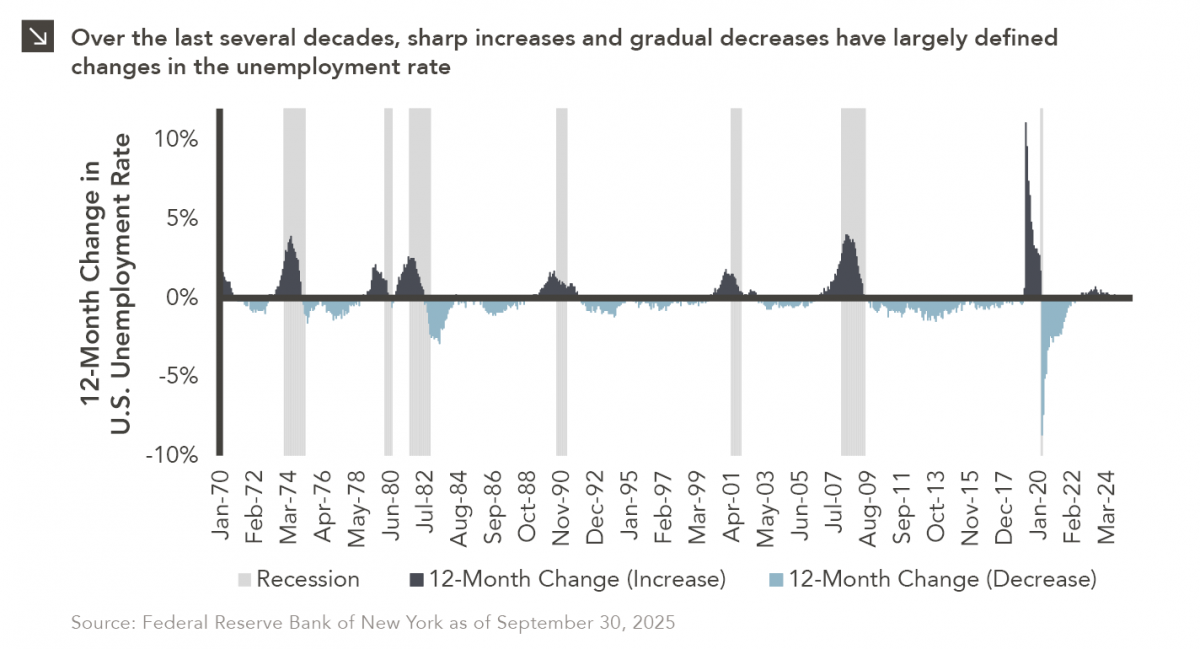

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

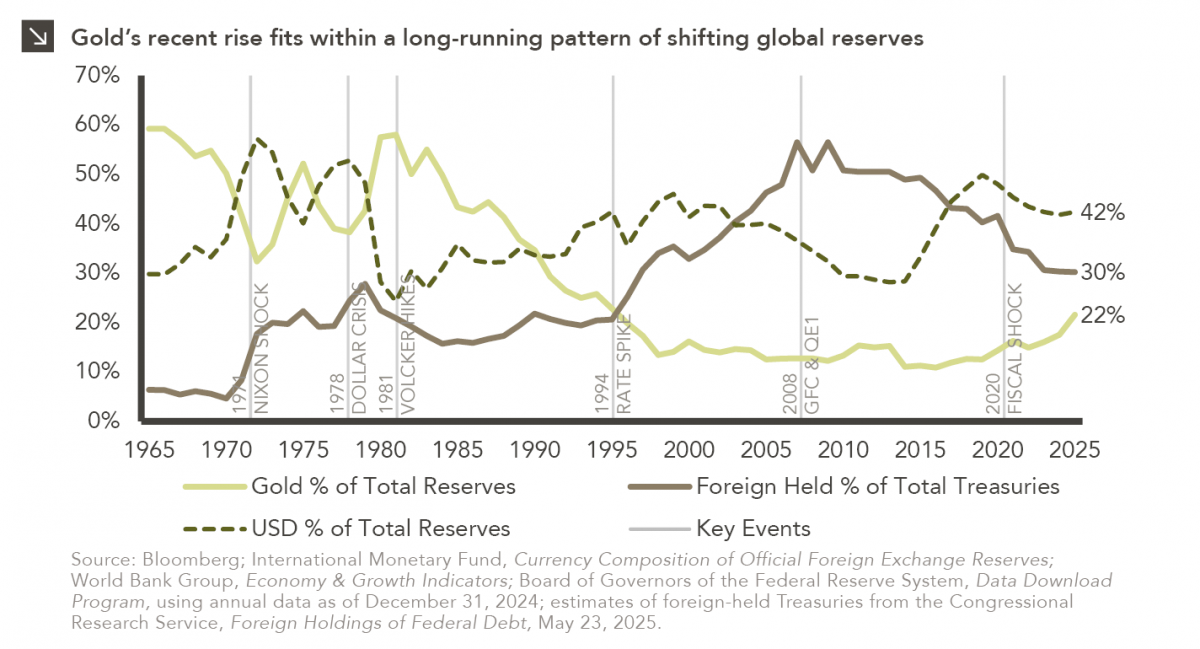

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

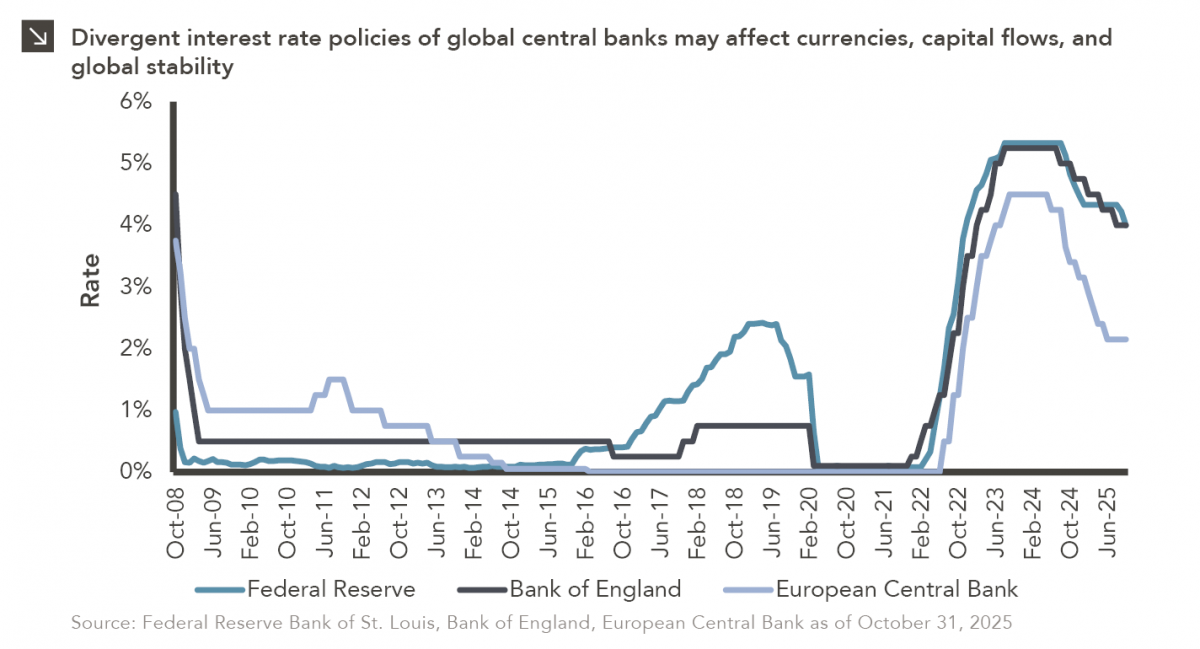

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >