Evan Frazier, CFA, CAIA

Senior Research Analyst

Quite simply, this has been the worst start to a year since the 1930s:

2022 to date has featured a myriad of macroeconomic factors coming to a head: inflation at its highest level since the 1980s, the Federal Reserve responding with aggressive rate hikes, and increasing concerns about the health of the consumer leading to a possible recession. An evolving pandemic, a war in Eastern Europe, and draconian lockdown policies in the world’s second-largest economy and largest manufacturing hub have further added to the problem and complicated the solution. With these macro headwinds and uncertainties driving markets year-to-date, Marquette’s fixed income, U.S. equities, and non-U.S. equities teams discuss the impacts on their asset classes and weigh in on the outlook from here.

Read > Flirting With a Bear Market: How Did We Get Here and What Comes Next?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

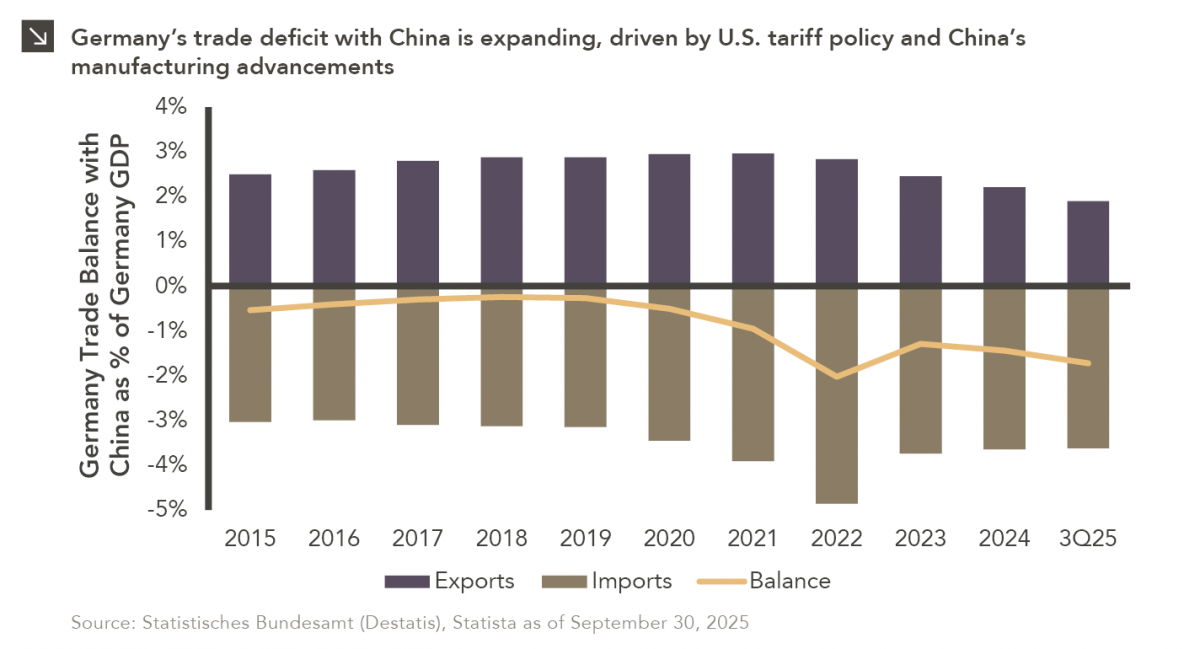

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

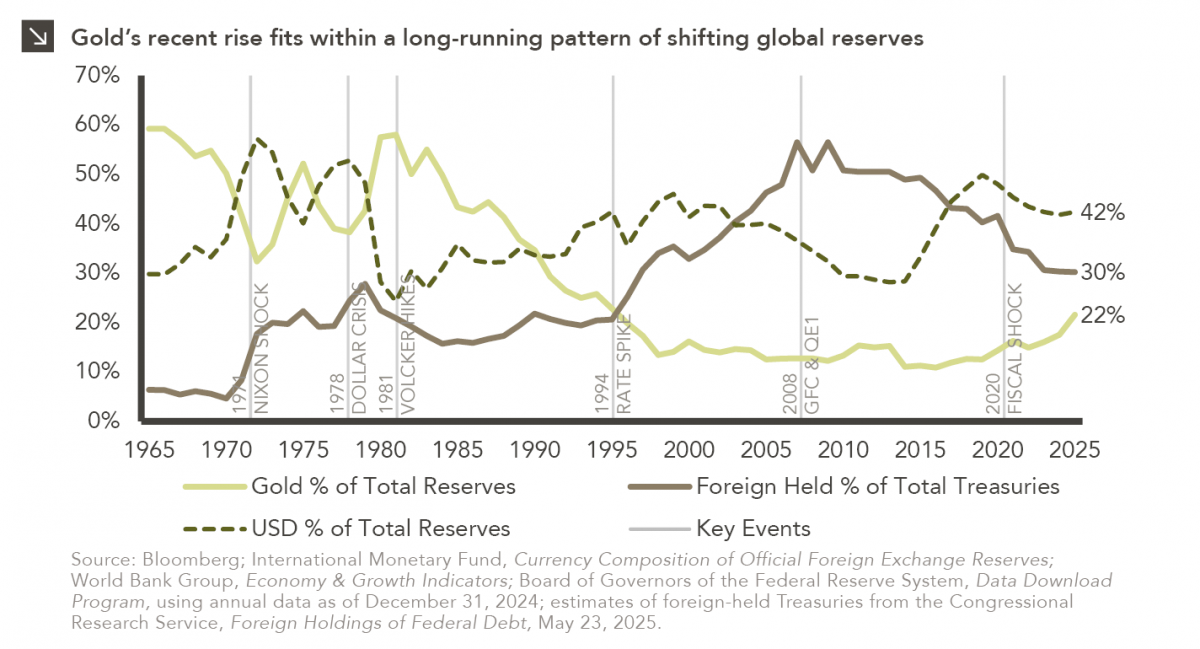

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

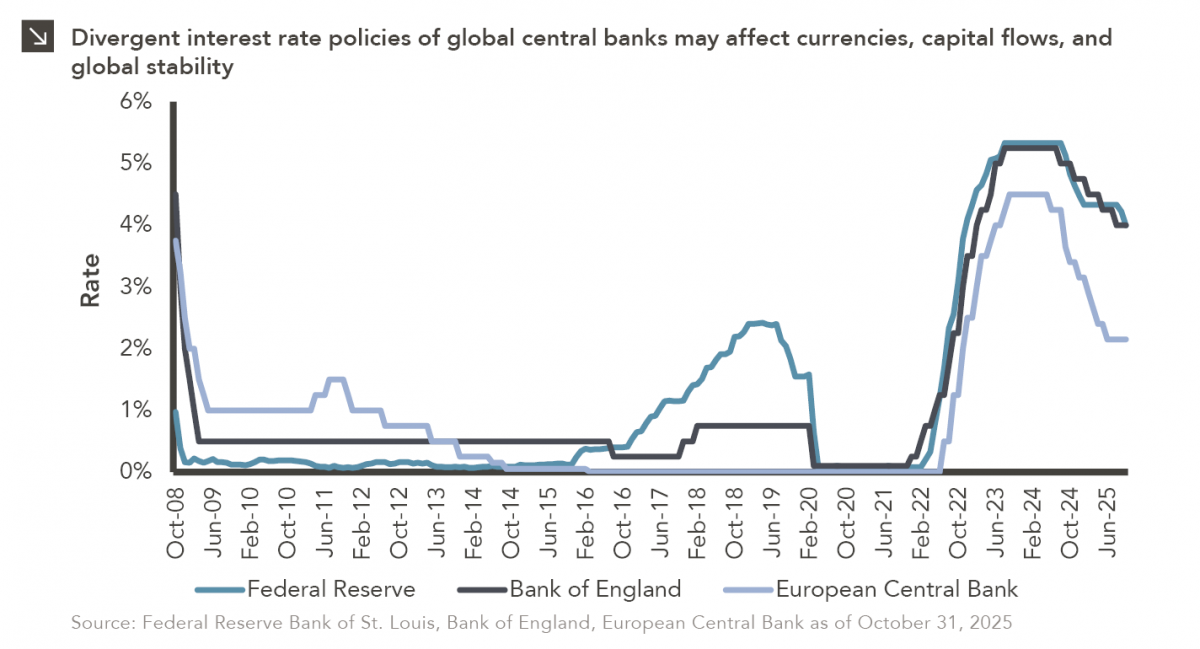

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >