Tom Salemy, CFA, CAIA

Partner

This week’s chart compares non-profit health care organizations’ (“HCOs”) cost of debt versus their size. The chart illustrates the financial characteristics of 630 HCOs divided into quartiles based on borrowing costs measured by option-adjusted spread1 (“OAS”). The HCOs examined show a wide dispersion of borrowing costs. Top quartile HCOs have an average OAS of 0.76%, while bottom quartile HCOs have an average OAS of 3.69%.

Looking at the data, there is a clear positive correlation between an HCO’s size, as defined by revenue and assets, and its OAS. Higher revenue and more assets appear to equate to lower borrowing costs. In addition to revenue and assets, average days cash-on-hand is a financial metric commonly used to assess HCOs financial health. The table illustrates that a higher days cash-on-hand metric typically, but not always, translates into lower borrowing costs.

It appears that while days cash-on-hand is an important determinant of an HCO’s financial health, an HCO’s size, as defined by revenue and assets, is the primary determinant of borrowing costs. If size continues to be the main determinant of HCOs borrowing costs, we would expect to see smaller HCOs continue to merge with larger peers.

1The option adjusted spread is the spread over U.S. Treasuries that would discount a bond’s future cash flows back to its current price.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

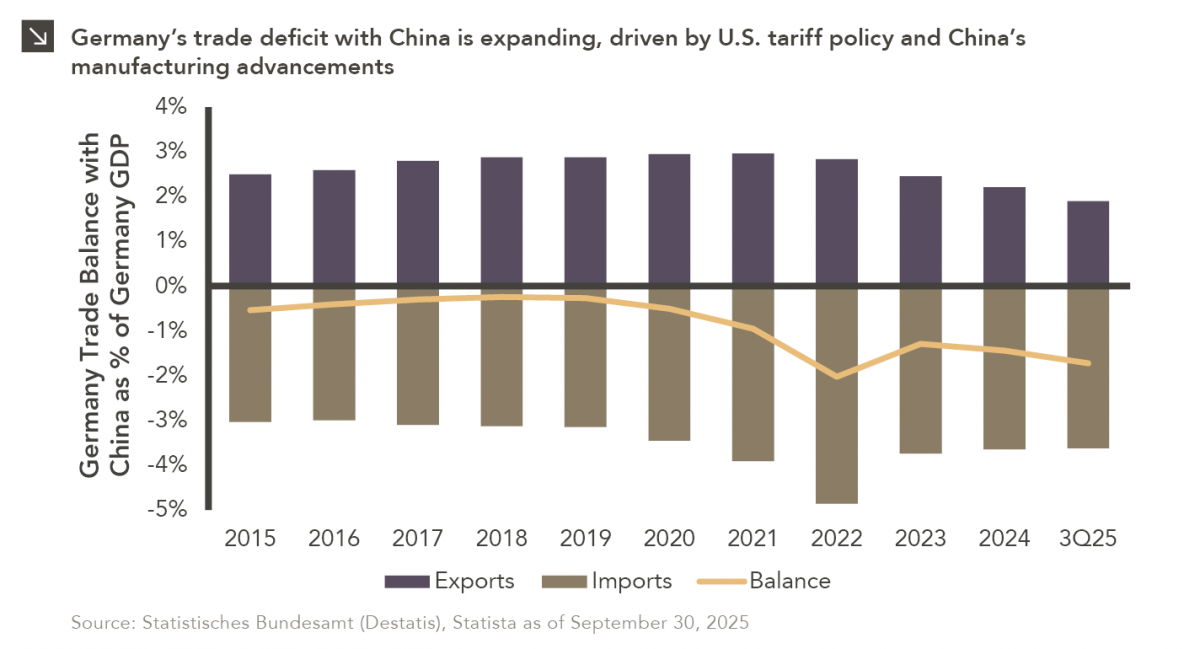

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

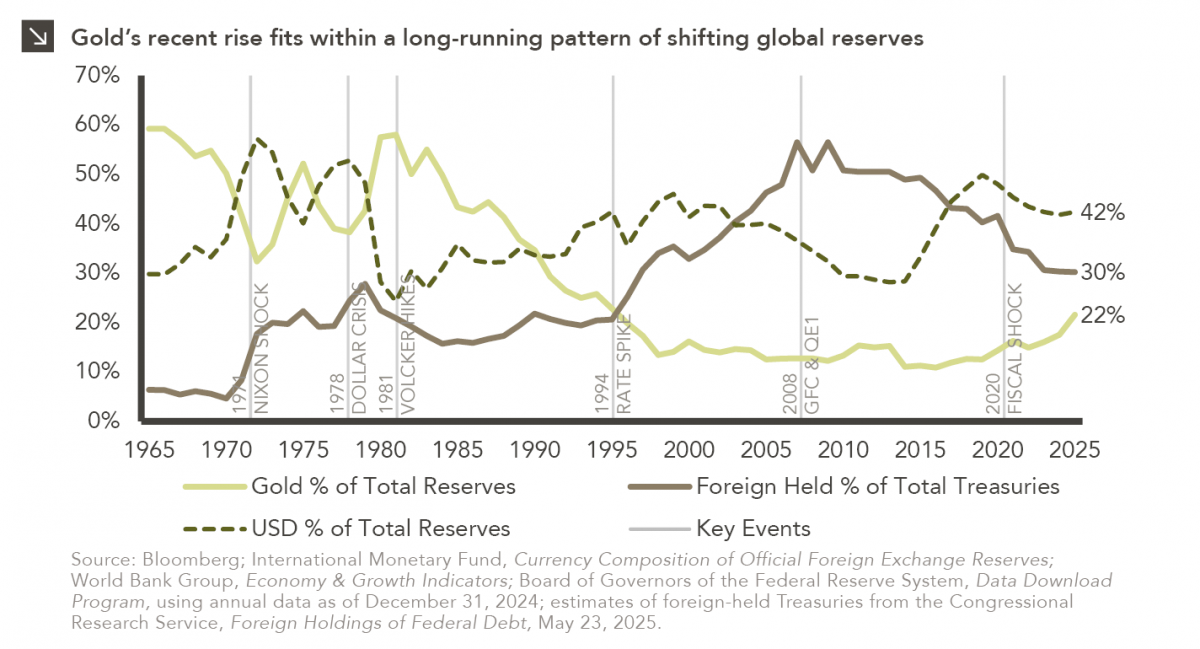

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

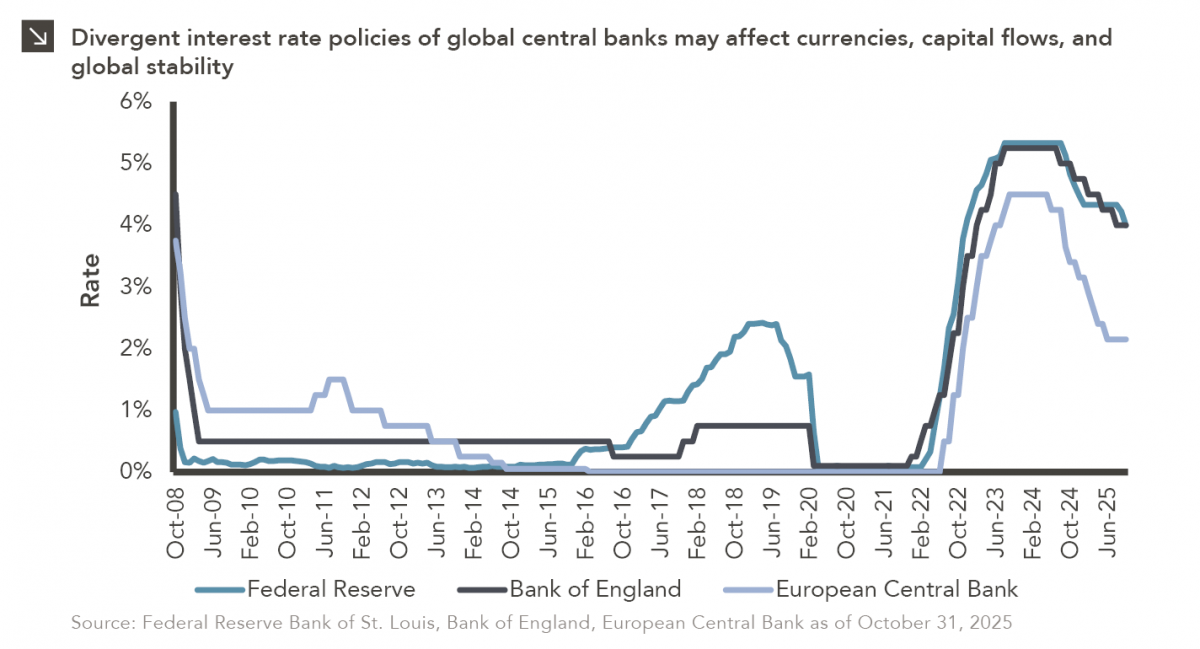

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >