Greg Leonberger, FSA, EA, MAAA, FCA

Partner, Director of Research

When it comes to baseball, successful hitters have little trouble hitting the ball when they know what pitch is coming. But when pitchers can vary the speed as well as the spin and curve of the ball, hitting becomes exponentially more difficult. An effective curveball can make even the most accomplished hitter look feeble.

As we look at the second half of 2024, we are reminding our clients to “keep their eye on the ball.” Indeed, the first half of the year has been pretty “hittable” as far as returns are concerned, with the majority of asset classes positive through June 30. However, curveballs such as Fed policy, equity index concentration, exchange rates, and a capricious election could quickly flip the script and send investors back to the dugout shaking their heads.

With that said, here is our scouting report for the second half of the year, organized by asset class. We share not only “down the middle” themes but also the curveballs that could flummox performance. A well-prepared investor is no different than a well-prepared baseball player: Insight and realistic expectations provide the foundation for a successful season!

Read > Keep Your Eye on the BallThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

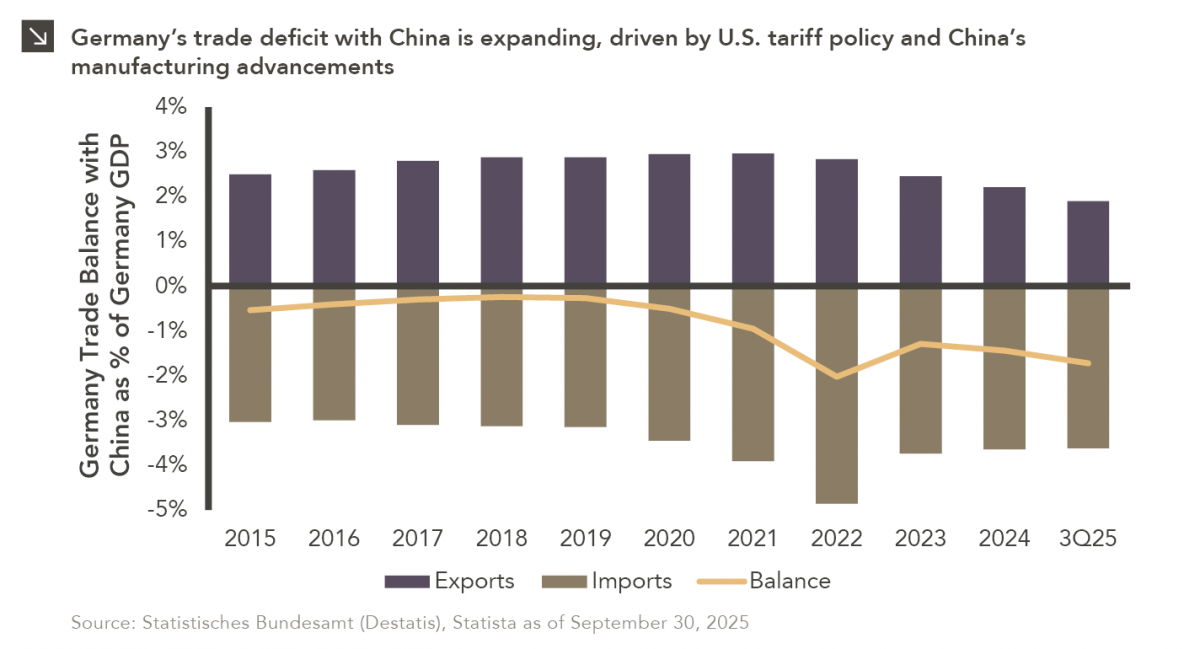

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

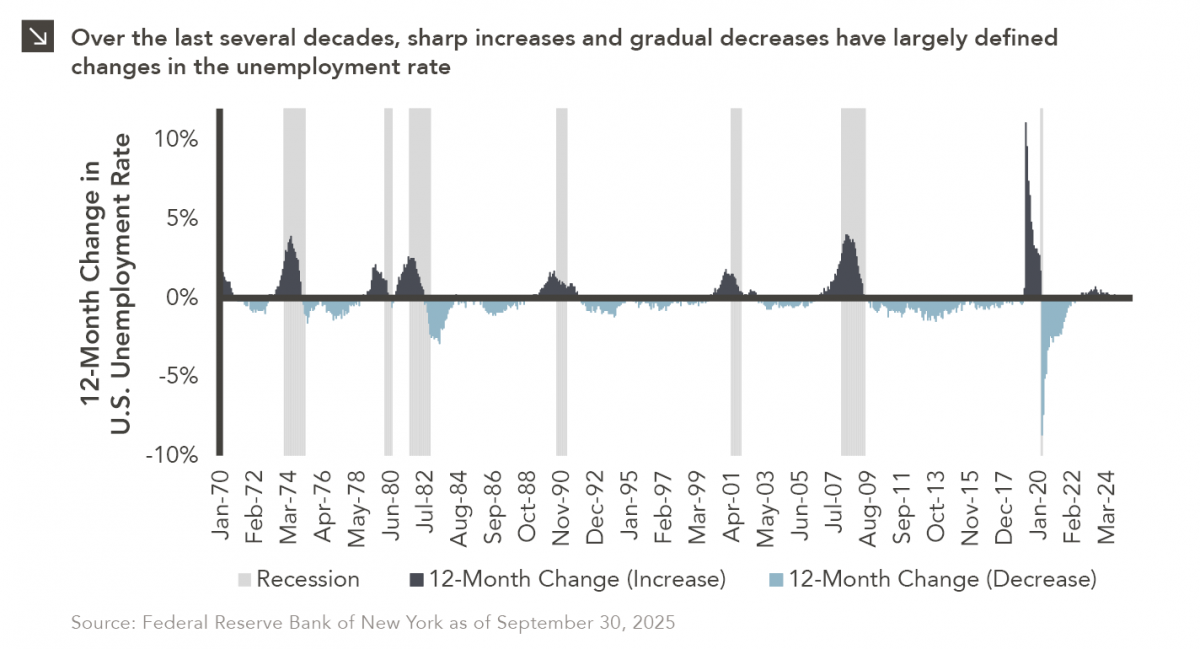

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

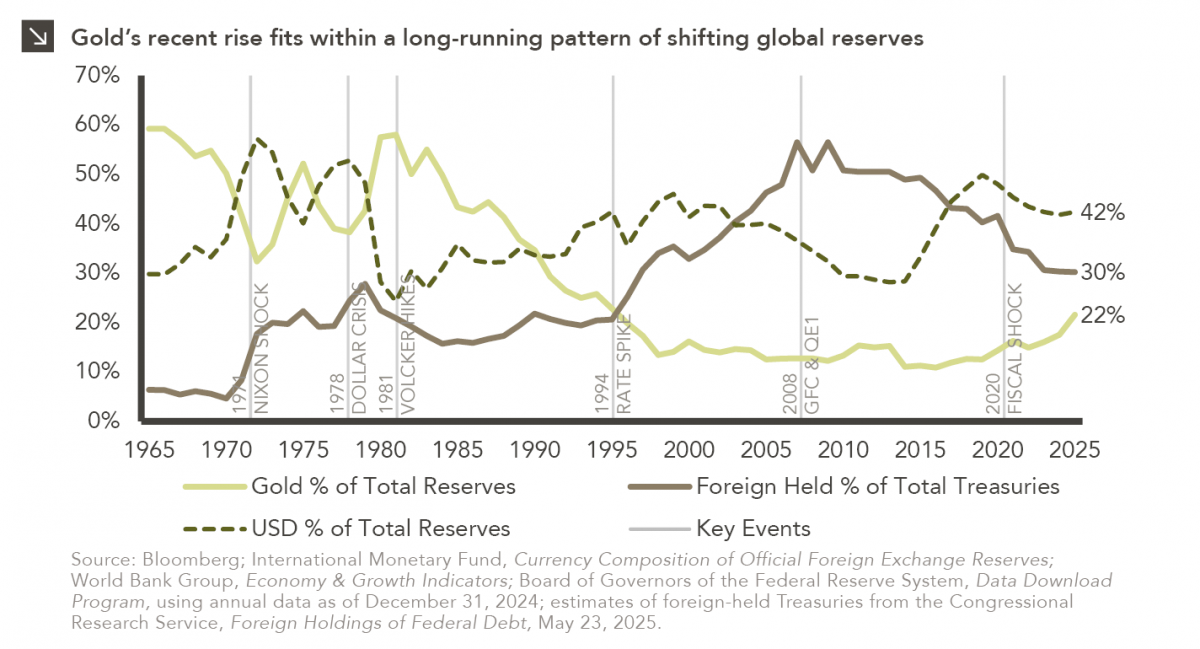

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

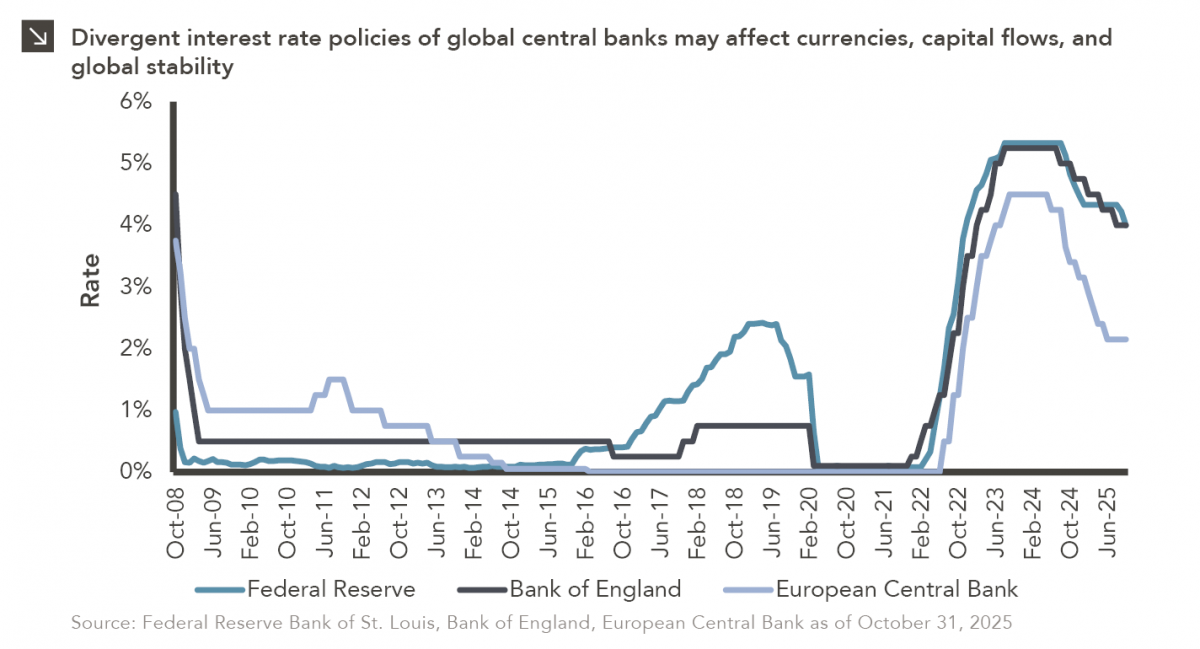

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >