William Torre, Jr., CFA, CAIA

Principal

Our Chart of the Week reviews the link between the 10-year U.S. Treasury Yield and the Trade Weighted U.S. Dollar Index. The Trade Weighted U.S. Dollar Index measures the value of the U.S. dollar relative to a broad group of currencies circulated throughout the globe, lending insight into the global purchasing power of the dollar.

The left axis displays the yield on the 10-year U.S. Treasury and on the right axis, the price of the Trade Weighted Dollar Index. Higher U.S. interest rates is one factor that can lead to a stronger dollar, as foreign investors look to place their monies into higher yielding U.S. government securities. This relationship holds true from the beginning of 2016 through October of 2017 at which point we see the two diverge. In the 4th quarter of 2017, we saw a pick up in the U.S. 10 Year Treasury yield as Congress passed favorable tax legislation.

An additional factor that helps to explain exchange rate movement is the current account balance which measures the balance of trade through the amount of country exports less imports. We saw dollar weakness as the current account deficit rose to $128.2 billion in the 4th quarter of 2017, the highest level since the end of 2008.

As equity volatility picked up in February 2018, we saw an inflection point in the data. Equity volatility can be measured through the VIX-CBOE Volatility Index, which measures the market’s expectations of 30-day volatility for the S&P 500 Index. The VIX increased from a level of 11 at the end of 2017 to a current level of 22.5; the long-term average is 20.

Historically speaking, the correlation between these two economic variables has been positive, but the two trends have diverged more recently. As economic and political developments occur, including the U.S. Federal Reserve’s normalization of short term interest rates, discussions of potential trade wars and other developments, we will continue to monitor the correlation between the U.S. 10 Year Treasury Yield and the Trade Weighted Index, with the expectation that a positive correlation will re-emerge in the coming year.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

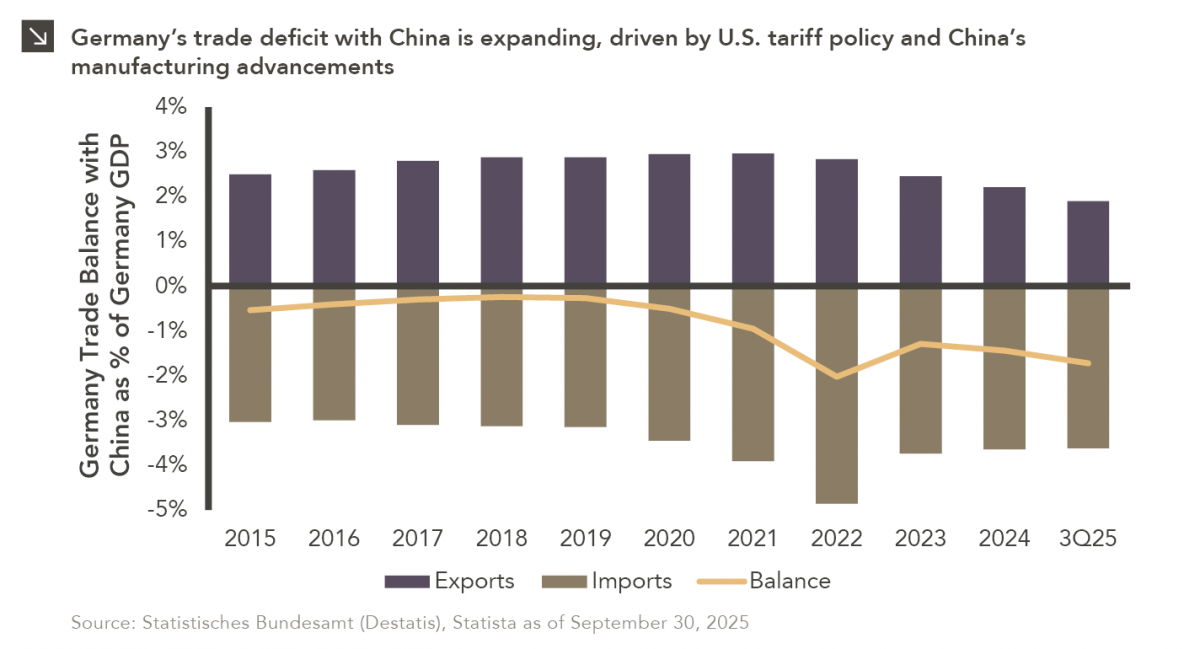

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

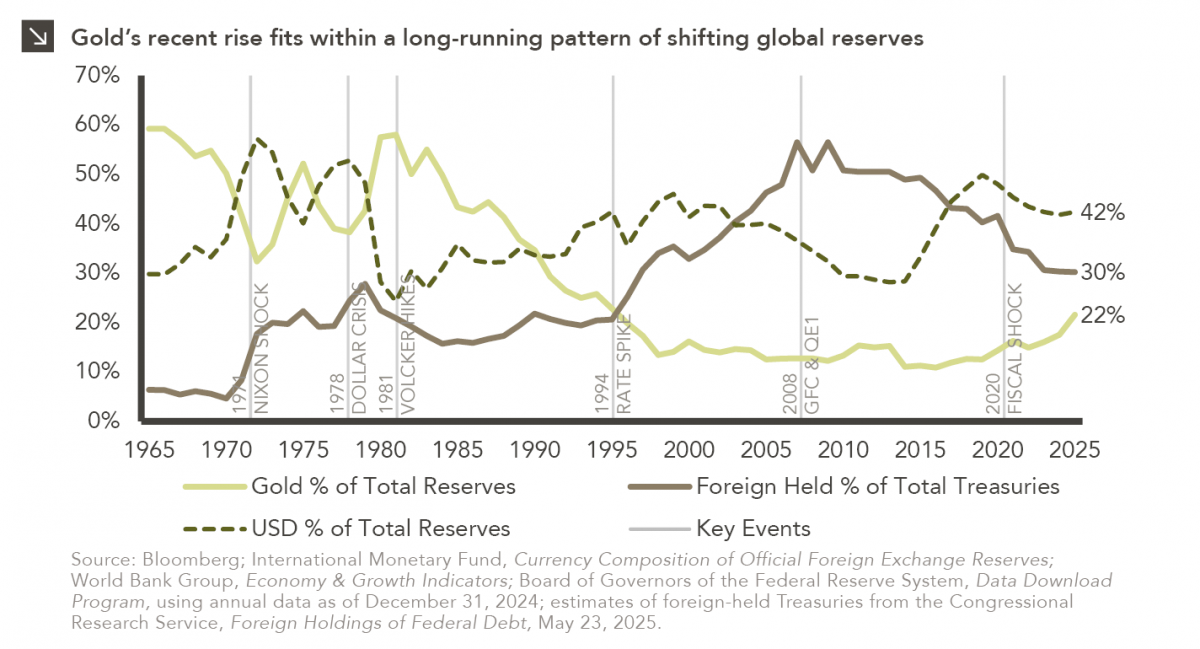

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

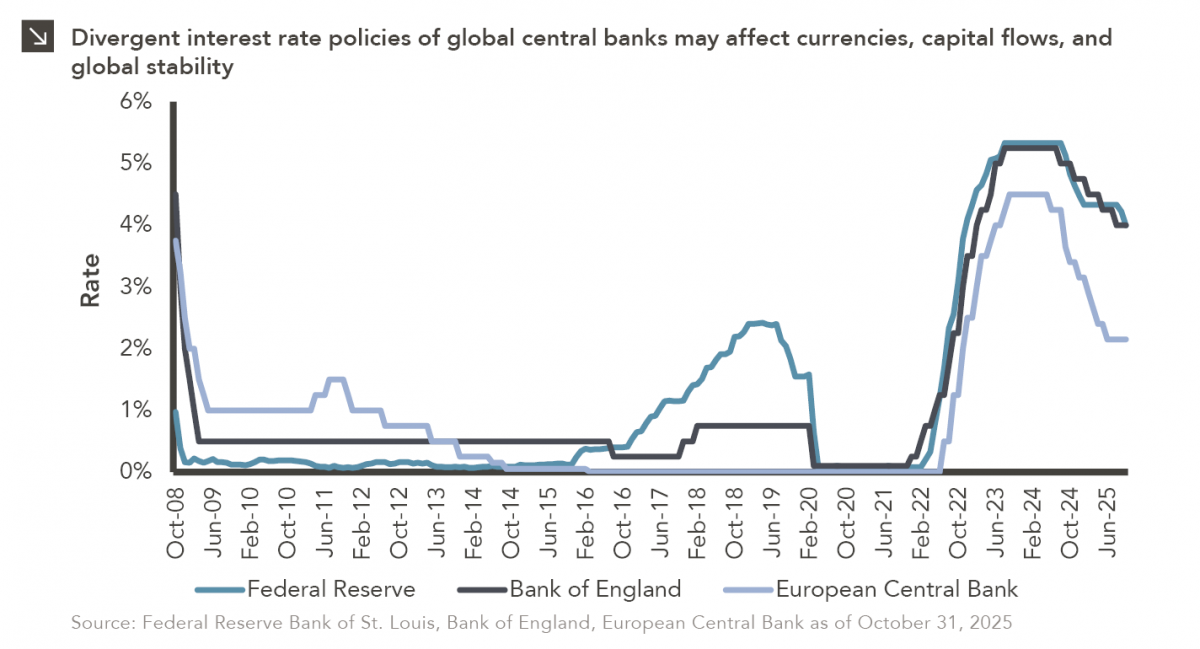

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >