Frank Valle, CFA, CAIA

Associate Director of Fixed Income

Going into 2023, one of the primary headlines was the return of “income” to the fixed income asset class. Largely as a result of Fed policy in 2022, yields increased significantly over the course of the year, thus finally offering meaningful income to bond investors. At long last, fixed income could provide all three of its staples to portfolios: diversification, liquidity, AND income. With the Federal Reserve committed to further hikes during the first half of the year, expectations were that the opportunity set would last well into the year.

However, bank failures and the associated fear of contagion have been known to not only fuel volatility in equity and credit markets but send investors to the safety of Treasuries. This dynamic naturally drives prices higher and yields lower as investors look to insulate their portfolios from large drawdowns. That said, the Silicon Valley Bank shutdown coupled with other nervousness around regional banks and then the eventual absorption of Credit Suisse by UBS has not had a significant impact on the outlook for fixed income as of quarter end. After trading inside of 2% since 2020, the yield on the Bloomberg aggregate index closed the first quarter at 4.40%, slightly lower than the December 31, 2022 figure of 4.68% but well ahead of its near-zero value in the years leading up to 2022.

This newsletter analyzes recent market dynamics and the current environment and outlook for fixed income.

Read > Here to Stay? Fixed Income Opportunities Persist Despite First Quarter Volatility

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.17.2025

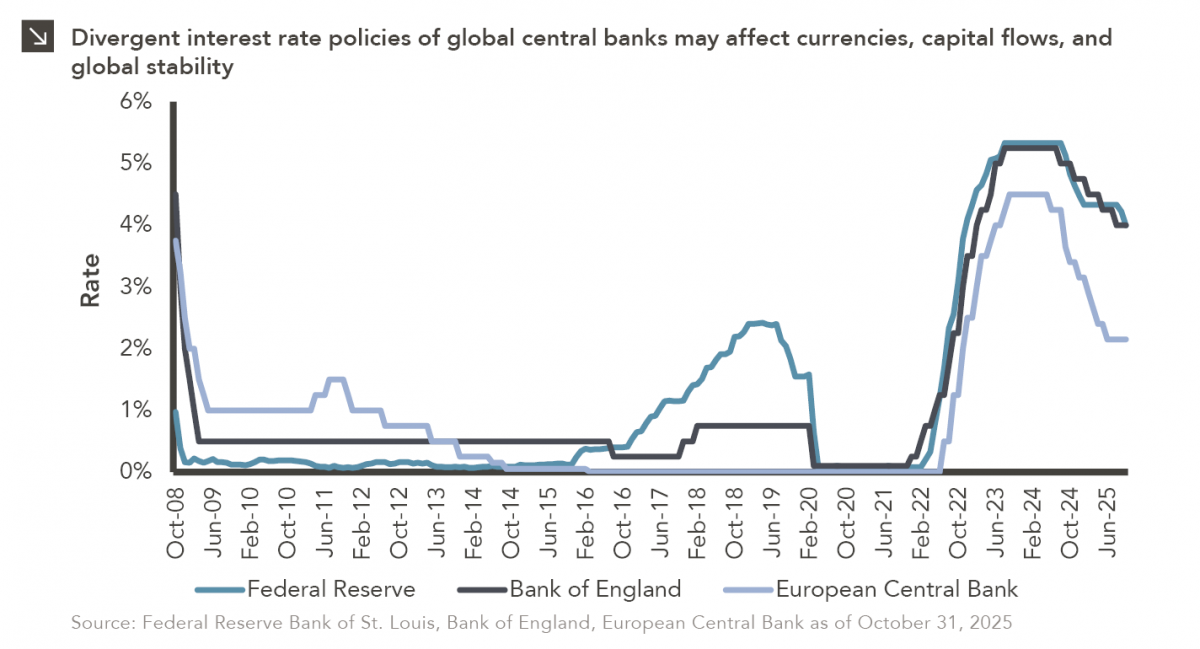

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >