David Hernandez, CFA

Director of Traditional Manager Search

This week we look at the historic three year discount margin for bank loans. Bank loans provide a source of financing for public and private corporations as well as private equity firms. They are a floating rate debt obligation generally linked to LIBOR and typically callable with few or no penalties. In comparison to investment grade bonds, bank loans have higher credit and liquidity risk, but lower interest rate risk. In a low rate environment, floating coupons can be attractive to investors.

In 2008 and 2009 liquidity issues caused bank loan prices to drop drastically. This can be seen in the chart, as the price drop drove the three year discount margin to all time highs. Since then, liquidity has improved and the discount margin has come down. In 2012 we saw the discount margin fall from 656 bp to 555 bp. Even with the pronounced decline from 2009, discount margins are still above the long term median of 387 bp. This spread appears to be an enticing option for investors looking to decrease interest rate risk. The discount margin also compares favorably with high yield bonds, and based on early data, institutional investors have begun to swap high yield investments for bank loans.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

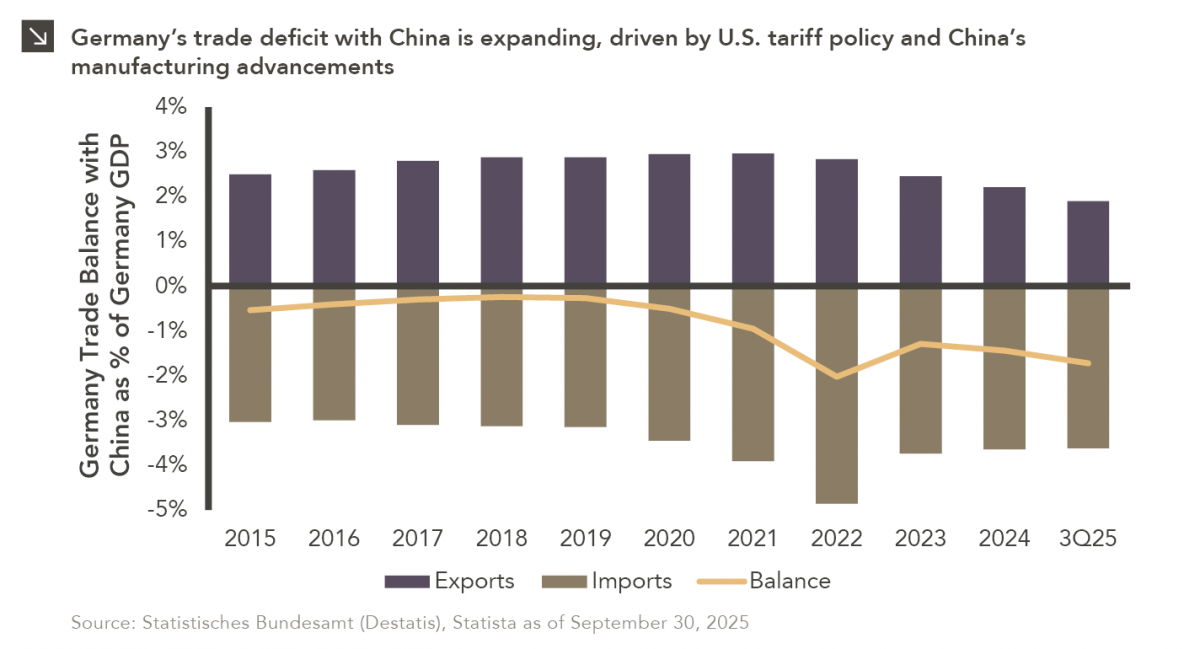

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >