12.10.2025

Small Caps: Unprofitables Lead, Active Managers Lag, But Can it Last?

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

In response to the Fed’s emergency rate cut of 100 basis points over the weekend that brought the target fed funds rate to 0.00%–0.25%, the S&P 500 plunged 12% on Monday (March 16th). This is likely a sign that the markets believe that monetary stimulus is not enough to stave off a coronavirus-triggered recession.

The following newsletter includes Marquette’s assessment of the situation as well as perspectives on liquidity, fiscal stimulus, positioning, and expectations for the economy and financial markets in the coming months.

Read > Back to Square One: Fed Cuts Rates to Zero, Market Responds

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

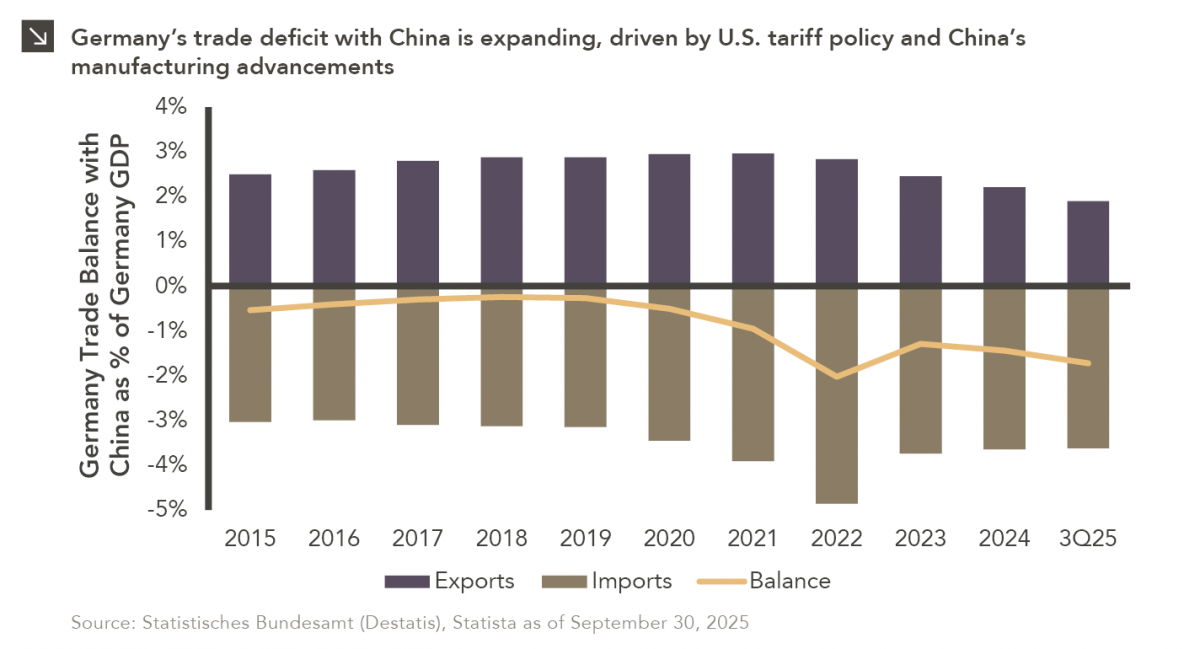

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

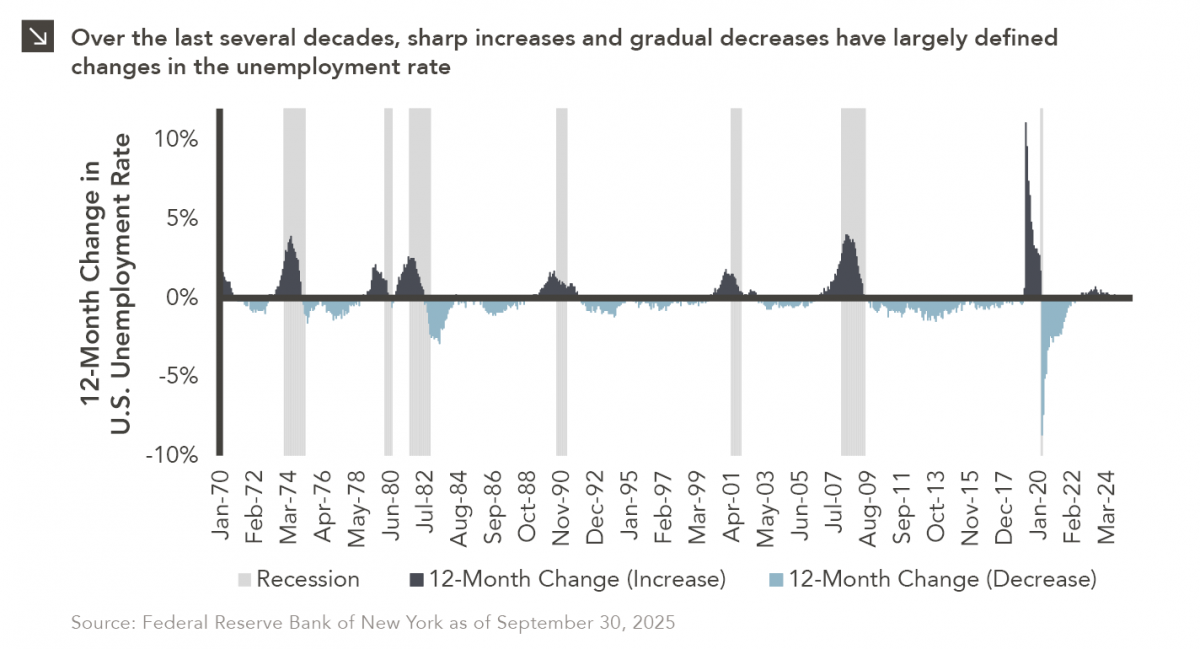

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

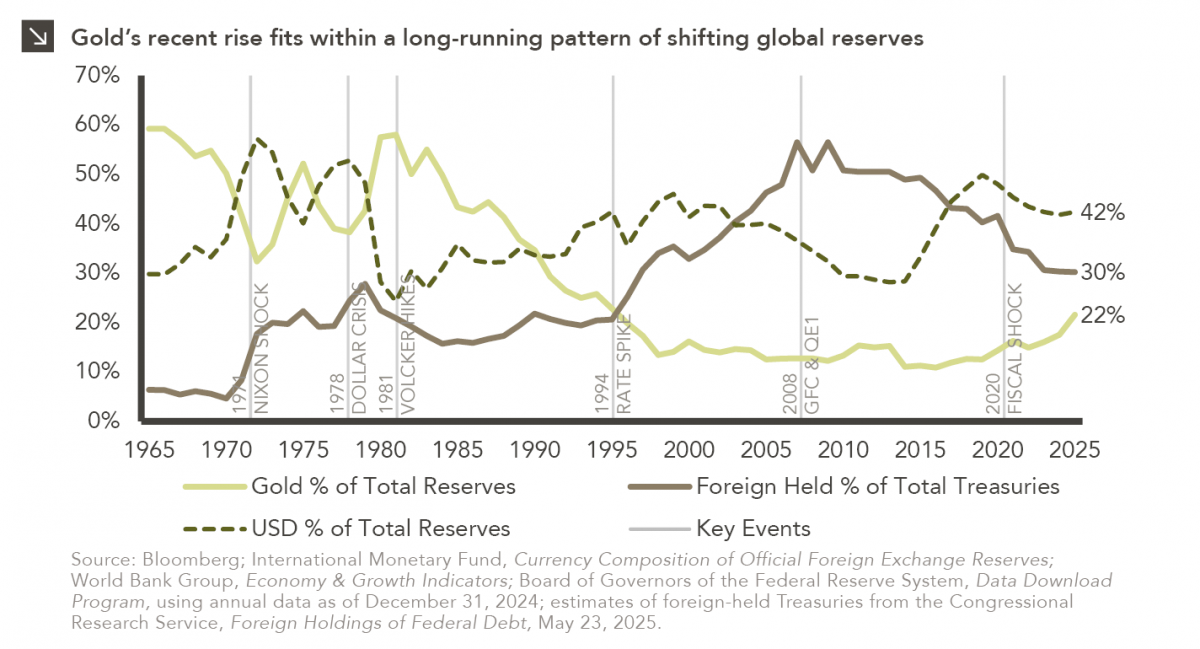

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

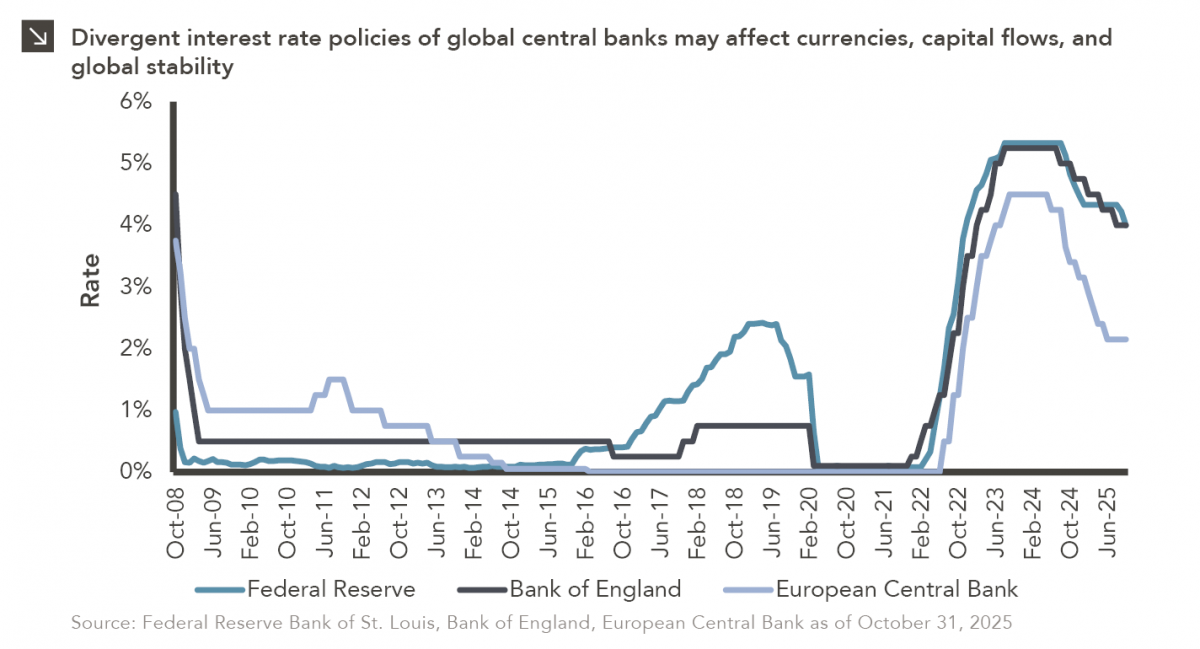

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

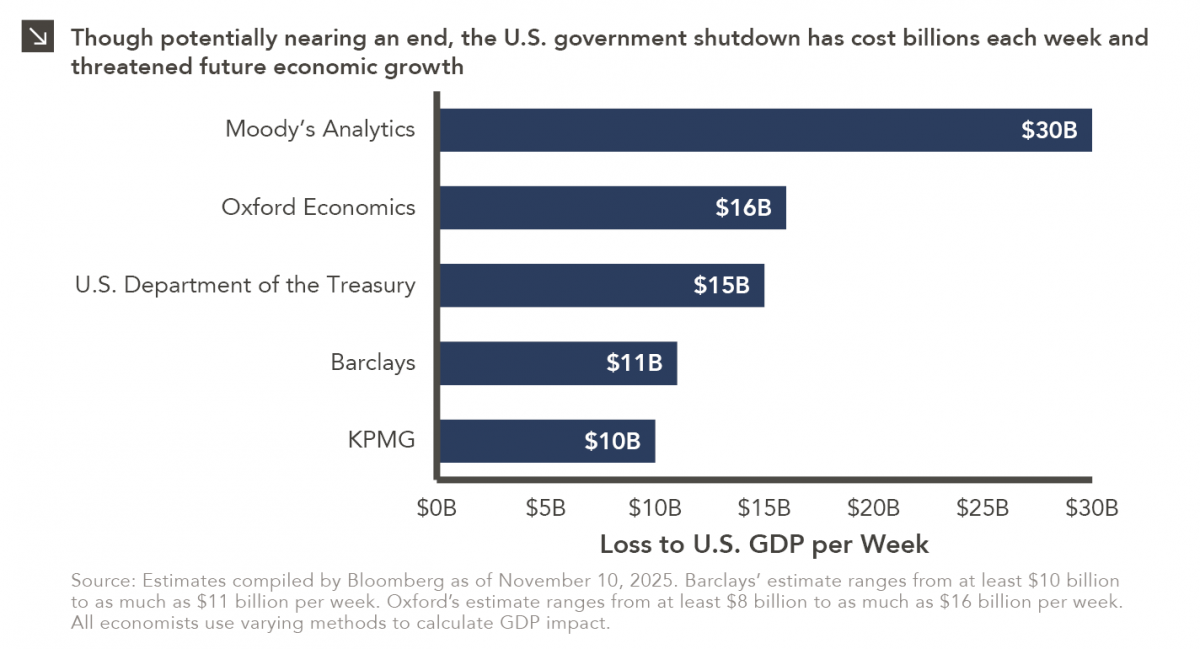

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >