12.29.2025

Glass Half Empty

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

This week’s chart shows broad asset class returns through July 31st of this year. Perhaps the most surprising performer has been international equity, which has outperformed even U.S. equities. Much of the outperformance is due to the strong U.S. dollar, which has increased international developed countries’ exports. The same factor has in turn contributed to the lower performance of U.S. equities. With so many of the S&P 500 companies’ revenues dependent on international growth (about 46%), the strong dollar has weighed heavily on EPS growth. In addition, the same factors many of our readers have heard before — the slowdown in the energy sector and the cold winter — have also played major roles.

The other darling this year, as widely predicted, has been Real Estate. Throughout the first half of the year, growth has in large part been due to income, lease turnover, and appreciation (most notably in the Southwest U.S.). The remainder of the year is likely to see less contribution from income and more contribution from appreciation.

Now let us turn to the poor performers. Bonds, both Global and U.S., continue their same old story: the specter of the Fed rate hike continues to loom, in addition to the Greek debt crisis and China’s now not-so-secret efforts to prop up growth. Emerging Markets have been the worst performers this year, thanks in large part to their dependence on commodities and the domino effect of China’s slowing growth which has translated into weakening currencies.

Where will the rest of the year take us? As the issues we have discussed will continue to weigh on asset classes, it will not be surprising if meandering to disappointing returns across asset classes continue for the rest of 2015.

1 Real Estate Returns through 6/30/15; Private Equity Returns through 3/31/15

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

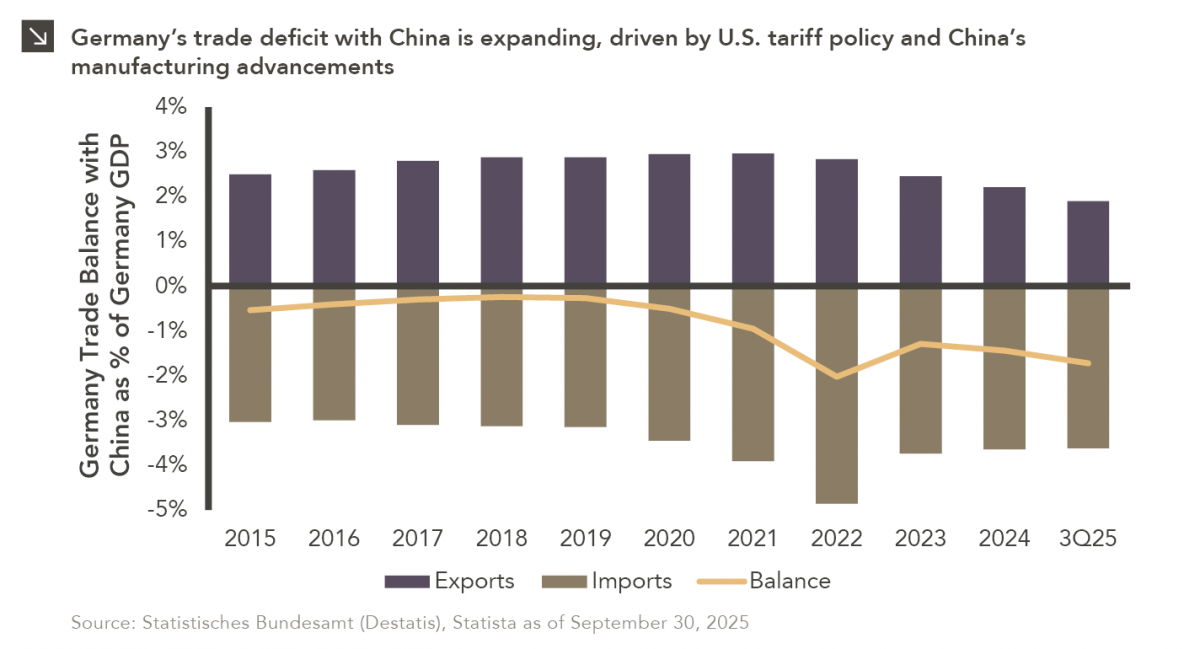

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >