Nic Solecki, CBDA

Research Analyst

Geopolitical risk has shifted center stage as evolving international dynamics have driven asset allocators to reassess risk exposures and market opportunities. While the Russia-Ukraine conflict has dominated headlines, a number of recent events in the Asia-Pacific region have also led to heightened volatility, directly impacting global markets.

China-Taiwan: Tensions have escalated following House Speaker Pelosi’s visit to Taiwan, with the Fourth Taiwan Strait Crisis now in its fourth week. Taiwan seems to be at the center of a series of ongoing territorial disputes within the first island chain. China’s growing influence and military footprint within the first island chain could create considerable headwinds for investors as trade relations and global supply chains are forced to adapt.

Xinjiang: The situation in Xinjiang continues to draw western criticism, with the U.S., Canada, U.K., and E.U. imposing sanctions on Chinese officials — further stressing diplomatic and economic relations in the wake of the recent Sino-American trade war.

China-India: At the same time, the Sino-Indian border disputes have been ongoing since May 2020, and violent flare-ups persist as one of the most apparent obstacles for Indian and Chinese markets and the BRICS alliance. Developments in Sino-Indian relations could be significant as an increase in trade between China and India would likely generate tailwinds for emerging markets.

Myanmar and Sri Lanka: The conflicts in Myanmar and Sri Lanka may also have broad implications for emerging markets. Myanmar’s internal conflict presents economic and humanitarian issues for neighboring states. China recently announced the China-Myanmar Economic Corridor (CMEC) Plus initiative. While improved stability and infrastructure could bolster global investment, parallels may be drawn to Sri Lanka, where economic conditions deteriorated due to unproductive and unsustainable sovereign debt — approximately 10% of which was Chinese-owned infrastructure loans. Facing default, Sri Lanka relinquished control of Hambantota International Port and 15,000 acres of adjacent land in a 99-year lease to China Merchants Port, a Chinese state-owned enterprise. On August 19th, a Chinese surveillance vessel docked in Sri Lanka reigniting western concerns that Chinese-owned emerging market debt could be leveraged to expand its military footprint.

Taken together, China’s relations with Taiwan, India, and Myanmar and the situation in Xinjiang are additional macro factors that allocators should understand and consider as they evaluate different investment opportunities and risks.

Print PDF > Geopolitics: The Final Frontier

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

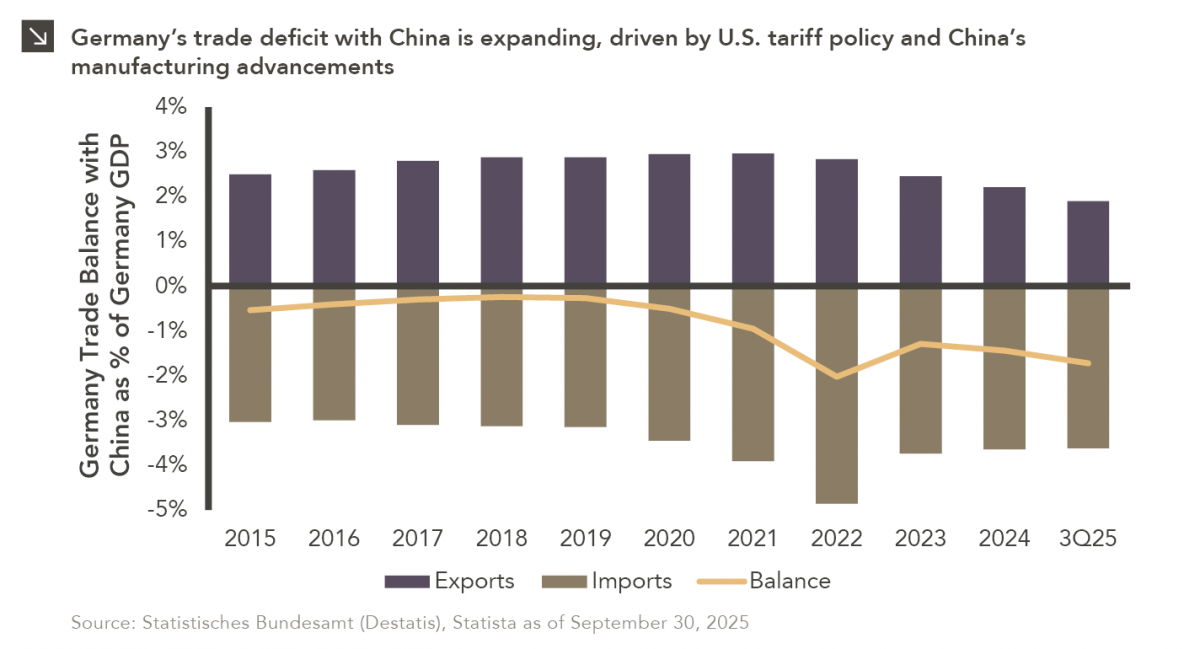

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

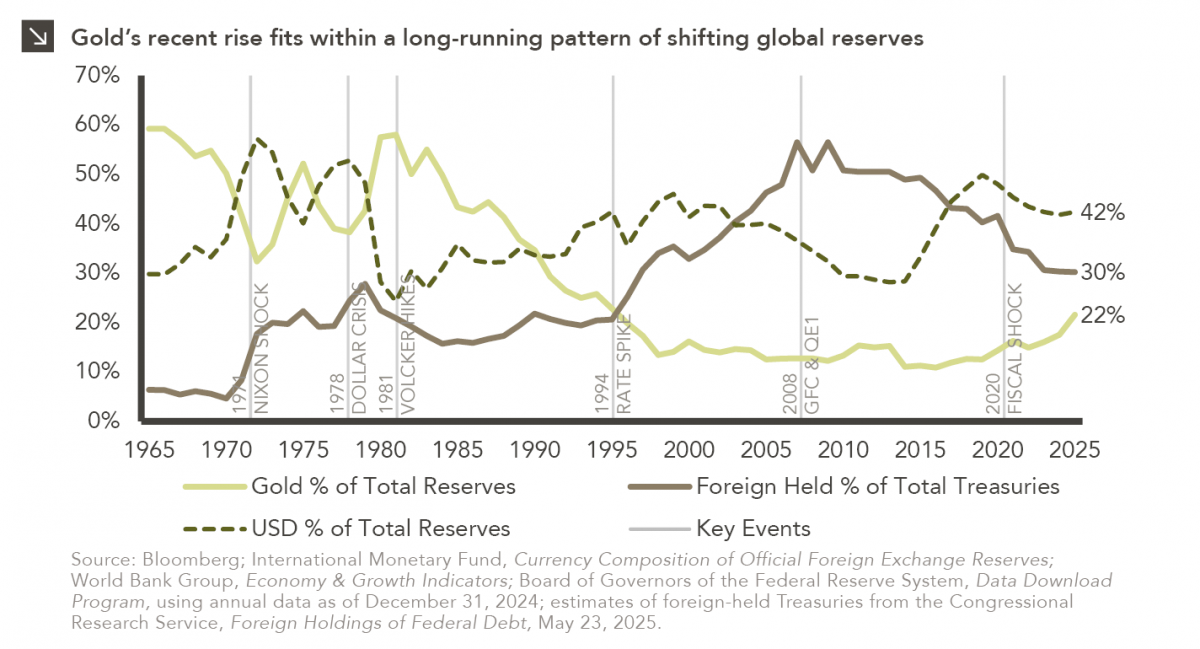

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >