12.29.2025

Glass Half Empty

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

This chart examines the most recent property type sector breakdown within the NFI-ODCE¹ including apartments, industrial, office, retail and other. While the actual “other” sector only represents 4% of the NFI-ODCE index exposure and typically includes land, parking and self-storage, what’s not that apparent is the “other” allocations within apartments and office.

Over the past several years, NCREIF has been trying to capture and measure “other” subtypes such as student housing and medical office, life sciences, manufactured housing and senior living under a field labeled for usage, but the reporting among ODCE managers has been inconsistent across the board. For example, a manager may report a student housing asset as “apartment” with a classification for garden, high rise or low rise, while at the same time submit the asset under the “usage” field making it unclear how much student housing is represented within the apartments sector.

With that said, managers have started and are likely to increase their exposures to these “other” property types given their unique risk-adjusted return profiles in this mature market cycle. For example, medical office and life science tenants tend to be much stickier and sign longer-term leases compared to traditional office tenants making them a more attractive tenant to have. The question going forward will be whether or not these “other” sectors develop into more mainstream standalone sectors and how much they will represent within the ODCE over the coming years.

¹The NCREIF Fund Index – Open End Diversified Core Equity (“NFI-ODCE”) – is an index of fund-level investment returns reporting on both a historical and current basis.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

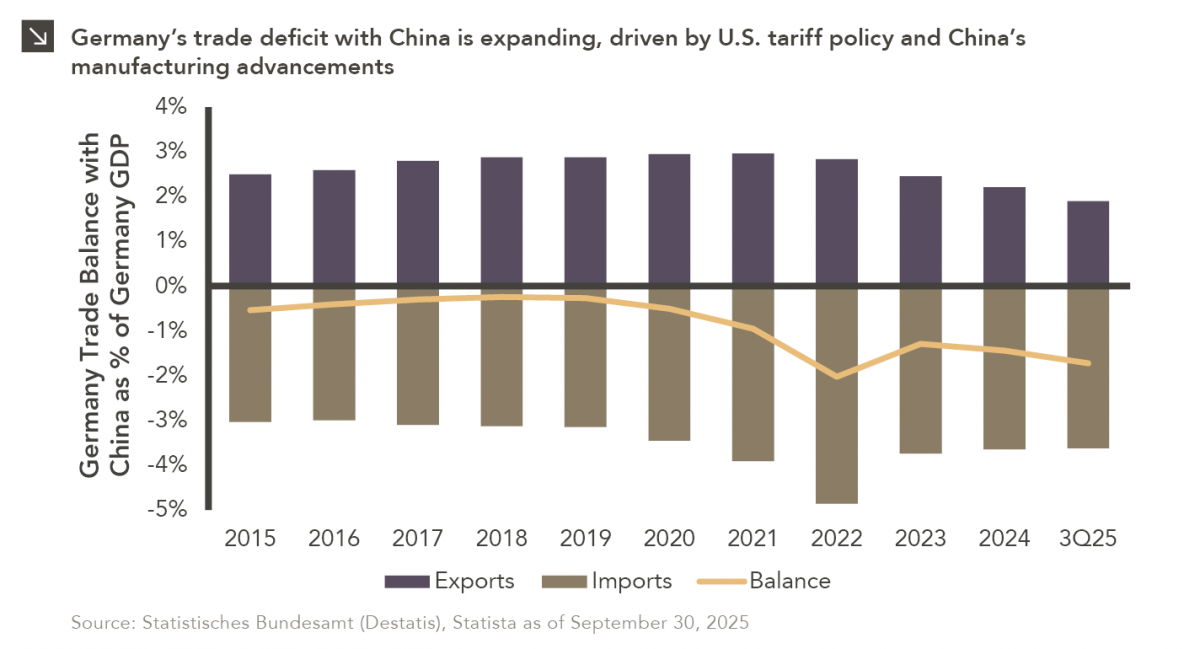

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >