Catherine Hillier

Senior Research Analyst

Indexing has risen in popularity over the last decade, particularly for U.S. equity investors. The fees are lower and indexing is perceived as less risky, with investors primarily seeking beta exposure to the market. However, these indices have evolved against an ever-changing economic and financial market backdrop. As a result, several unintended structural issues have emerged, particularly related to concentration risk. Understanding this evolution and how it could alter the overall exposures within a broader portfolio is critical, as these indices are not static. Notably, the composition of some indices alongside the increase in passive capital has created headwinds for active managers and helps to explain recent performance challenges.

This newsletter examines the progression of passive management, how and why U.S. equity index concentration has increased in recent years, and the effects and risks investors need be aware of across the market capitalization spectrum.

Read > What Does Elevated Index Concentration Mean for Active U.S. Equity Managers?The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

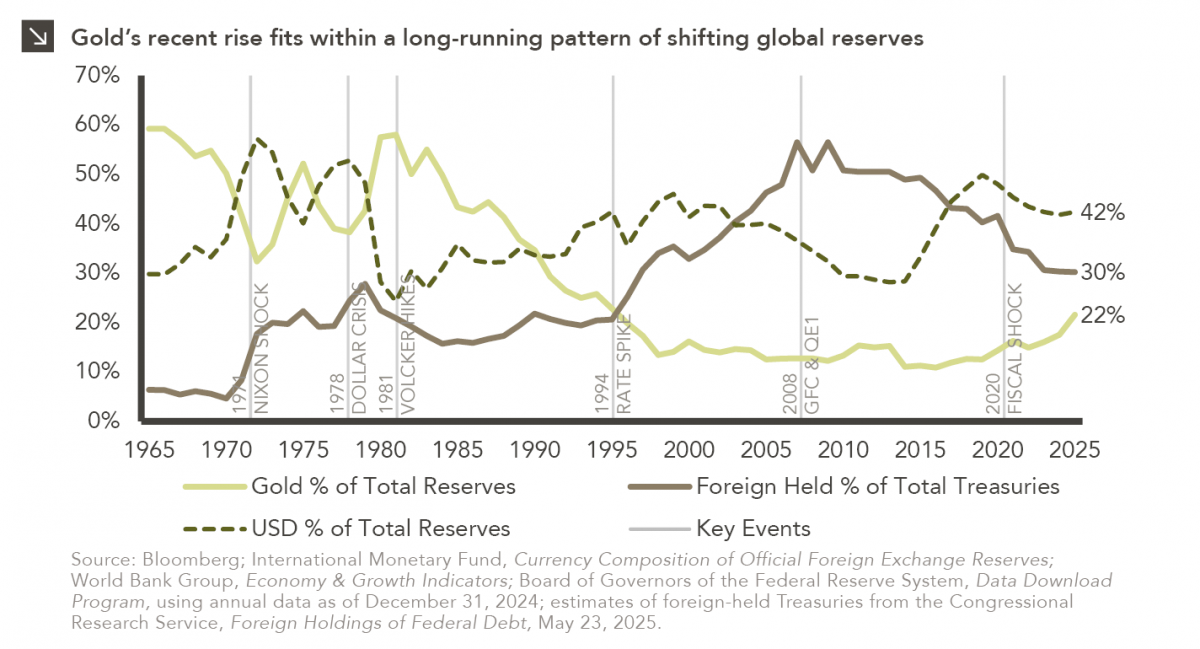

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

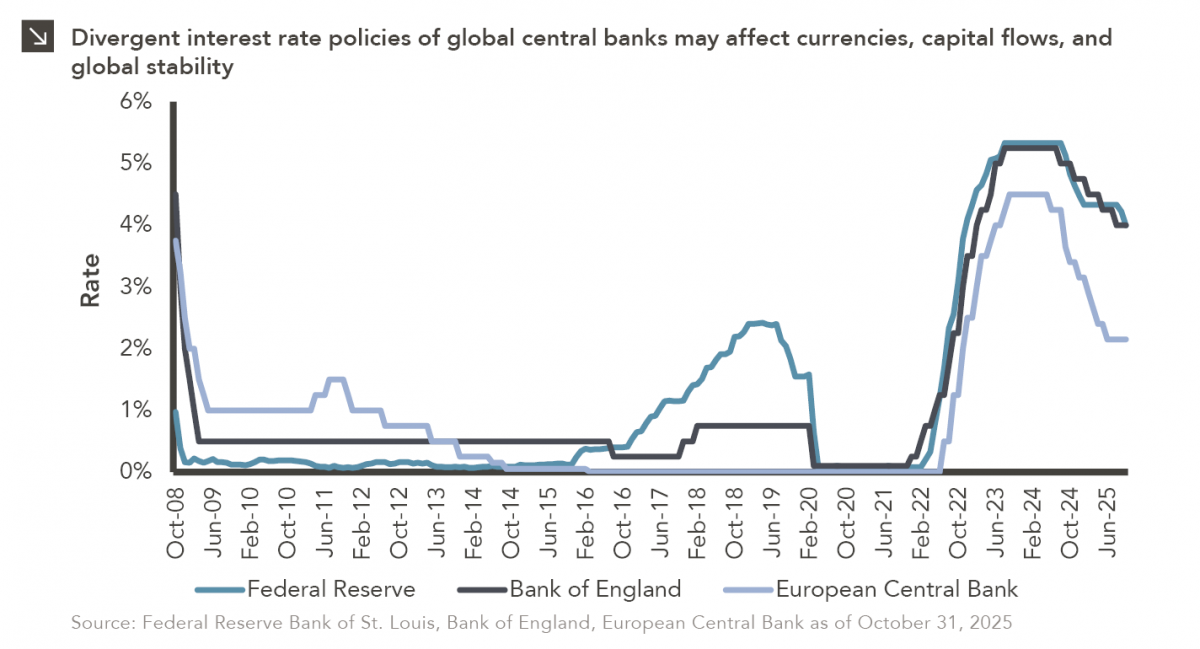

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >