12.29.2025

Glass Half Empty

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

The chart above depicts the amount of Italian government bonds held by Italian banks. As seen in the chart, this amount hovered between $200 and $250 billion until December of 2011, which is when the first round of the Long-Term Refinancing Operation (LTRO) began. A notable aspect of the LTRO was that it allowed Italian banks to borrow funds from the ECB for 3 years at a 1% interest rate with appropriate collateral. Given these favorable terms, Italian banks used portions of the funds obtained from the ECB to invest in higher yielding bonds issued by their government. As a result, the number of Italian bonds owned by Italian banks has since swelled to nearly $350 billion. Ultimately, this trend has been helpful to lower the interest rate on Italian bonds, but is troublesome since a large portion of the debt that Italy issued has been purchased by Italian banks because foreigners have been skittish to invest. Foreign investors have cut their holdings of Italian governments bonds to their lowest level since 2005. As Italian banks purchase more Italian government bonds, the public and private sectors become more intertwined.

Italy has a substantial portion of debt maturing in the next few months (table below). It remains to be seen if there will be sufficient demand (foreign and domestic) to refinance these obligations at a reasonable interest rate.

Italy – Principal Maturity

| Month |

Aug-12 |

Sep-12 |

Oct-12 |

Nov-12 |

Dec-12 |

| Amt (Mil) |

$30,663 |

$27,462 |

$36,751 |

$26,975 |

$53,718 |

ECB president Mario Draghi has indicated a willingness on behalf of the ECB to step in and purchase Italian bonds that fall on the short end of the yield curve to ensure liquidity. This implied guarantee means that Italy will most likely issue short term debt to attract investors. By issuing short-term debt, Italy essentially buys itself a little more time to demonstrate economic improvement to attract foreign investment. However, a lack of progress will likely translate into larger near-term debt and rising interest rates.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

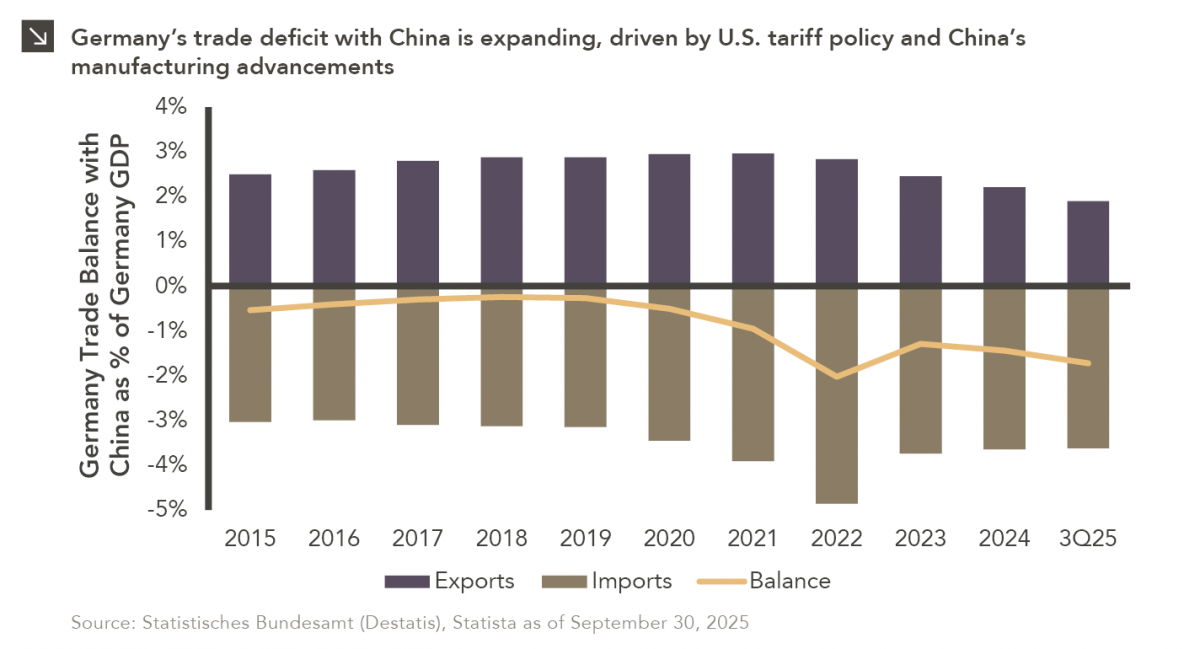

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

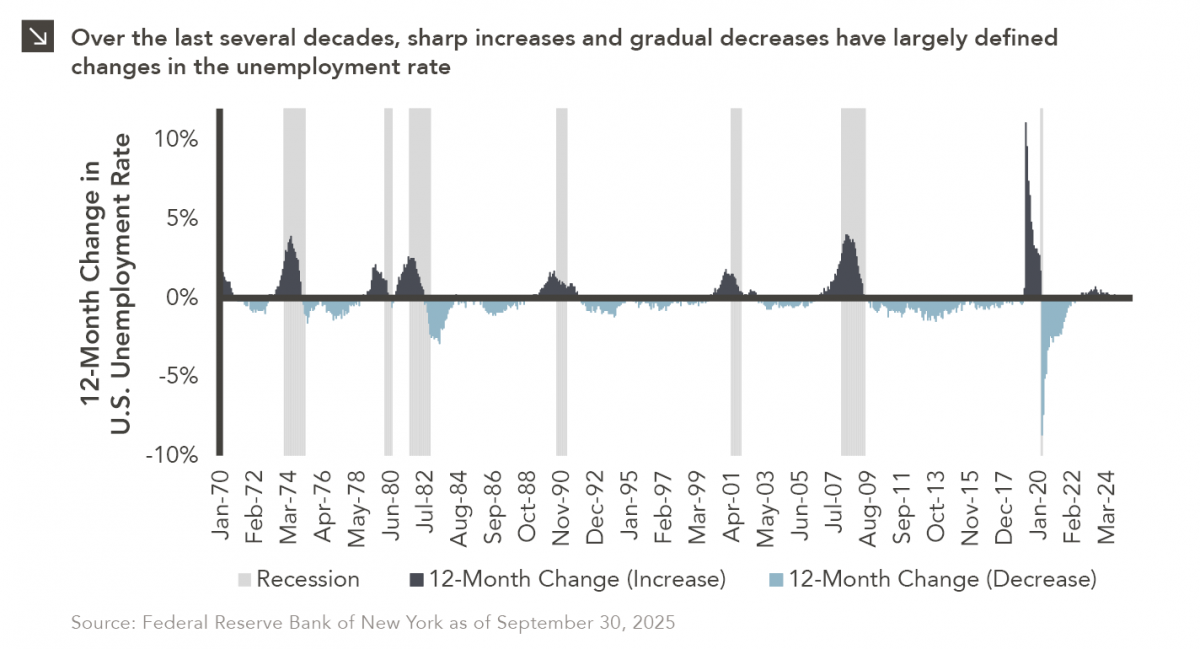

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

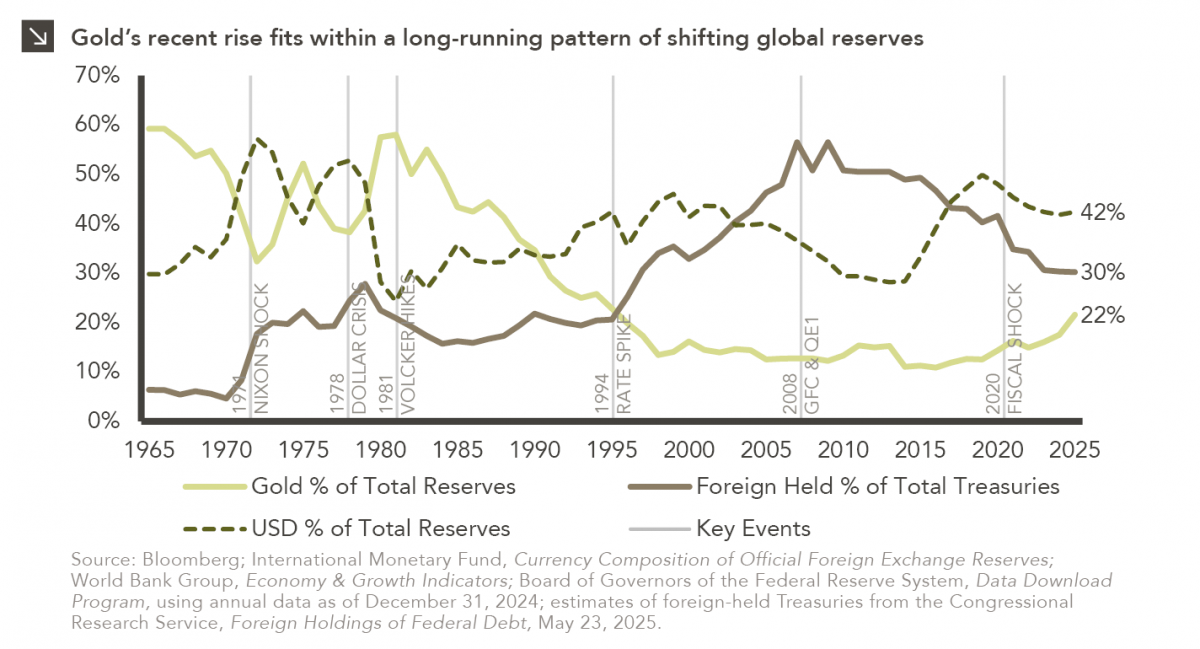

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >