12.10.2025

Small Caps: Unprofitables Lead, Active Managers Lag, But Can it Last?

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

The chart above shows labor share on the left axis, and corporate profits as a percentage of GDP on the right axis. Labor share is calculated by the U.S. Bureau of Labor Statistics, and measures the percentage of output that employers pay in employee compensation. Corporate profits as a percentage of GDP is calculated based on the U.S. Bureau of Economic Analysis (BEA). It includes income earned abroad by corporations.

Since the 1980’s until the most recent recession, the U.S. maintained relatively stable GDP growth. However, this growth was not evenly apportioned. During this time, income inequality increased, and labor’s share of output declined. Over the past decade this loss in income was supplemented with an increase in leverage, including mortgage debt. The subsequent consumer deleveraging has led to weak aggregate demand and tepid GDP growth out of the recession. With lower wage costs and new sources of global demand, corporate profits soared.

In the near term, these imbalances still seem firmly in place. Aggregate demand, and thus economic growth, is weak. Earnings growth remains comparatively strong. In the long-term, what may be good for the economy may or may not be good for corporations and the stock market. Wage inflation would improve household balance sheets by both increasing income and decreasing nominal debt burdens. However, higher costs would lead to declining corporate profits.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

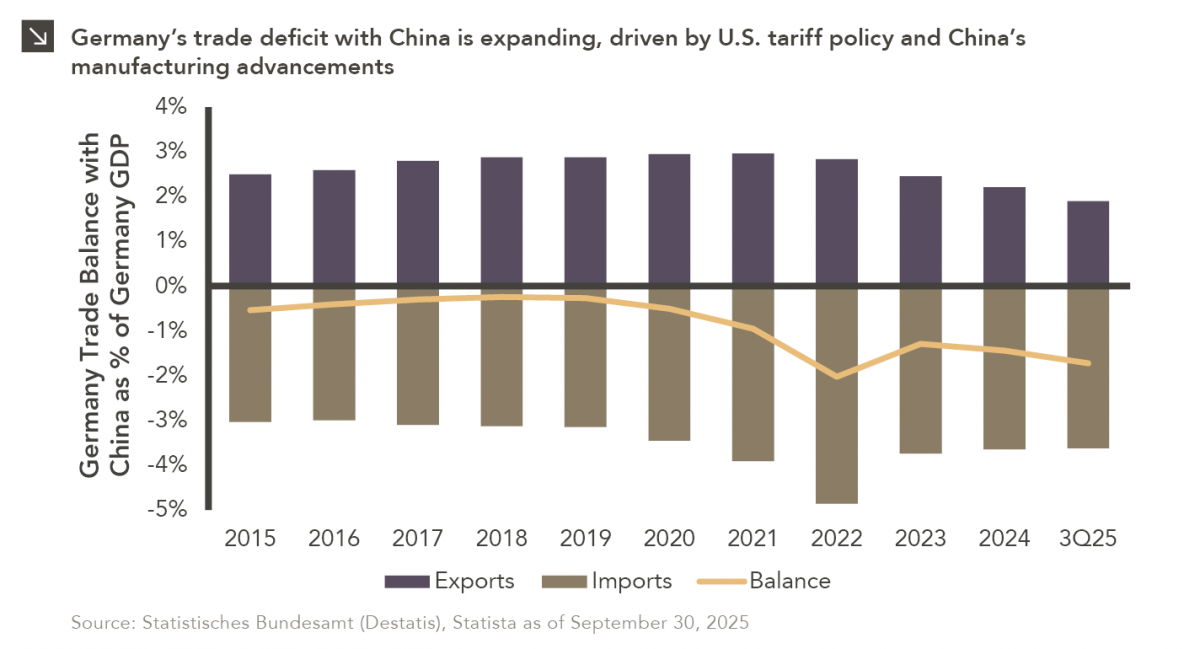

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

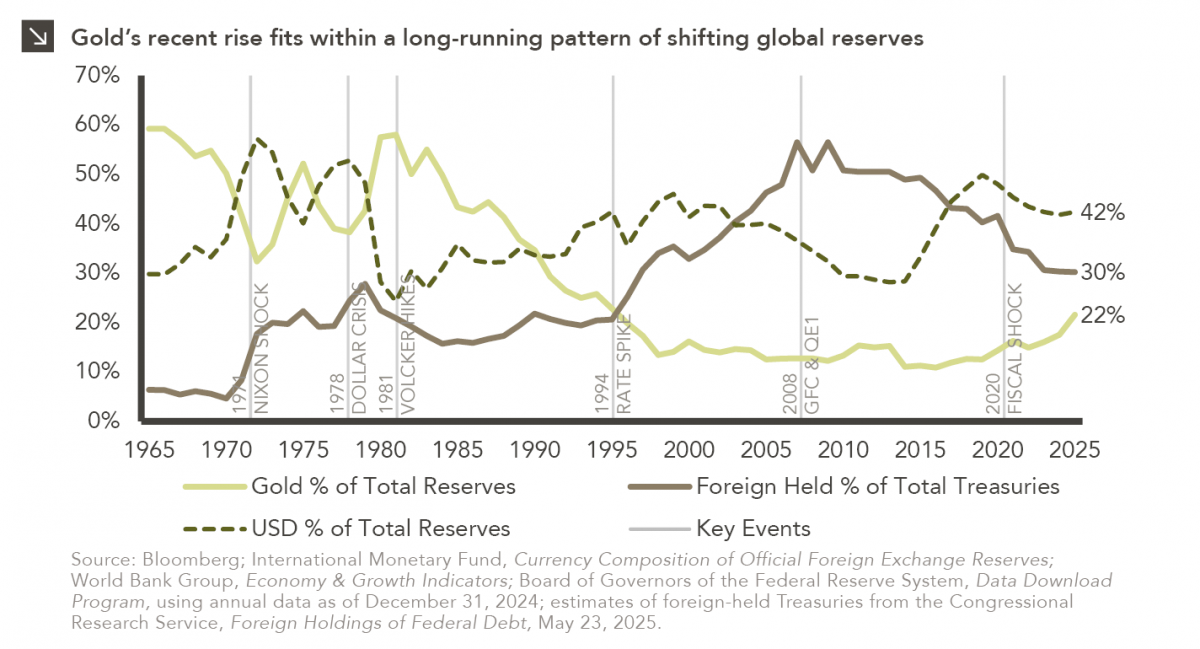

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

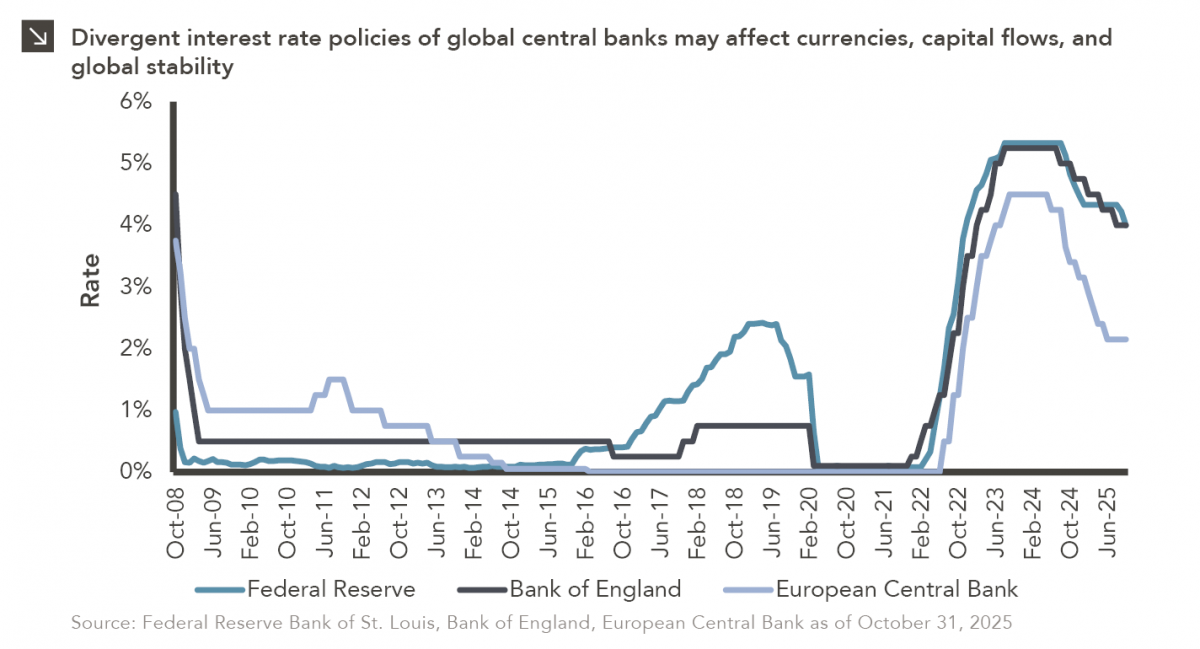

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >