Evan Frazier, CFA, CAIA

Senior Research Analyst

The beginning of 2022 represented a change of pace for equity investors, as increased geopolitical and macroeconomic uncertainty drove the S&P 500 to its first negative quarter in two years. In light of recent performance trends and the potential for continued asset price fluctuation, market participants may be interested in assessing the viability of strategies with lower risk profiles that still offer the potential for long-term gains similar to those of the S&P 500. One such strategy is low volatility equity investing. Though it has fallen somewhat out of favor in recent years, low volatility is a generally accepted risk premia factor (akin to value, size, quality, etc.), meaning investors can theoretically expect to earn excess returns by allocating to lower volatility equities over the long run. This newsletter seeks to understand the rationale and evidence for this premium, explain recent performance of low volatility stocks, and examine the prospects of the style going forward.

Read > Low Volatility: Factor or Fad?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.18.2026

Healthcare systems have faced an onslaught of challenges in recent years. They had to navigate the operational and financial headwinds…

02.17.2026

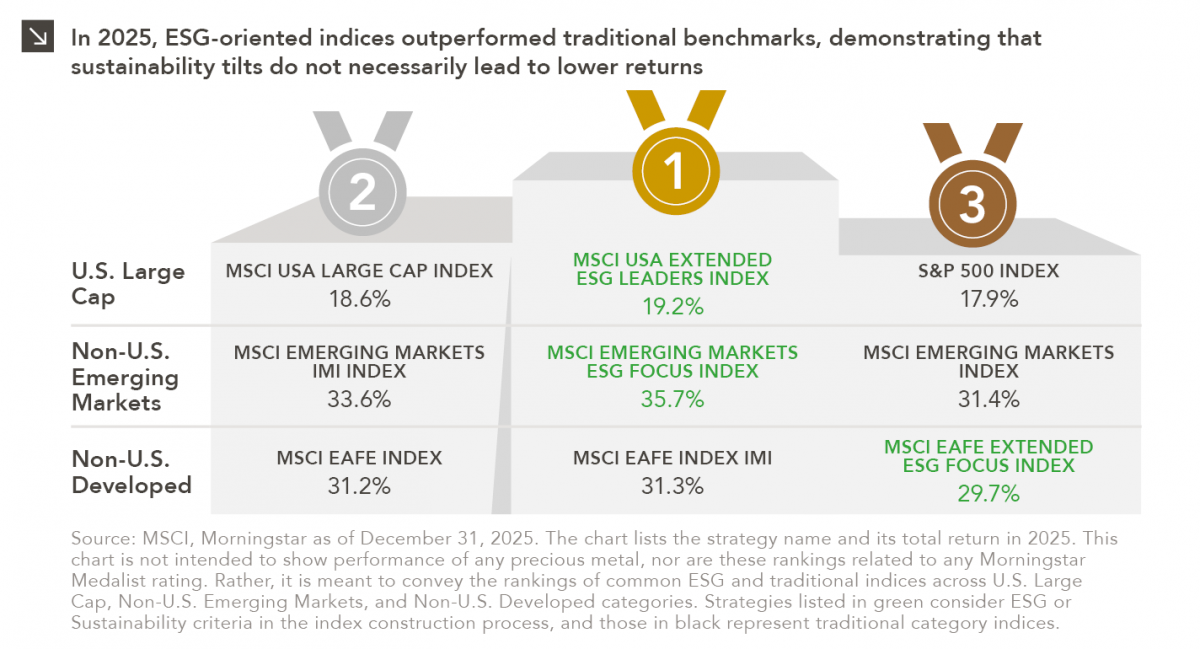

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

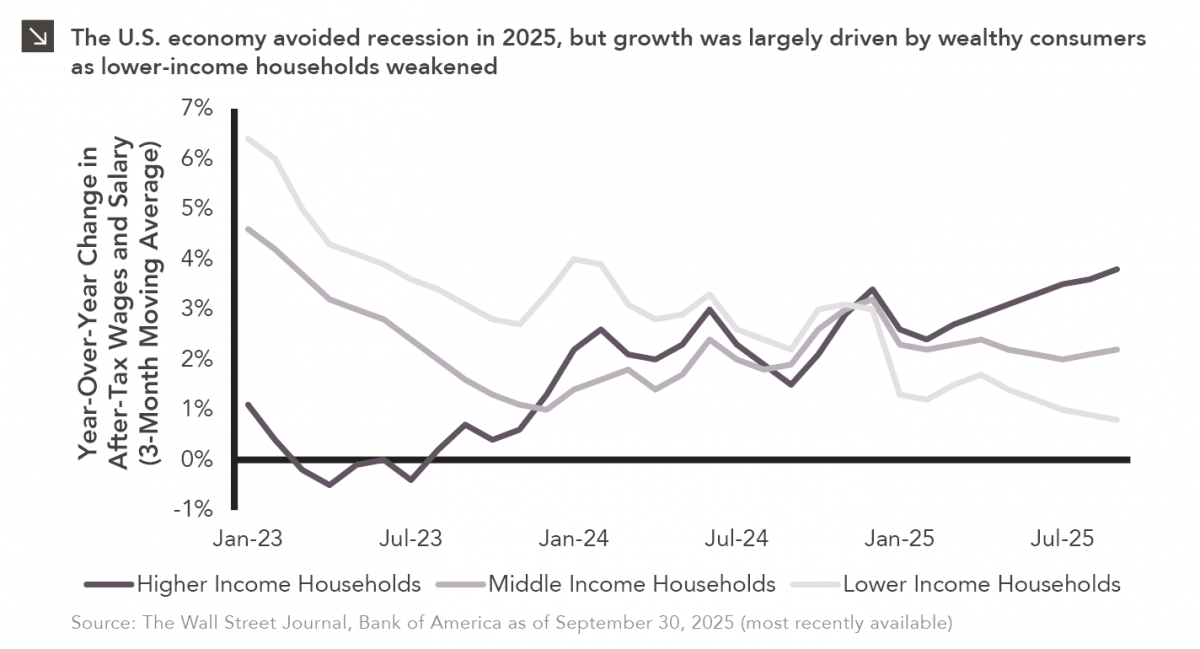

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >