Thomas Neuhardt

Research Associate

Get to Know Thomas

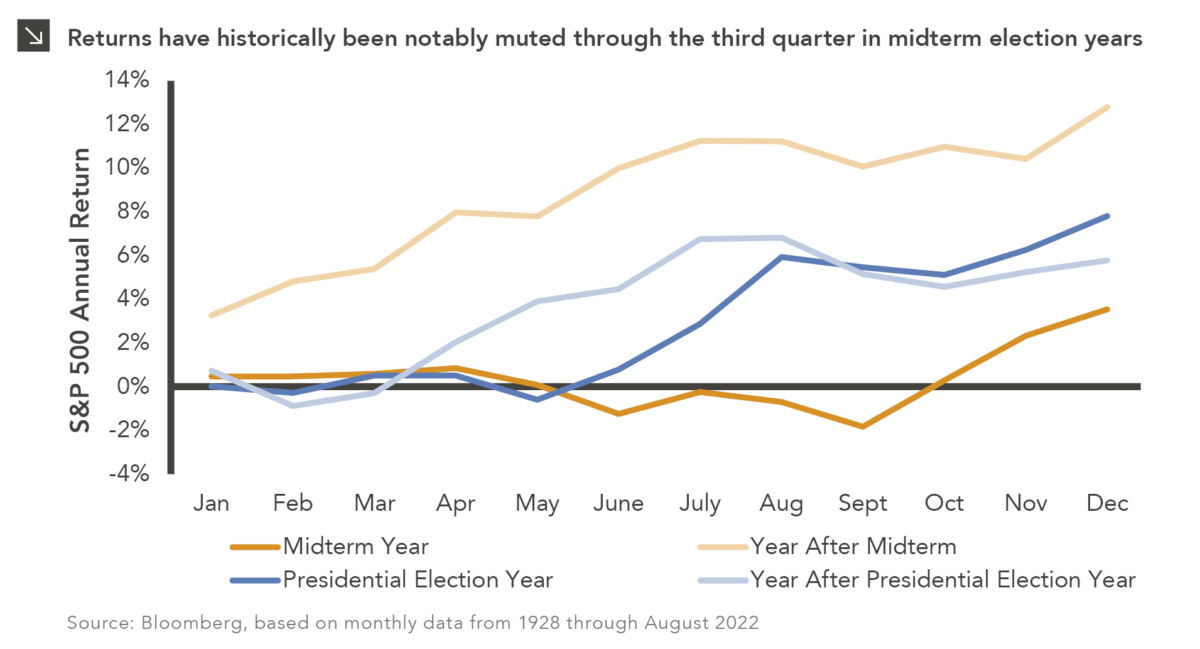

If inflation, rising rates, and a war in Europe were not enough to keep markets interesting this year, 2022 is also a midterm election year. Based on data over the last nine decades, midterm election years — while only marginally more volatile than non-election years overall — tend to exhibit a distinct performance pattern throughout the year. On average, returns during midterm years tend to be flat to slightly negative through the first three quarters as investor confidence is dampened by uncertainty around the outcome of the election. Historically, returns start to pick up as November draws near and tend to finish strongly, with fourth quarter returns in midterm years significantly stronger than non-midterm years. This holds true regardless of which party wins the House and Senate and whether or not there is a change of control, suggesting investors value predictability more so than a specific party controlling Congress. While each year is unique, and this analysis does not consider the deluge of other macroeconomics issues plaguing 2022, it is interesting historical context. Come November 6, there may be one less source of uncertainty in markets.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

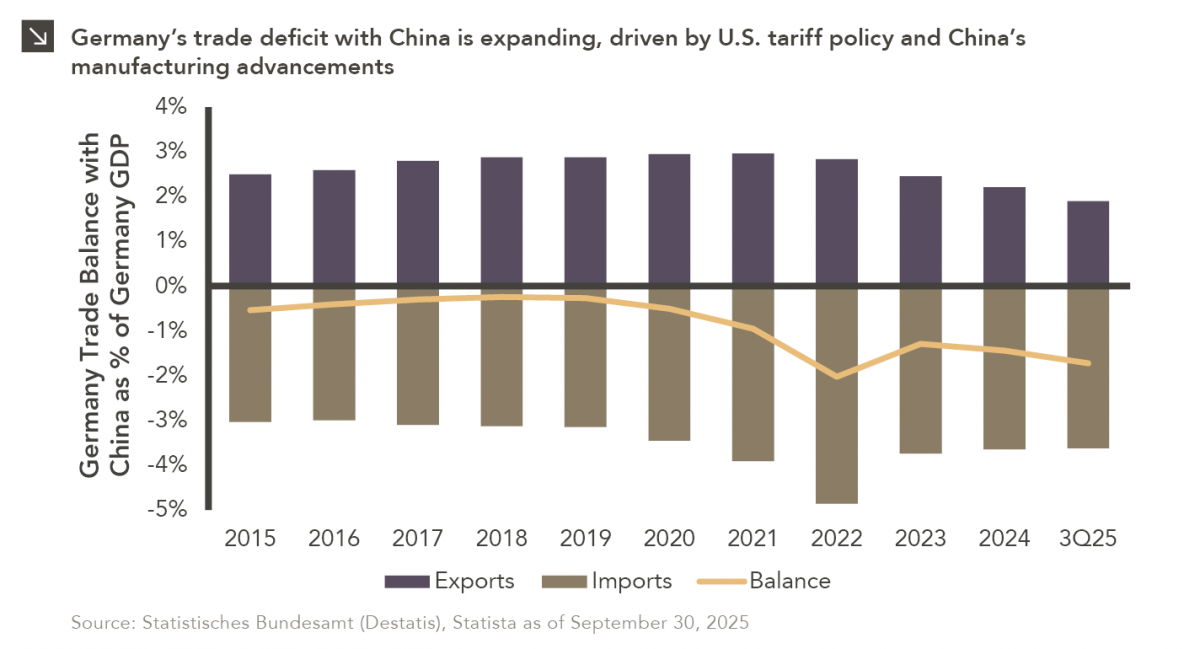

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >