Nat Kellogg, CFA

President

Despite the recent increase in long-term interest rates, the low rate environment is now more than four years old and continues to create challenges for investors. While interest rates are notoriously volatile the current low rate environment and negative real yields on risk free securities is unprecedented in its duration. Given the Federal Reserve’s clear indication that it will not raise interest rates until there is a substantial drop in unemployment or increase in inflation, it appears the current low rate environment is unlikely to change in the near future. While this creates challenges for all institutional investors, it creates a unique set of challenges for non-profit health care organizations (“HCOs”).

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.06.2025

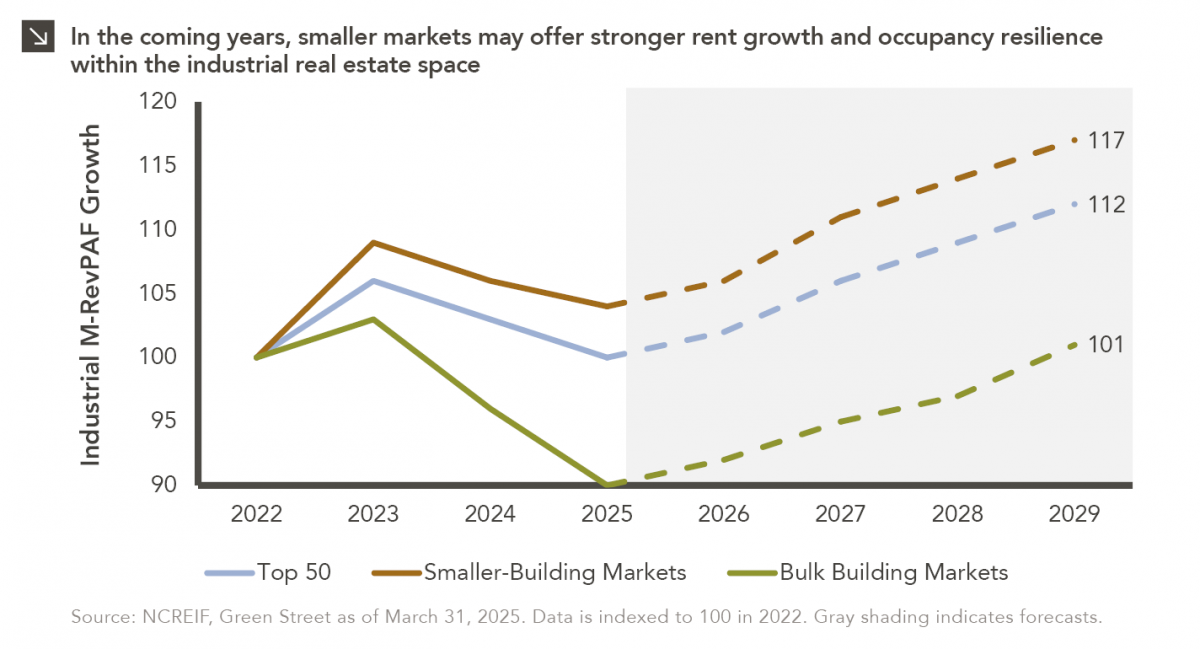

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

08.25.2025

Over the last several decades, artificial intelligence (“AI”) has evolved from a theoretical concept into a transformative force across a…

08.19.2025

On August 7, 2025, President Trump signed an executive order to expand alternative investment access in defined contribution retirement plans…

08.06.2025

Despite the U.S. economy’s impressive growth in recent decades, the federal government currently faces elevated borrowing costs to fund its…

07.21.2025

Despite allocations to various segments of corporate capital structures, most balanced portfolios have a degree of overlap when it comes…

07.16.2025

Emerging markets (EM) equities have gone through cycles of performance throughout time, creating varied investor sentiment towards the asset class….

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >