Amy Miller

Associate Director of Private Equity

Some of the key hallmarks of an attractive private equity deal include businesses with a loyal and diversified customer base, recession-resistant and diversified revenue streams, and observable, steady growth in historic asset values. While this may be a mission-critical software company, it may also be the English Premier League or the National Basketball Association. A growing consortium of private equity funds has begun to recognize the inherent value of professional sports and is increasingly purchasing stakes in leagues, teams, media rights, and related real estate. As of August, $6.2 billion had already been invested in 2022, with the full year on track to exceed 2021’s $6.3 billion. Much of this can be attributed to the swell of activity in European football leagues, with the Chelsea Football Club comprising nearly half of the 2022 year-to-date total.¹

From an investor’s perspective, professional sports franchises provide economic exposure to a diverse set of assets, low correlation to broader equity markets, and recurring and predictable revenue streams. The observable growth in asset value has also added to private equity’s interest in the segment. In the 20 years ended 2021, the average cumulative price return for professional sports team franchises in the NHL (+467%), the NFL (+558%), the MLB (+669%), and the NBA (+1,057%) all outpaced the S&P (+458%), according to Forbes, Sportico, and Pitchbook data. While valuations have risen with a limited number of franchises available to buy, the numbers reflect the attractive characteristics of the assets, such as broadcasting rights, streaming, and the opportunity to further monetize a dedicated fan base. While still in the early innings (or first quarter, half, or period), this is a sub-segment within private equity worth a keen eye as investment continues to grow.

Print PDF > Pitch Perfect, Slam Dunk

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

10.01.2025

Please join Marquette’s research team for our 3Q 2025 Market Insights Webinar analyzing the third quarter across the…

09.29.2025

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both…

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

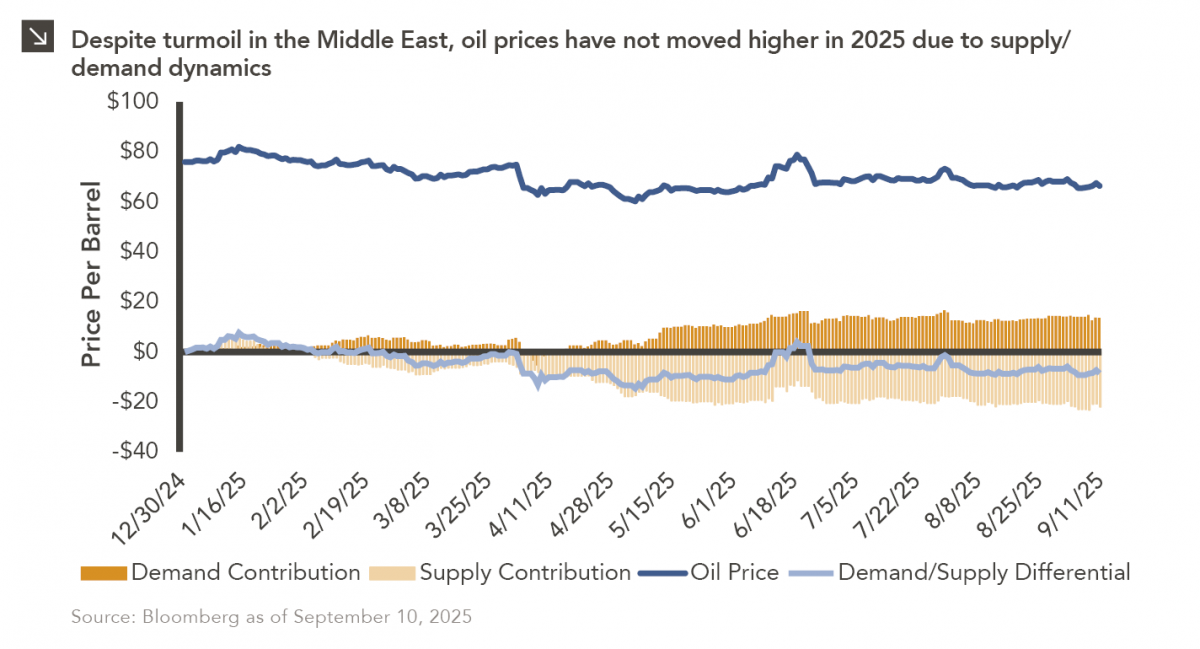

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

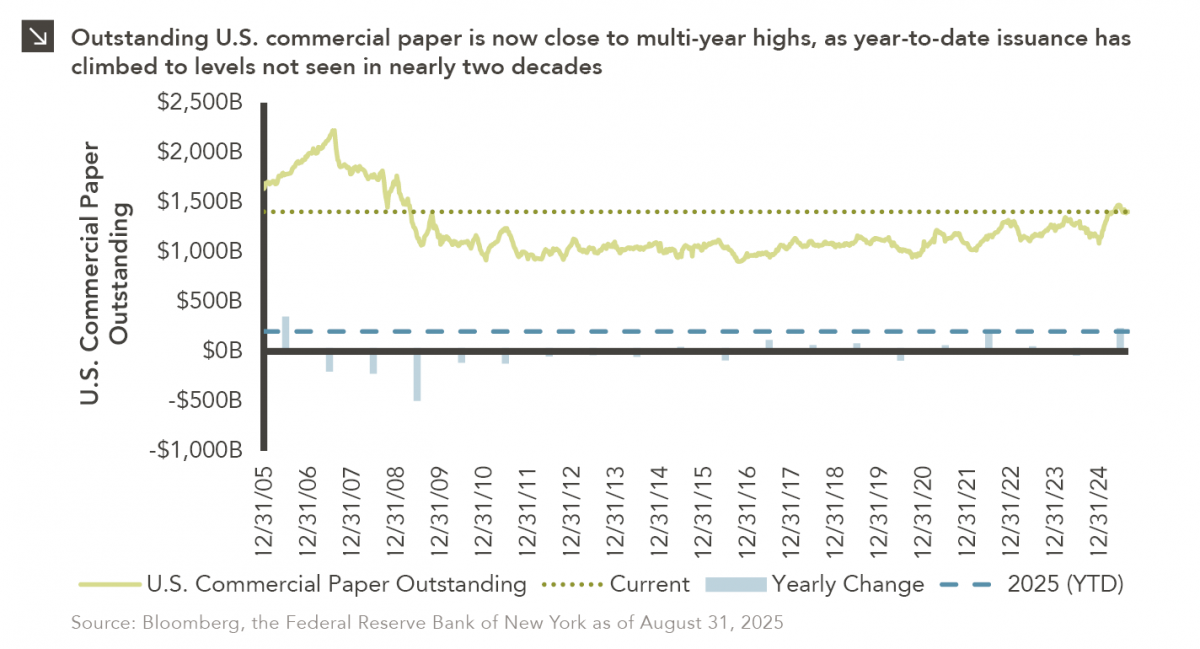

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >