12.29.2025

Glass Half Empty

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

This week’s chart analyzes job growth after the last four recessions by examining employment levels 60 months after the start of each recession. The data focuses on private employment, not government employment. Ellipses on the chart represent the end point of each recession, whereas squares represent the beginning of job growth.

The 1982 recession lasted seventeen months. After its cessation, it took only nine months for employee growth to emerge. While the 1990 recession lasted nine months, it endured an additional 26 until job growth began. The length of the 2001 recession was again brief lasting only nine months, but it withstood 30 months until growth mode. The most recent recession began in December of 2007 and lasted nineteen months. At 27 months and counting, we are still waiting for job growth to commence.

Five years after the ’82, ’90, and the ’01 recessions, private sector job levels were well ahead of their pre-recessions levels. Unfortunately, it is difficult to paint a happy picture on the current status of employment: while there has been progress in recovering lost jobs, substantial headwinds remain, as 6.3 million more jobs are needed to return to pre-recession levels.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

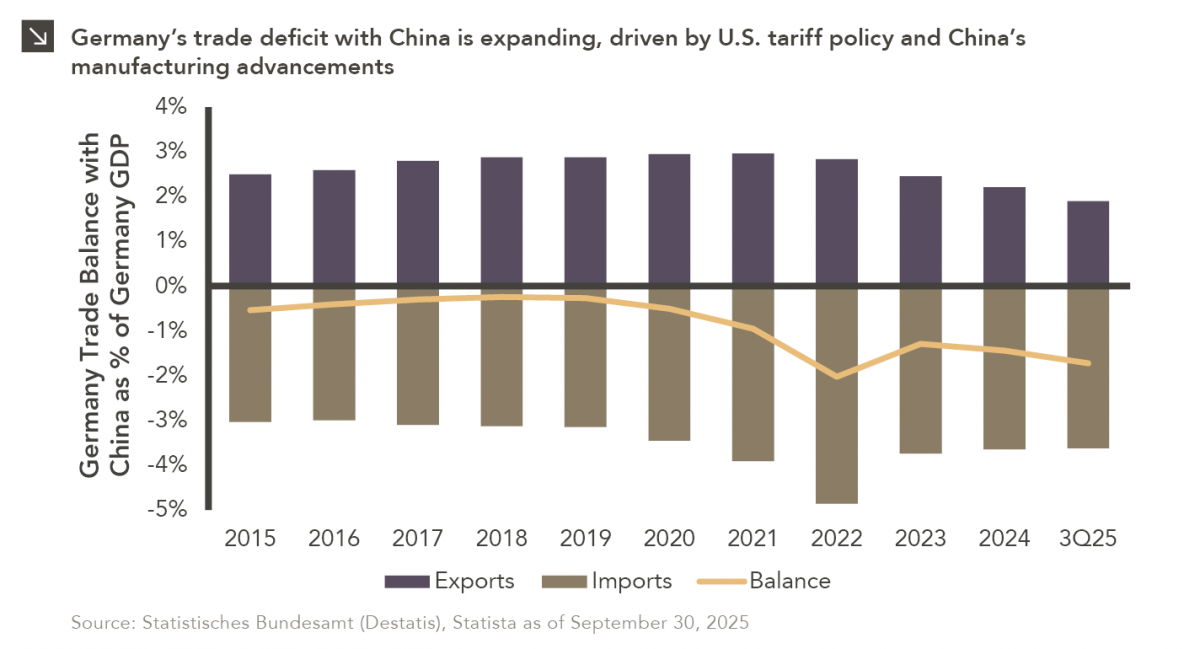

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >