04.16.2024

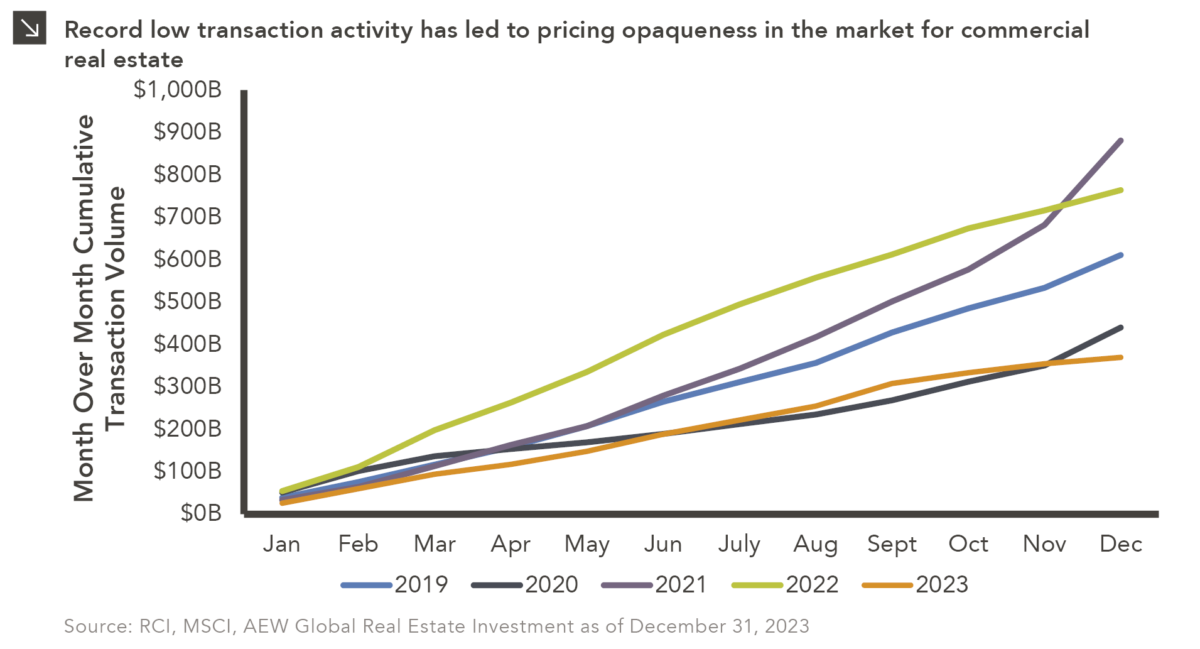

The Banks’ Real Estate Problem

First quarter earnings season is getting started, with the largest banks reporting first. In the wake of last year’s regional…

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

04.16.2024

First quarter earnings season is getting started, with the largest banks reporting first. In the wake of last year’s regional…

04.10.2024

— LIVE WEBINAR APRIL 25 — Please join Marquette’s research team for our 1Q 2024…

02.12.2024

Alternative credit, also referred to as private credit or private debt, has emerged as an area of significant interest for…

01.26.2024

This video is a recording of a live webinar held January 25 by Marquette’s research team analyzing 2023 across the…

01.25.2024

A former colleague once described his brother-in-law to me as a “40 degree day.” The puzzled look on my face…

01.24.2024

The 10-year Treasury yield notably displayed significant movements throughout 2023. Specifically, it was largely range-bound over the summer (between 3.5%–3.8%),…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >