Thomas Neuhardt

Associate Research Analyst

Get to Know Thomas

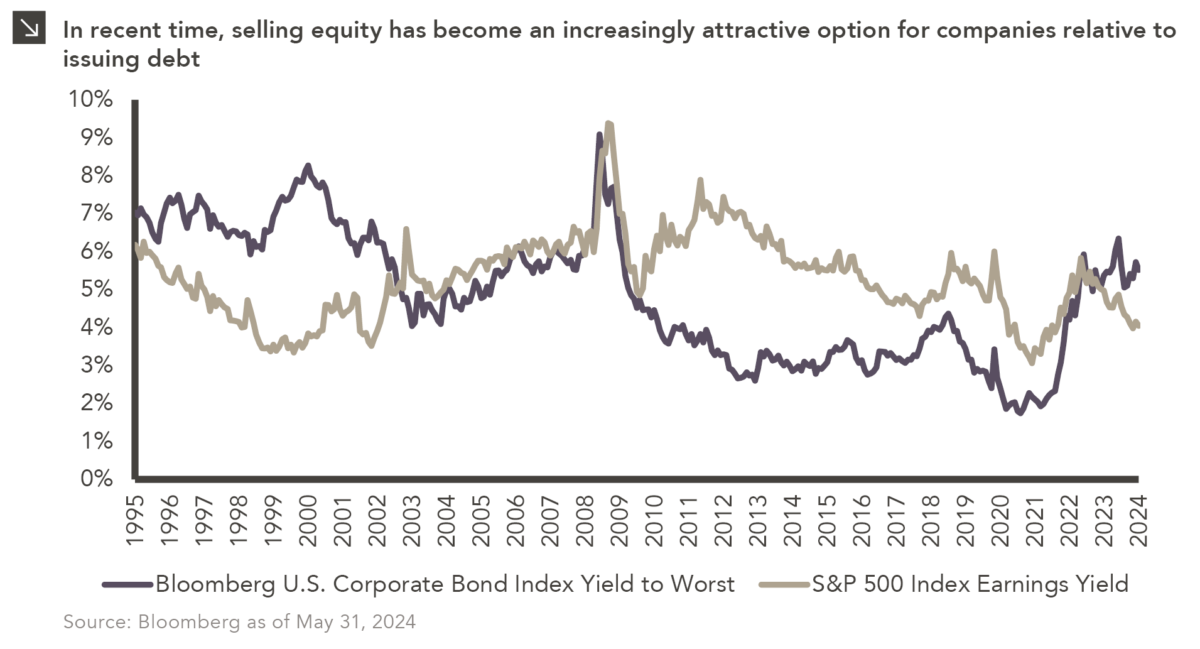

In the years following the Global Financial Crisis, issuing new debt was an easy decision for companies looking to raise capital given an environment of historically low interest rates. That said, decisions related to the composition of corporate capital structures are now less straightforward due to seismic shifts in monetary policy that have taken place in recent time. To that point, this week’s chart compares the yield-to-worst of the Bloomberg U.S. Corporate Bond Index, a proxy for the cost of debt, to the earnings yield of the S&P 500 Index. The earnings yield is calculated by dividing earnings-per-share by the price of the index and is used as a proxy to determine the costs companies face when it comes to new equity share issuance (i.e., the lower the earnings yield, the cheaper it is to sell shares and vice versa). As readers can observe in the chart above, this yield now sits below the yield-to-worst of the fixed income index.

Companies generally prefer issuing debt over equity due to the tax shield associated with this financing (i.e., interest expenses are typically tax-deductible), which still renders debt the more cost-efficient option for many companies in the current environment. Further, equity issuance is often viewed negatively by market participants due to the dilution of per-share earnings that arises as a result. There are, of course, additional factors beyond the costs of debt and equity that CFOs must consider when making decisions related to capital structure dynamics. That said, in light of the trends outlined above, many companies may begin to view equity issuance as a more attractive option when it comes to raising capital.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >