Lili Park

Vice President, Client Service

Get to Know Lili

This week’s chart takes a look at the S&P 500 index in direct correlation to corporate profit earnings. Thriving on corporate profits, the S&P 500 index closed at 1593.37 this past Thursday, its highest level in history. Profits by corporations, in addition to a recovering housing market have helped expand the economy for 14 consecutive quarters. Corporate profits can be attributed to the elevated growth in emerging economies in conjunction with the positive contribution of drastically lower interest rates to the bottom line.

With corporate spreads tightening and record low interest rates, investors seeking higher returns are diverting from secure investments and saving accounts to riskier investments such as stocks. The preceding 10 months have demonstrated that stocks have advanced approximately 25%, as measured by the S&P 500, with $6 trillion of wealth created for U.S. households, institutional investors, and corporations.

With corporate profits blooming, the U.S. stock market is becoming one of the strongest bull markets in 50 years. Charged by growing signs of a recuperating economy, the S&P 500 has now recouped more than all of its losses since the financial collapse and crisis of 2008.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.08.2025

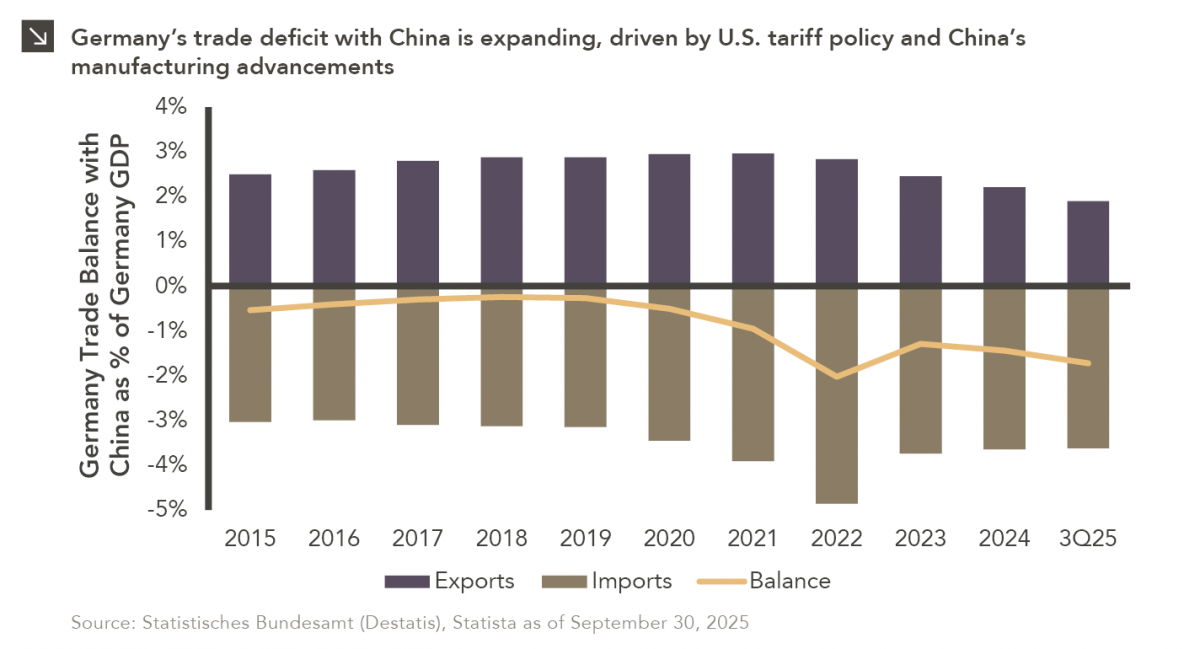

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >