James Torgerson

Senior Research Analyst

Before the football season began, we authored a white paper that detailed offensive and defensive elements of a fixed income portfolio. For most investors, an aggregate (core) mandate provides defense while strategic allocations to high yield, senior secured loans, and emerging market debt (EMD) are the primary sources of offense. Relative to an aggregate benchmark, this structure has outperformed over market cycles. However, just as championship teams adjust and innovate throughout a season, so too should an investor’s portfolio.

Multi-Asset Credit (MAC) strategies are single portfolios that dynamically allocate across a broad range of global credit markets to provide higher levels of income and a diversity of fixed income exposures. These mandates can serve as a single-solution credit allocation or as a credit alpha overlay in the context of a broader credit portfolio. There is no perfect definition of MAC, but what they do offer is diversification, flexibility, and ease of access and operations. While these markets are not new, investors may be unfamiliar with the mechanics of a MAC strategy and its potential benefits.

This newsletter provides an overview of MAC, including the opportunity set, allocation structure and considerations, diversification benefits, and sample MAC manager performance.

Read > Multi-Asset Credit: Taking Offense From Good to GreatThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

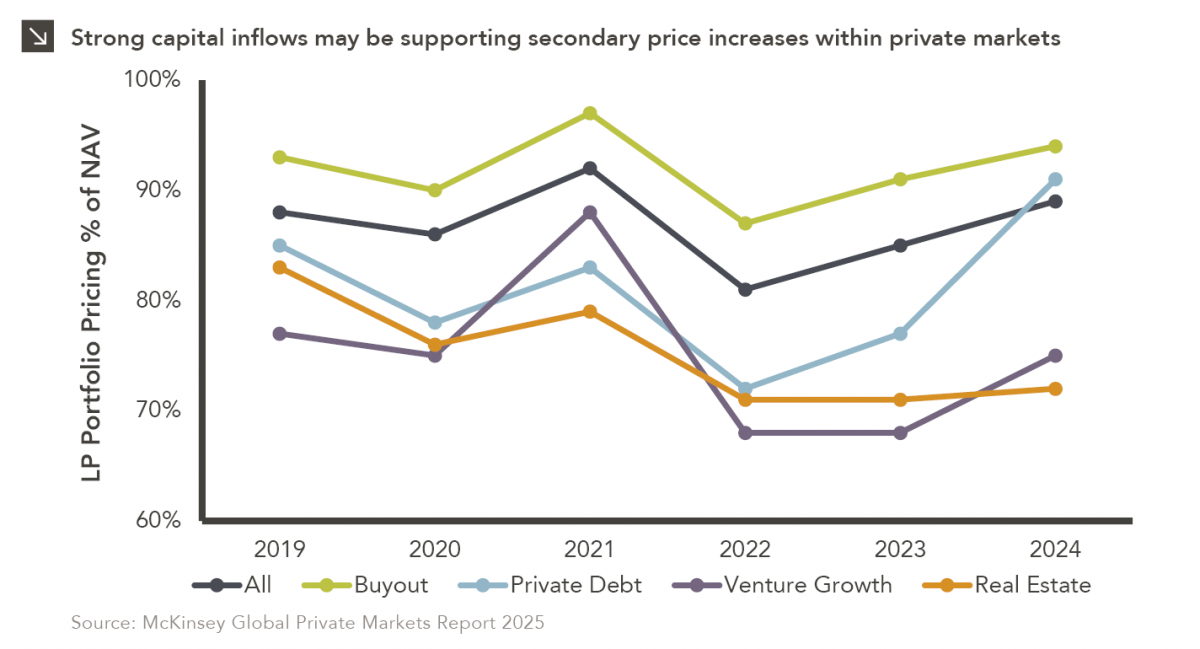

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >