01.12.2026

I Drink Your Milkshake

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

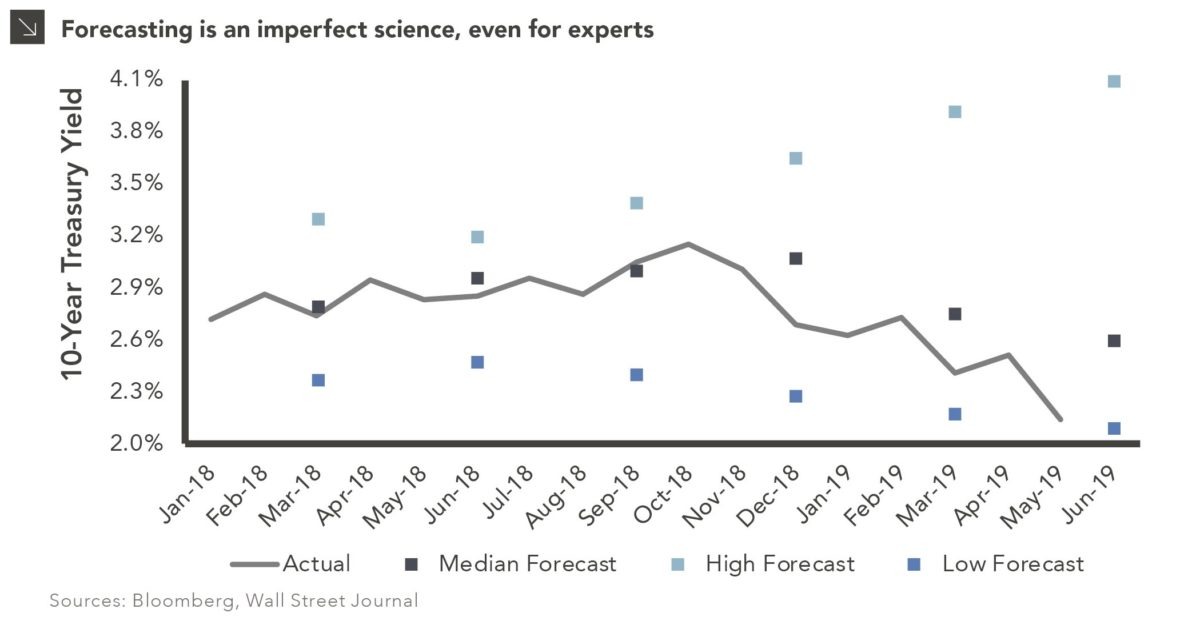

Since the end of October, the yield on the 10-year Treasury fell more than 1% and as of writing stands at 2.12%. The drop resulted in the yield curve inverting between the 3-month and 10-year maturities, and the 2-year yield is getting dangerously close to also surpassing the 10-year. This dramatic decline and inversion made investors nervous that a recession was on the horizon and caught most economists off-guard. In both 4Q and 1Q the 10-year yield ended lower than the average forecast from the Bloomberg consensus by about 0.4%. 2Q is on track to be even worse as the yield may fall below the forecasted low from the survey.

Towards the end of 2018, most believed the 10-year would rise thanks to continued growth and further rate hikes by the Fed. However, volatility and ongoing concerns about tariffs have pushed investors into safe-haven assets. This was further fueled by the weaker than expected job reports and most now believe the Fed will likely cut interest rates at least once before the end of the year. As a result, some institutions revised their forecasts for the remainder of 2019, going as low as 1.75% for the 10-year. That said, there is still a great deal of uncertainty and rates could just as easily rebound should we get more positive economic data, if the Fed chooses not to decrease rates, or if there is a resolution to the trade conflict. Overall, this serves as a reminder to investors that timing the market is an imperfect science and even experts can miss the mark by a wide margin. We continue to encourage clients to stick to their investment policies, invest for the long-term, and follow a disciplined rebalancing routine.

Print PDF > When the Experts Are Wrong

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >