David Hernandez, CFA

Director of Traditional Manager Search

With the unemployment rate (6.6%) approaching the Fed’s forward guidance target of 6.5%, this week’s chart examines two additional labor market indicators: the number of people working part-time for economic reasons and the number of individuals who have been unemployed for longer than six months. In her February report to Congress, the new Fed Chairperson, Janet Yellen, identified these two data points as important gauges for evaluating the health of the U.S. job market.

While we have seen steady improvement in the headline unemployment number (down from a high of 10.0%), much of the “recovery” has been due to a decreasing labor participation rate, and overall the labor market remains relatively weak. Many individuals have resorted to working part-time due to poor labor demand and this segment constitutes 5.3% of currently “employed” workers. While below the high (7.0%) it is still above the long-term average of 4.4%. In addition, a large percentage of the unemployed (35.6%) have been so for more than six months. This is above the long-term average of 25.5% yet below the peak of 45%.

With the risk of inflation remaining relatively low, the market expects the central bank to refrain from increasing the fed funds rate at least through the first half of 2014 in an attempt to strengthen the economy and labor market even if the unemployment rate drops below 6.5%.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.01.2025

Please join Marquette’s research team for our 3Q 2025 Market Insights Webinar analyzing the third quarter across the…

09.29.2025

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both…

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

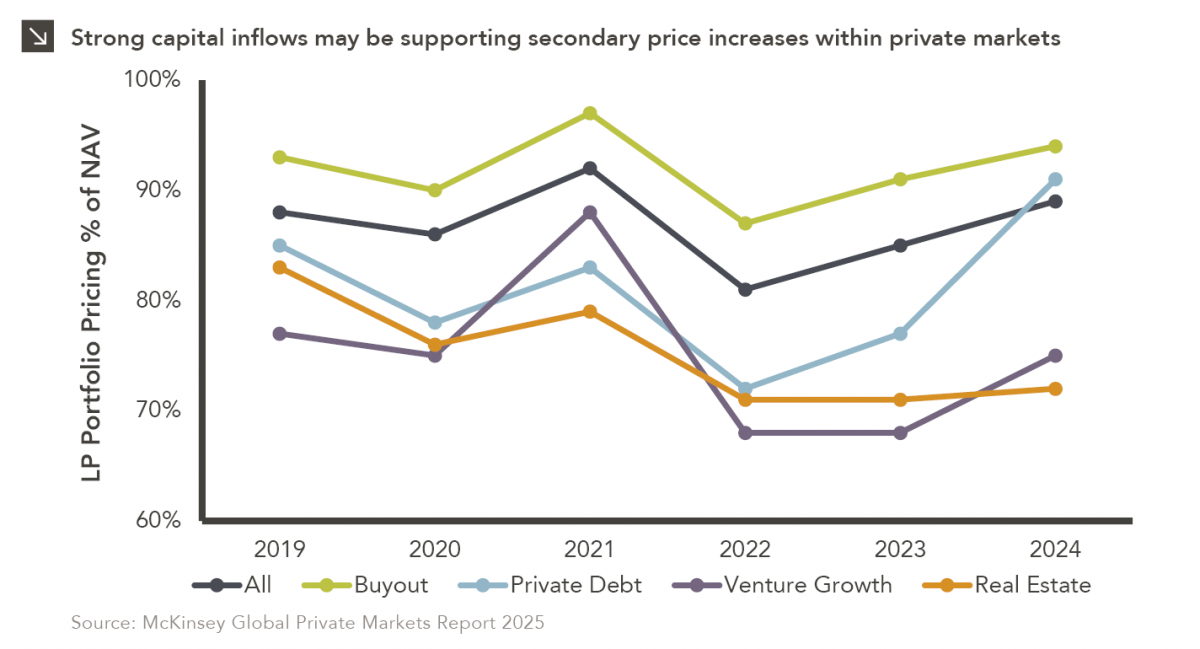

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >