David Hernandez, CFA

Director of Traditional Manager Search

This week we examine the valuation of developed non-U.S. small-cap equity (MSCI EAFE small-cap) compared to U.S. small-caps (Russell 2000). The chart displays the relative price-to-earnings (P/E) and price-to-book (P/B) ratios for the two asset classes. A lower number indicates the U.S. is more expensive compared to non-U.S small-cap stocks. Based on the historical averages for both P/E and P/B, non-U.S. equity looks relatively attractive.

Small-cap companies in the U.S. have performed well in this historically low interest rate environment. Now five years into the economic recovery, market participants expect a rate hike from the Fed to occur sometime mid next year. With U.S. small-cap stocks lacking extraordinary earnings growth, many investors are questioning their valuations. In the Eurozone and Japan, two areas that account for over 40% of the MSCI EAFE small-cap index, the economies are earlier in their respective recoveries and experts anticipate lower interest rates to persist in these regions, which should be accretive for equities in those markets. Investors looking to reduce their U.S. small-cap exposure should consider developed non-U.S. small-cap, given the accommodative central bank policies and relative valuations.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

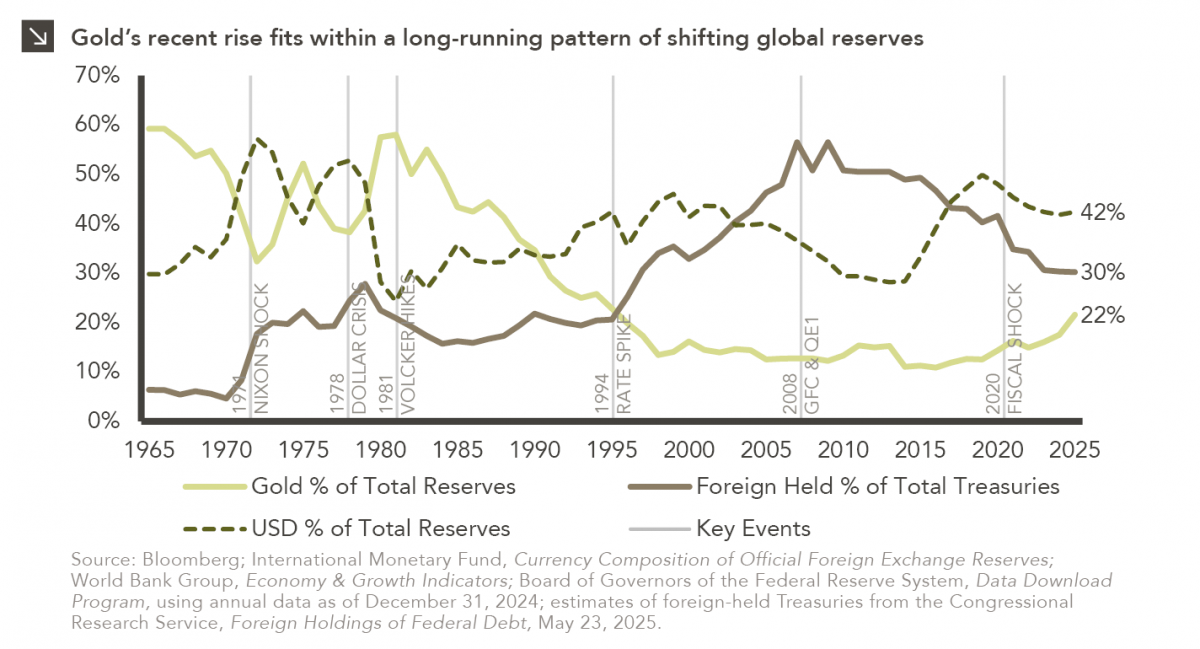

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

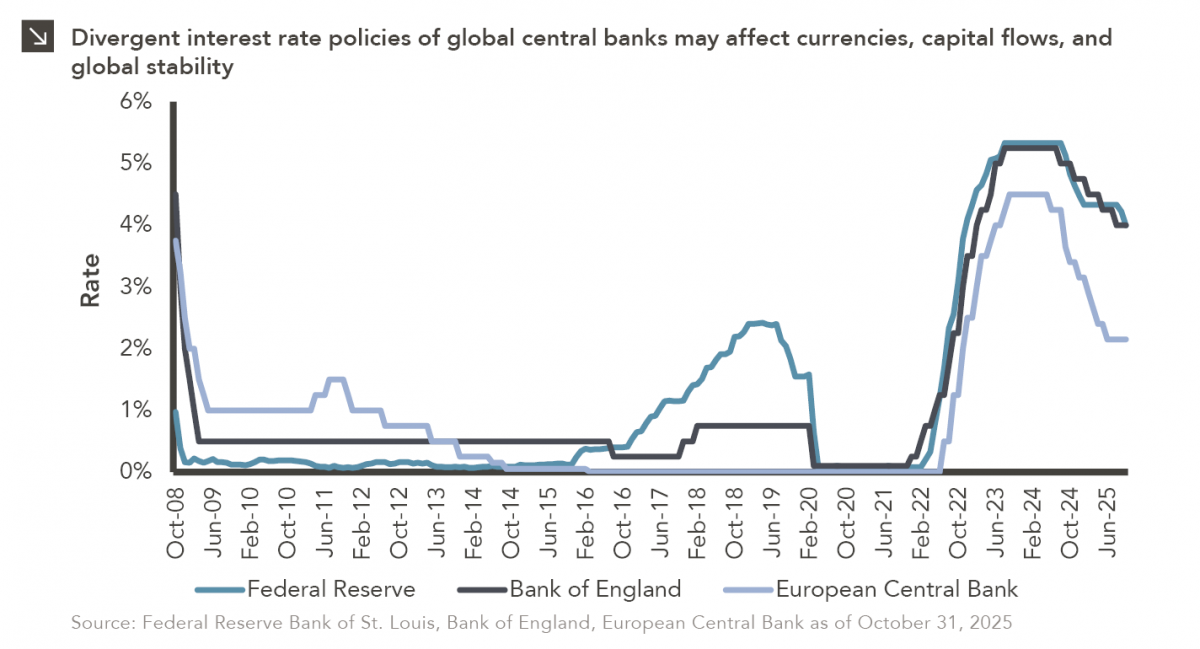

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >