01.07.2026

2026 Market Preview Webinar

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

This week’s Chart of the Week takes a look at Master Limited Partnerships (“MLPs”) and their current valuations based on their EBITDA Multiple (calculated by Enterprise Value divided by the 12-month EBITDA). Generally, a higher multiple implies a more expensive valuation. Relative to long-term averages and the S&P 500, MLPs appear expensive today. The elevated valuations, however, are pricing in higher expected rates of growth. These higher growth expectations do not come as a surprise given the recent increase in domestic energy production and expected midstream infrastructure expenditures, which could approach $640 billion between now and 2035.1 Compared to the prior study done in 2011 ($261B), the 2014 estimates represent a 145% increase in infrastructure spending.

Paying a premium for MLPs relative to historical averages may not necessarily be a bad thing assuming that the estimated growth within the energy infrastructure sector comes to fruition. If, however, there is a catalyst in the market such as a rapid increase in interest rates, regulatory change, or an international crisis, MLPs may experience a correction.

1 Interstate Natural Gas Association of America

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

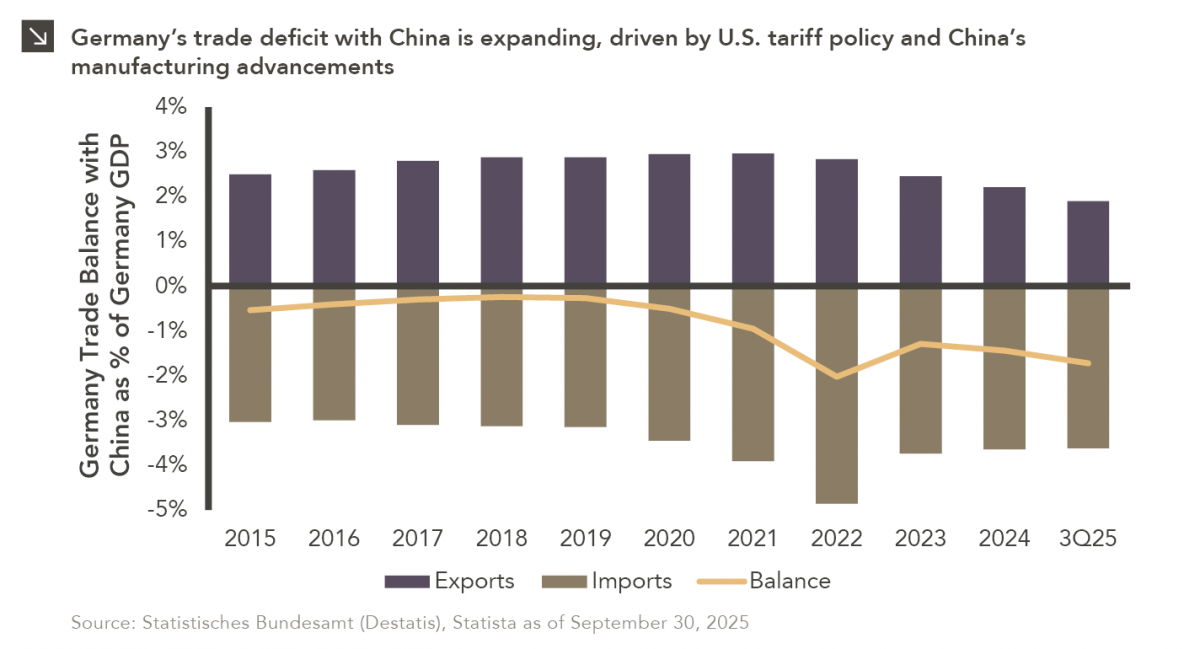

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >