Evan Frazier, CFA, CAIA

Senior Research Analyst

The S&P 500 index — up 9.6% on a year-to-date basis through May — recently entered into a technical bull market, mostly due to a resurgence of growth-oriented areas of the U.S. equity space like Information Technology and Communication Services. At the same time, data related to futures contracts on the index could indicate extremely bearish sentiment on the part of hedge funds and speculators. As of the end of last month, these investors and traders were net short more than 400,000 E-mini S&P 500 futures contracts — the largest such position since Bloomberg started tracking the metric in the early 2000s.

There are several potential explanations for this phenomenon. First, investors may believe the recent run of the S&P 500 is not reflective of the current economic climate and overly dependent on a small basket of securities. To that point, the year-to-date return of the benchmark would actually be negative through the end of May excluding just seven high-performing index constituents (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla). This type of sentiment could lead the index to retract meaningfully should one of these companies stumble. However, this same group of investors has maintained net long positions on similar NASDAQ futures contracts in recent time, which does not support the notion that investors are inordinately bearish on these stocks. Dynamics within S&P 500 futures markets could also be a reflection of hedge funds and other investors having a significant number of high-conviction long positions with fewer alpha short ideas, which could necessitate hedging to lower net exposures and would actually be a bullish indicator. Whatever the reason for this positioning, it is important for investors to remember that no one variable is sufficient when it comes to explaining overall market machinations. Marquette will continue to monitor equity and futures markets and advise clients accordingly based on our findings.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.18.2026

Healthcare systems have faced an onslaught of challenges in recent years. They had to navigate the operational and financial headwinds…

02.17.2026

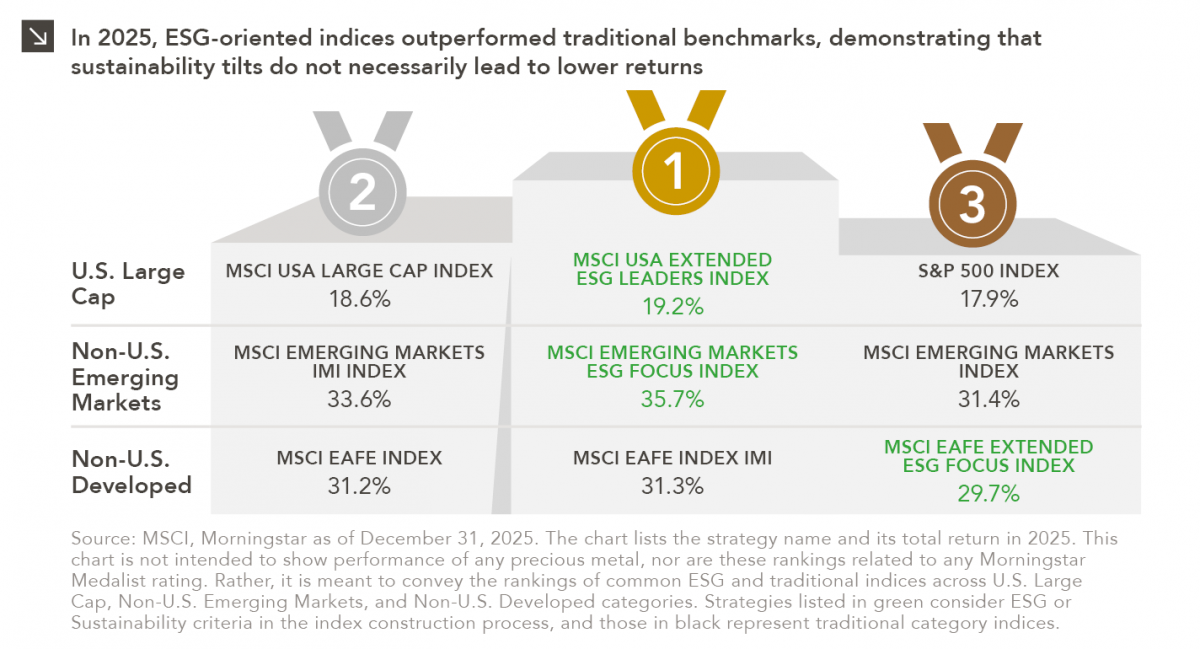

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

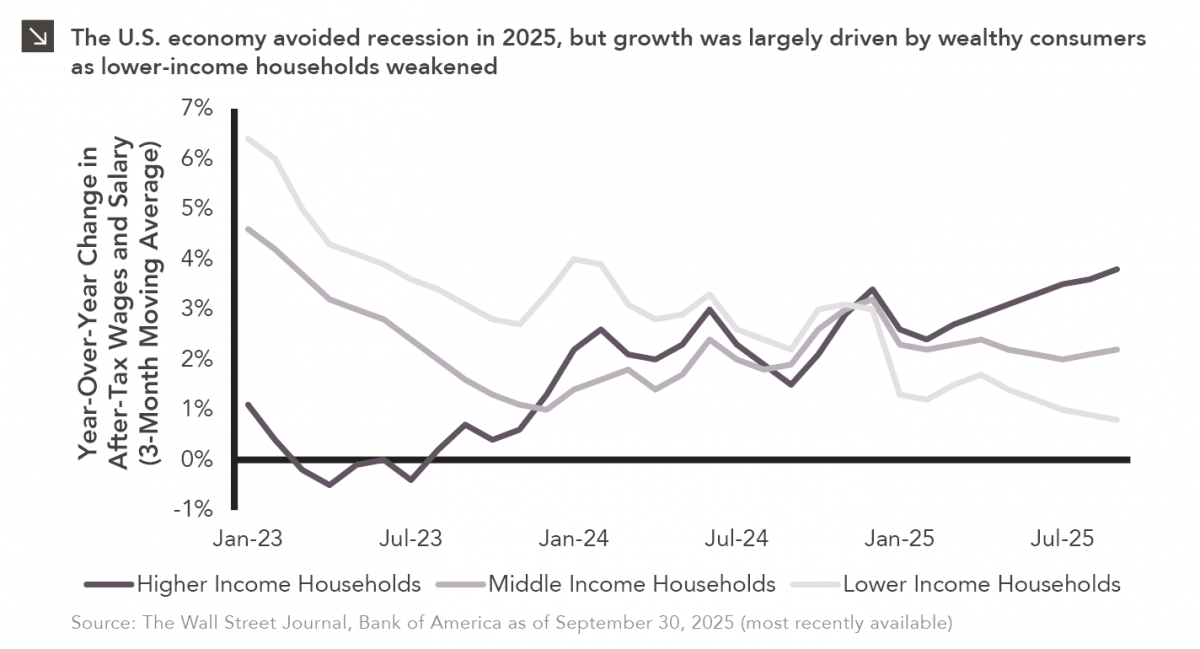

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >