Zach Houston-Read, CFA

Associate Research Analyst

Get to Know Zach

The new year brings a new political administration with fresh approaches and drastically different perspectives on topics ranging from immigration to foreign policy. As the Biden era exits and another Trump era begins, federal spending and the deficit persists. Borrowing began with financing the Revolutionary War, and it is as American as baseball and apple pie. The national debt clock in Manhattan has a massive figure of over $36 trillion that is owed by the government to holders of Treasuries. Talks of the deficit and debt ceiling emerge every year and politicians put off the issue rather than finding ways to reduce borrowing by increasing taxes and/or reducing spending. Will there ever be any repercussions to running such a high deficit?

While you will never see an explicit bill from the government with your family’s share due, there is a limit to the amount the U.S. can borrow without any consequences. This paper will give the reader an anatomy of the deficit and debt, consequences of running such a high deficit, and summary of the high-level solutions that have been proposed.

Read > The Debt and Deficit DilemmaThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

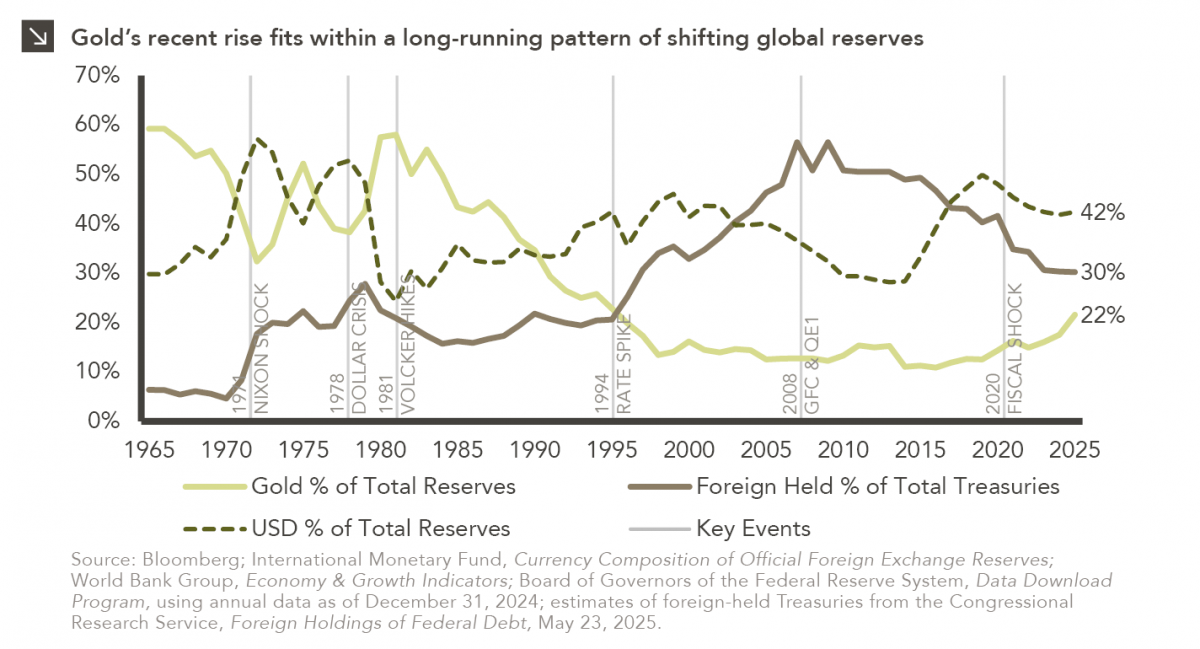

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

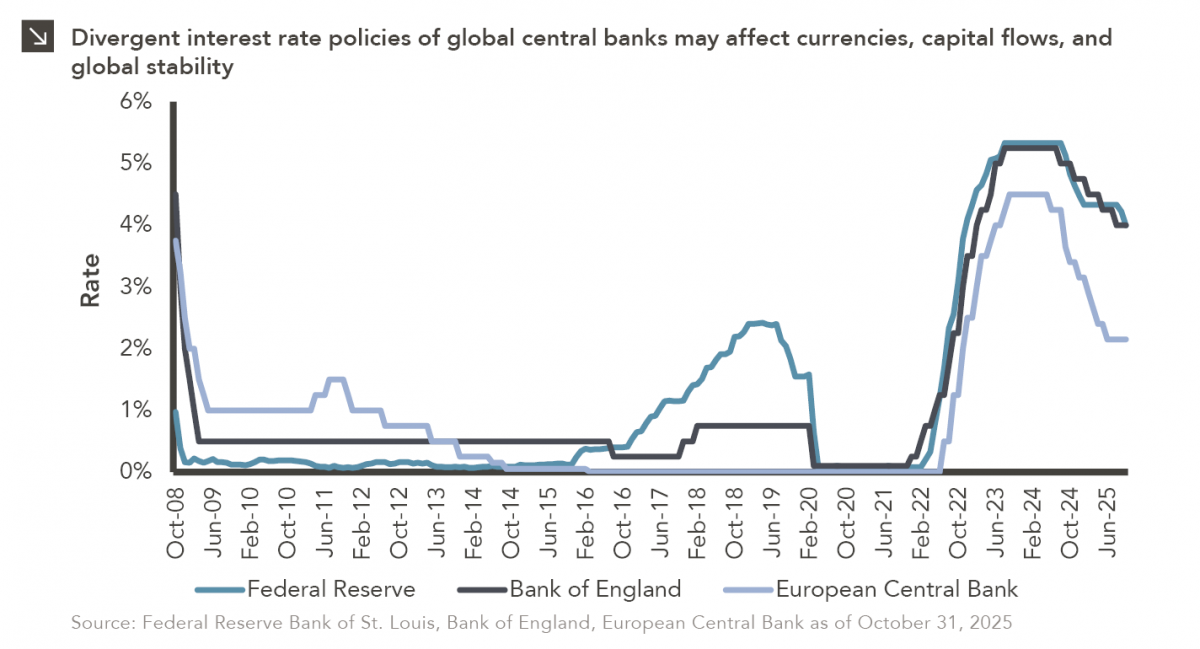

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >