Evan Frazier, CFA, CAIA

Senior Research Analyst

In February of this year, Marquette published a Perspectives piece entitled Is the Sky Falling? that detailed the history of the United States debt ceiling, as well as the early innings of negotiations surrounding its possible increase or suspension given the fact that the $31.4 trillion limit was reached on January 19. In the months since, the Treasury Department has been forced to resort to “extraordinary measures” in order to prevent the U.S. from defaulting on its obligations, including suspending sales of state and local government series Treasury securities. Those measures, however, will likely be exhausted in the very near future according to the nonpartisan Congressional Budget Office (perhaps as early as June), at which point the federal government will ultimately be unable to pay its obligations fully and, as a result, have to delay making payments for some activities and/or default on its debt obligations. This is commonly referred to as the x-date. It is worth pointing out that a number of large Wall Street firms have brought their forecasts of this date forward in recent days.

This newsletter analyzes potential repercussions of a U.S. default and options for a resolution of the debt limit impasse in Congress.

Read > Down to the Wire: An Update on the 2023 U.S. Debt Ceiling Crisis

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.10.2025

At the start of 2025, very few could have predicted the wild ride that awaited equity markets. After a volatile…

12.01.2025

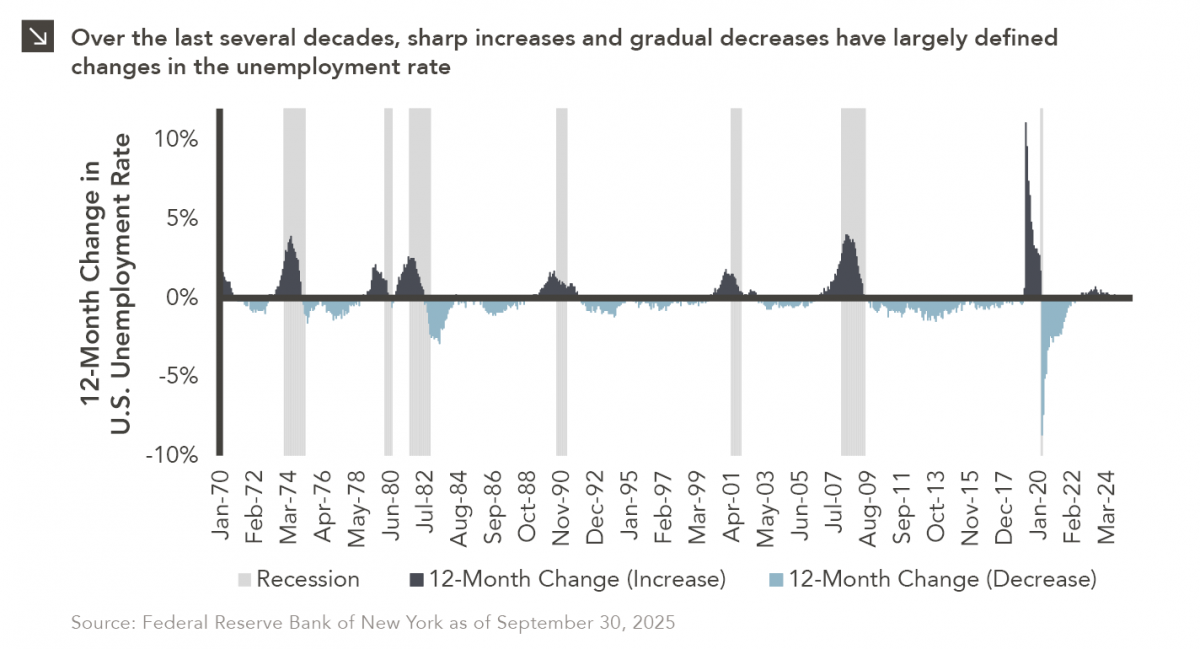

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >