David Hernandez, CFA

Director of Traditional Manager Search

In 2010, the emerging markets equity benchmark was all about “ME” as materials and energy constituted 28% of MSCI’s Emerging Markets Equity Index. Today, however, they account for half of that, and IT and Consumer Discretionary have nearly doubled, growing from 19% in 2010 to 34% in 2020.

In September of 2018, MSCI adjusted its sector classification standards, partially in response to the increasing integration of the internet into all aspects of our communication and business transactions. This change specifically reclassified e-commerce to include companies providing online marketplaces for consumer products and services in the Consumer Discretionary sector rather than their previous IT classification. Alibaba — the largest stock in the index and one of the largest internet-based companies in the world — serves as one example of a company reclassified under the 2018 standards.

Emerging Markets have become less reliant on commodity prices over the past decade and we see this as a positive. Investors can benefit from the larger investment opportunity set which includes companies that are capitalizing on technology trends that played out in the U.S. throughout the 2010s and continue today, including e-commerce, online payment processing, and social platform businesses.

For more coverage on the Emerging Markets Index, reference our recent newsletter, The Changing Landscape in EM Equity.

Print PDF > EM: Less About “ME” and More About “IT”

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

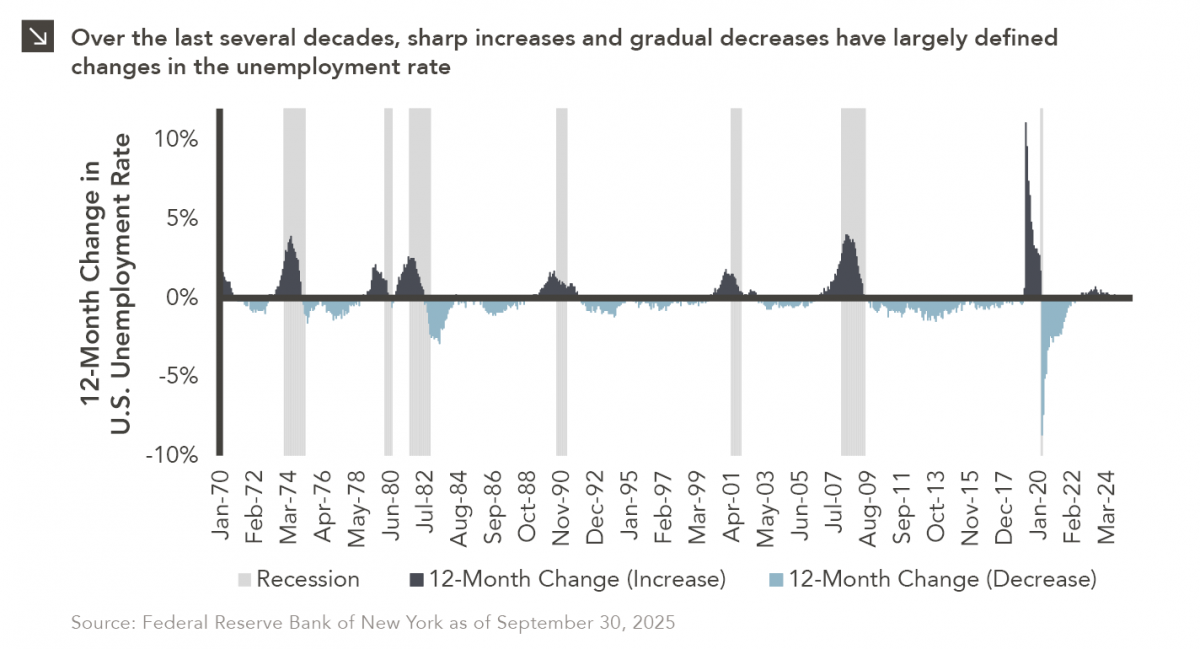

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

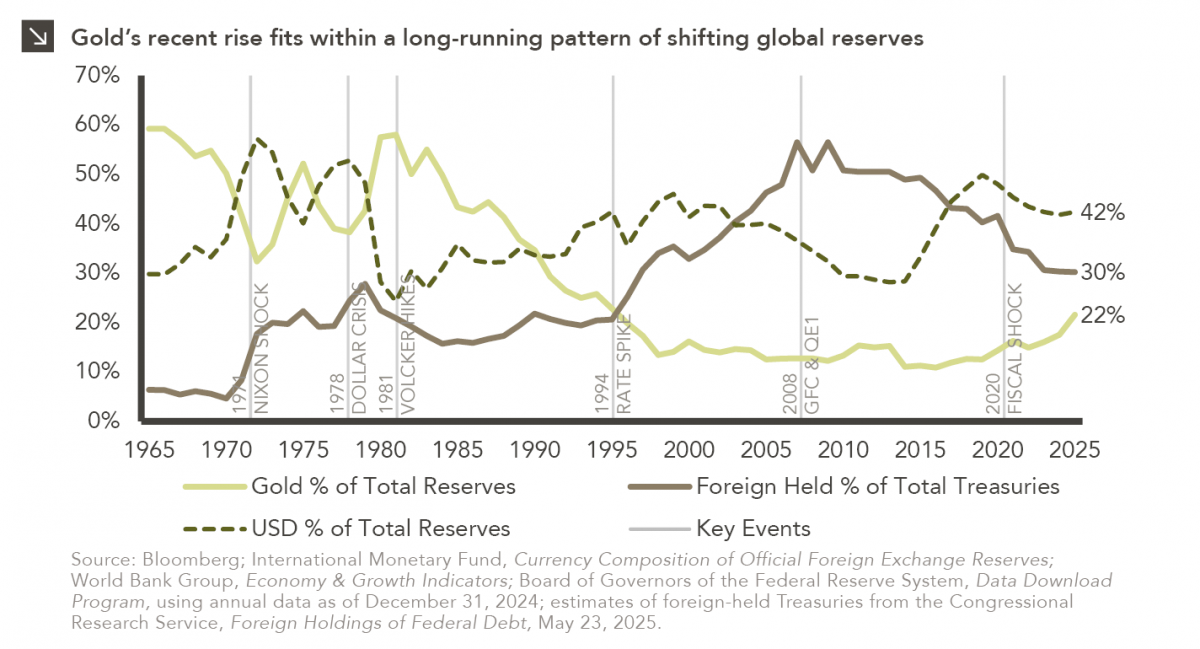

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

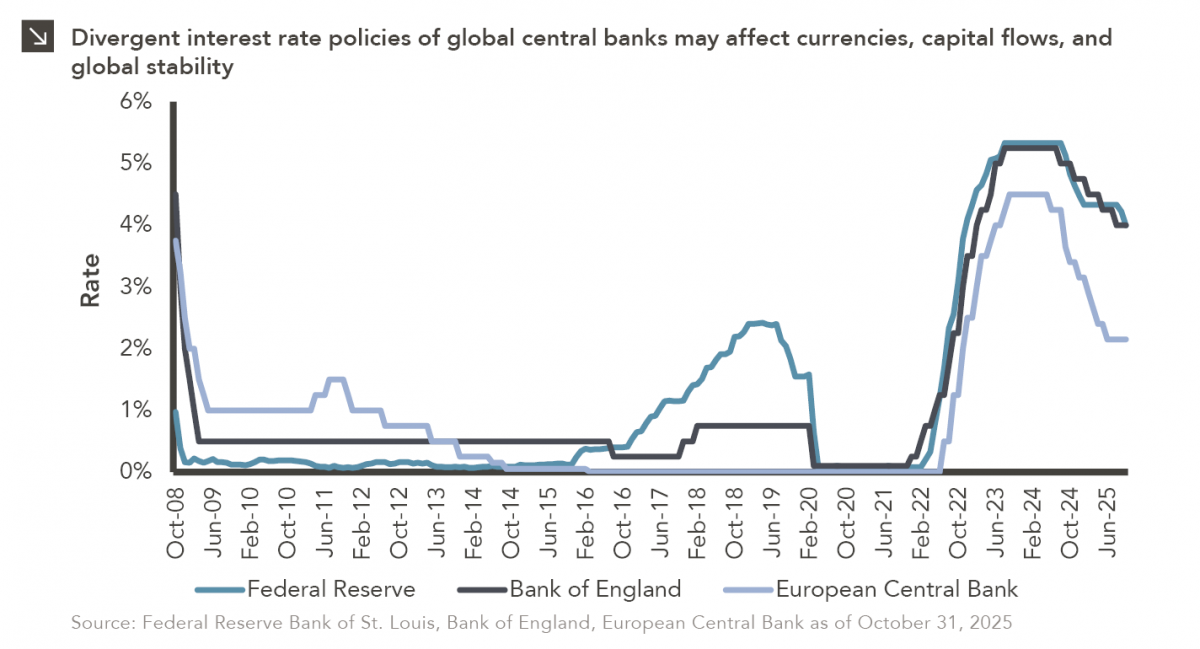

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

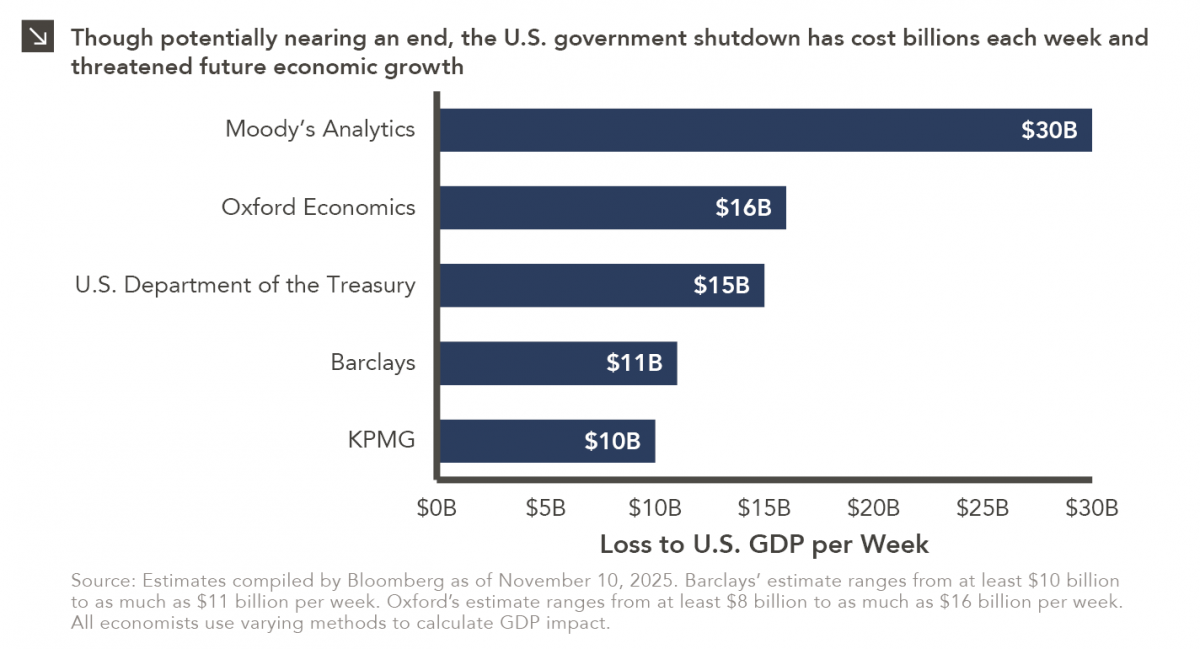

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >