David Hernandez, CFA

Director of Traditional Manager Search

Just over two years ago, on March 23rd, 2020, global equities hit their COVID-19-induced bottom. At their lows, the S&P 500, MSCI Emerging Markets Index, and MSCI EAFE Index were down 30%, 32%, and 33%, respectively, year-to-date. Over the next seven quarters, global equities produced mostly positive returns, with the S&P 500 leading the way. From the 2020 trough, the large-cap U.S. index was up an astounding 119% through the end of 2021.

This year, markets have faced several geopolitical and macroeconomic concerns that have squashed that positive momentum. Russia’s invasion of Ukraine in February and China’s rise in COVID-19 cases combined with its zero-COVID policy have worsened supply chain issues, exacerbated global inflation, and added to mounting economic pressures. To combat inflation, central banks have aggressively raised interest rates, which will likely further dampen economic activity. As a result of these headwinds, the S&P 500, MSCI EM, and MSCI EAFE benchmarks are all down roughly 17–19% year-to-date.¹ Despite these losses, global equities remain well above the COVID-19 trough, with non-U.S. equities still roughly 40+% higher and the S&P 500 77% higher. Looking forward, we expect global equities — particularly in developed countries — to face continued volatility in the second half of the year as central banks continue their fight against inflation, likely at the expense of economic growth.

Print PDF > Global Equities Still Well Above COVID Lows

¹As of June 29, 2022

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

10.01.2025

Please join Marquette’s research team for our 3Q 2025 Market Insights Webinar analyzing the third quarter across the…

09.29.2025

Trifecta status for a state exists when a single political party holds the governor’s seat and a majority in both…

09.22.2025

Barring a significant equity market drawdown in the coming weeks, the current bull market will turn three years old in…

09.15.2025

Earlier this year, Marquette published a Chart of the Week that detailed the muted change in oil…

09.08.2025

Commercial paper is a type of unsecured debt instrument that can be utilized by companies to finance short-term liabilities. The…

09.02.2025

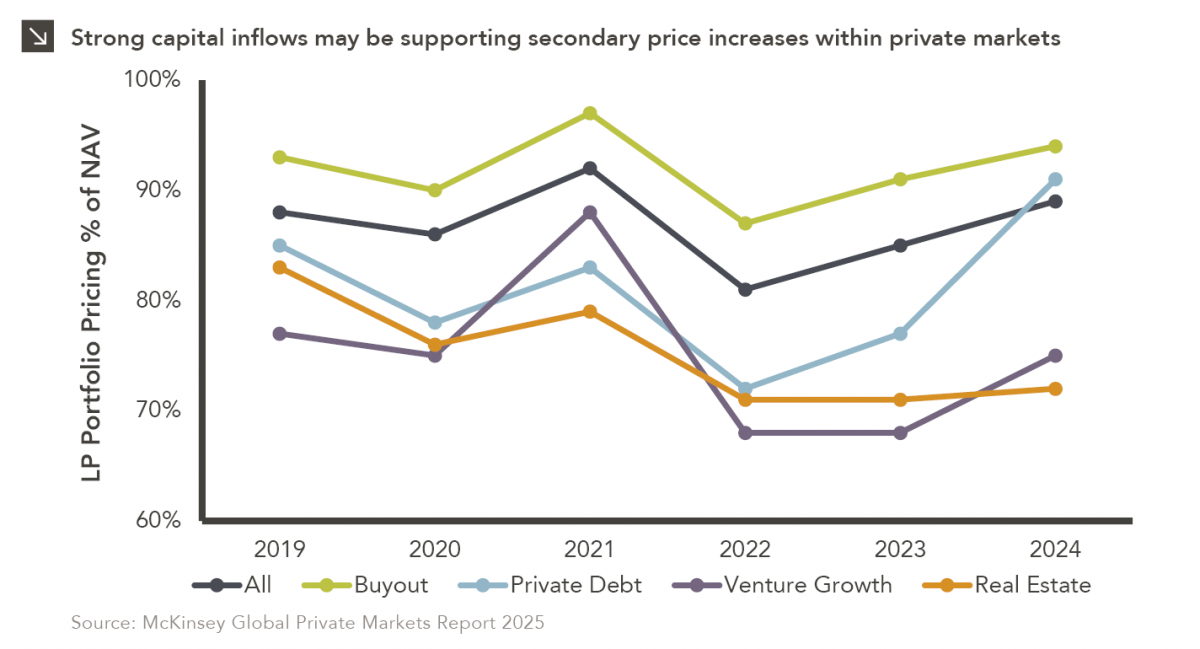

In private markets, secondary transactions have increasingly gained attention and acceptance as a viable liquidity option for both general partners…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >