Jessica Noviskis, CFA

Portfolio Strategist, OCIO Services

Gold prices are hitting new highs, closing above the $2,000 per ounce threshold for the first time yesterday, August 4th. It is a familiar scene amid the confluence of economic concern and uncertainty brought on by the spread of COVID-19, negative real interest rates with 10-year Treasury yields just above 0.5%, a weaker U.S. dollar, and the potential for increased inflation following unprecedented monetary stimulus. But with an asset class that only makes headlines at extreme levels, it is important that investors know what they are really getting.

Over time, gold has produced real returns about in line with Treasury Bills (before any storage costs or impact from rolling futures contracts in contango), but with volatility that more closely resembles the S&P 500. And despite being widely considered to hold its value over time, gold is a physical asset whose price is determined by supply and demand, including ongoing mining operations and a large gold jewelry market in China and India. But what is perhaps most surprising is that gold is actually a poor inflation hedge. Over the last 50 years, the correlation between gold and core inflation has ranged from -0.55 to +0.75, with an average of 0.05.¹ Over time, equities have been the best option for outperforming inflation.¹ Dating back to World War II, gold has only outperformed equities in the short windows when inflation has been categorically greater than 6% (the last of which ended in 1982), and even then only half the time.¹ Thus despite the headlines that gold receives when its price is notably rising, it is not a particularly attractive allocation for long-term investment portfolios.

¹ Goldman Sachs Investment Strategy Group

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.17.2026

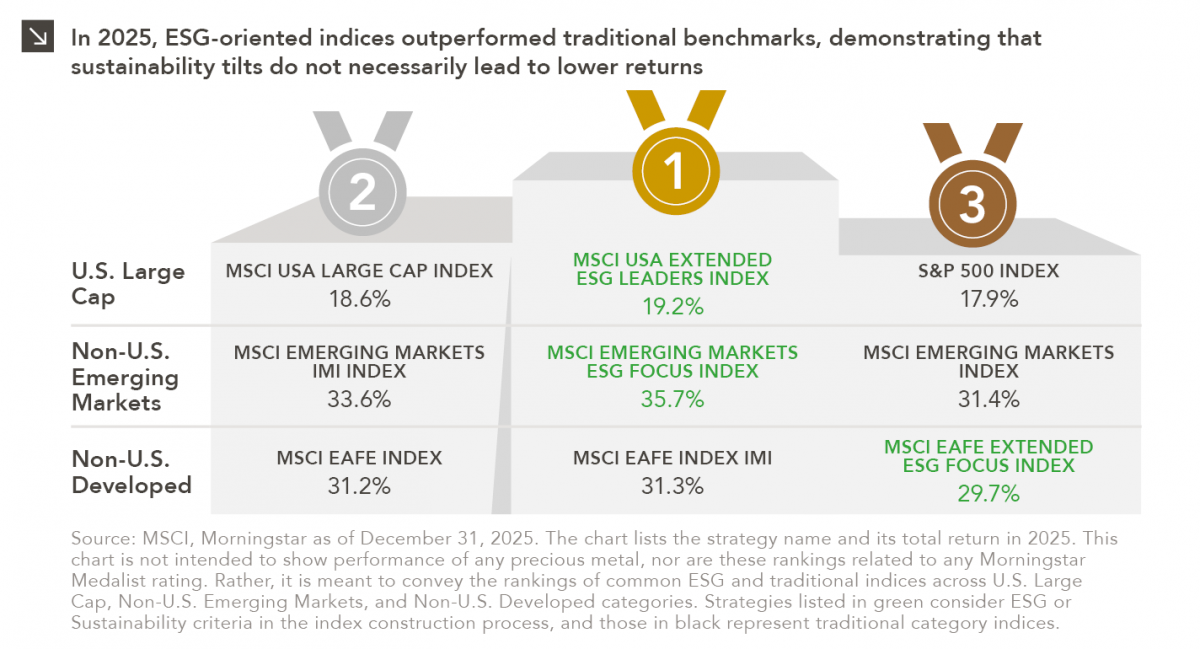

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

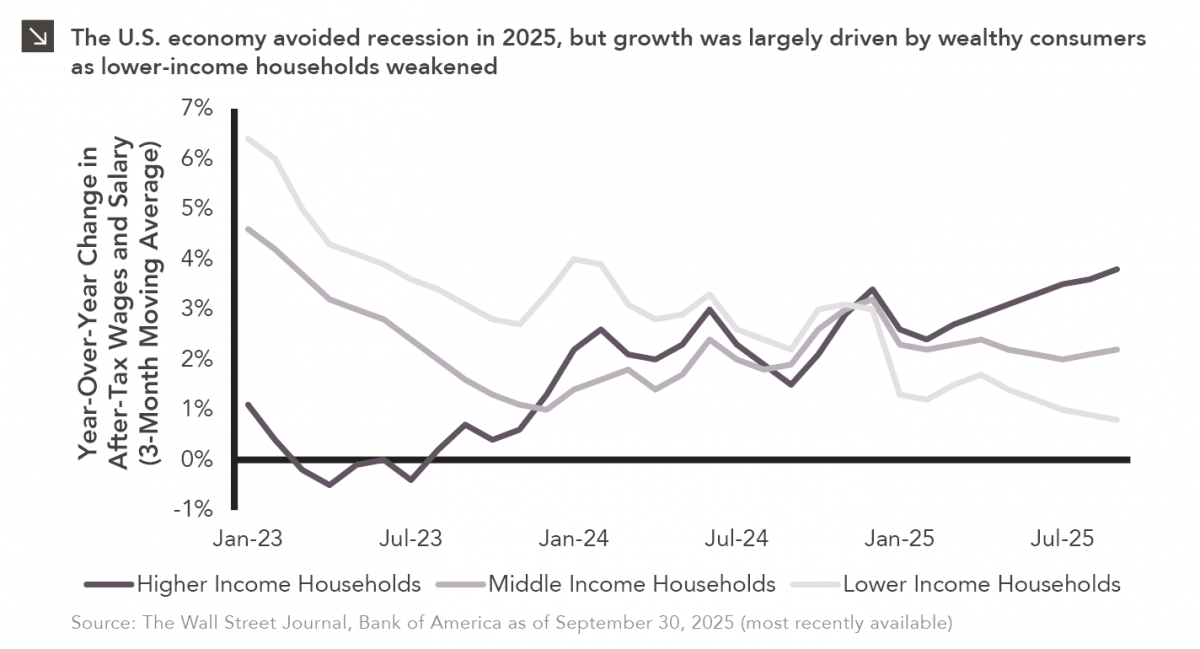

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.20.2026

Last week, Alphabet joined NVIDIA, Microsoft and Apple as the only companies to ever reach a market capitalization of $4…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >