David Hernandez, CFA

Director of Traditional Manager Search

This week’s chart examines the results from the first round of the European Central Bank’s (“ECB”) targeted long-term refinancing operation (“TLTRO”) which occurred on September 18th. The ECB announced this program in June 2014 with the goal of encouraging lending to small and mid-size companies in the region. The TLTRO essentially provides a four-year loan to banks at a fixed low rate. This serves as one of several tools the ECB has utilized to address the low inflation and contracting credit conditions in the Eurozone.

With 400 billion euros available, only €82.6B were borrowed by banks, well below the €150B estimated by a Bloomberg survey. Considering the initial outcome, investors are starting to question the potential effectiveness of the program. However, it is important to note that in the month of October the ECB will announce the results of the Asset Quality Review (“AQR”), which is a comprehensive assessment of banks’ balance sheets. The Eurozone’s financial institutions may be more willing to participate in the TLTRO after the stress tests are complete. The second round of TLTRO is slated for December and will provide insight into loan demand in the region as well as essential feedback to the ECB about the effectiveness of its policies. Without stronger demand for loans from this program, strong growth in the Eurozone would seem dubious, and thus participation in later rounds of TLTRO bears watching.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

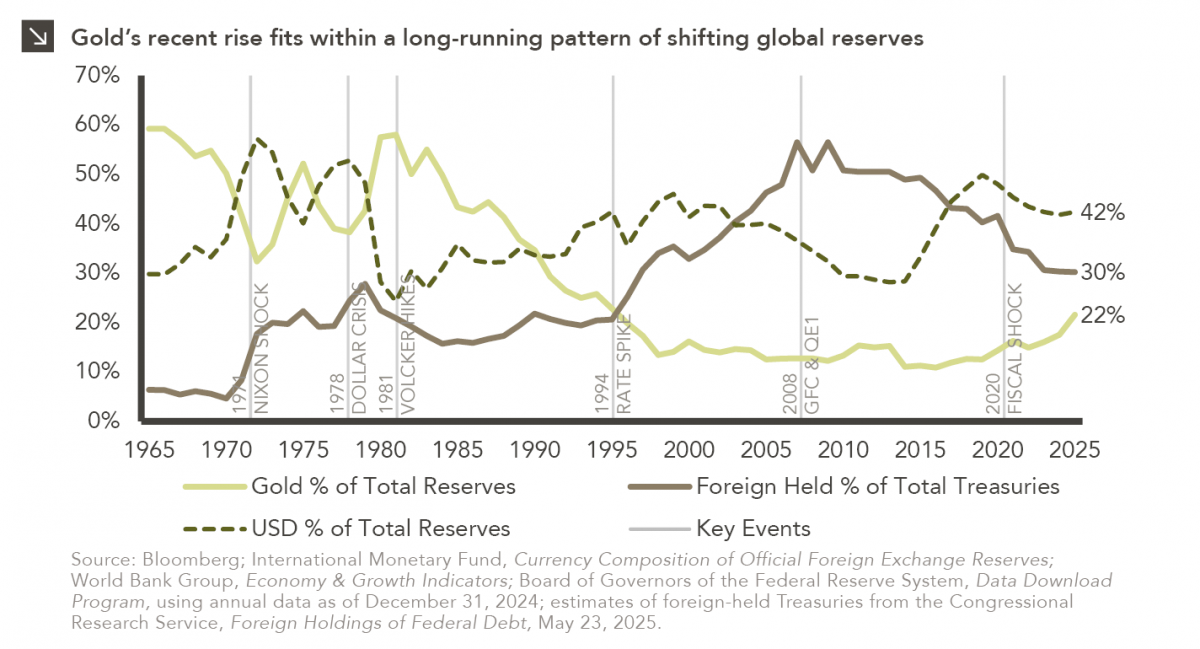

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

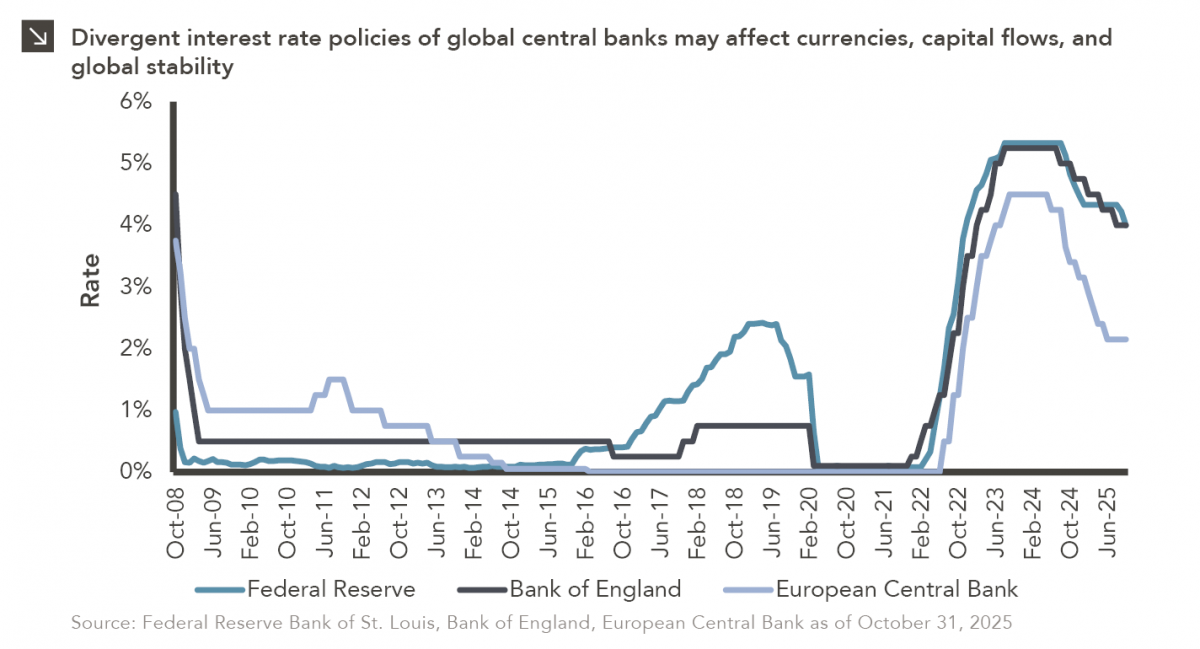

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >