David Hernandez, CFA

Director of Traditional Manager Search

The combination of rising high yield spreads and falling equity markets has led many investors to question if the U.S. is headed for a recession. This week’s chart examines the probability of a recession using the yield curve as a leading indicator of future economic activity. The Federal Reserve Bank of New York publishes a model that calculates the probability based on the difference (spread) between the 10-year and 3-month Treasury yields. As the spread narrows, the probability of a recession increases. Conversely, as the spread widens, the probability decreases. As the chart shows, this model has historically been a good predictor of future recessions. Based on January’s data there is only a 4.6% chance of a recession twelve months from now. Like all models, there are no guarantees that the predictive power will continue into the future, but this provides investors another tool to formulate future expectations.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

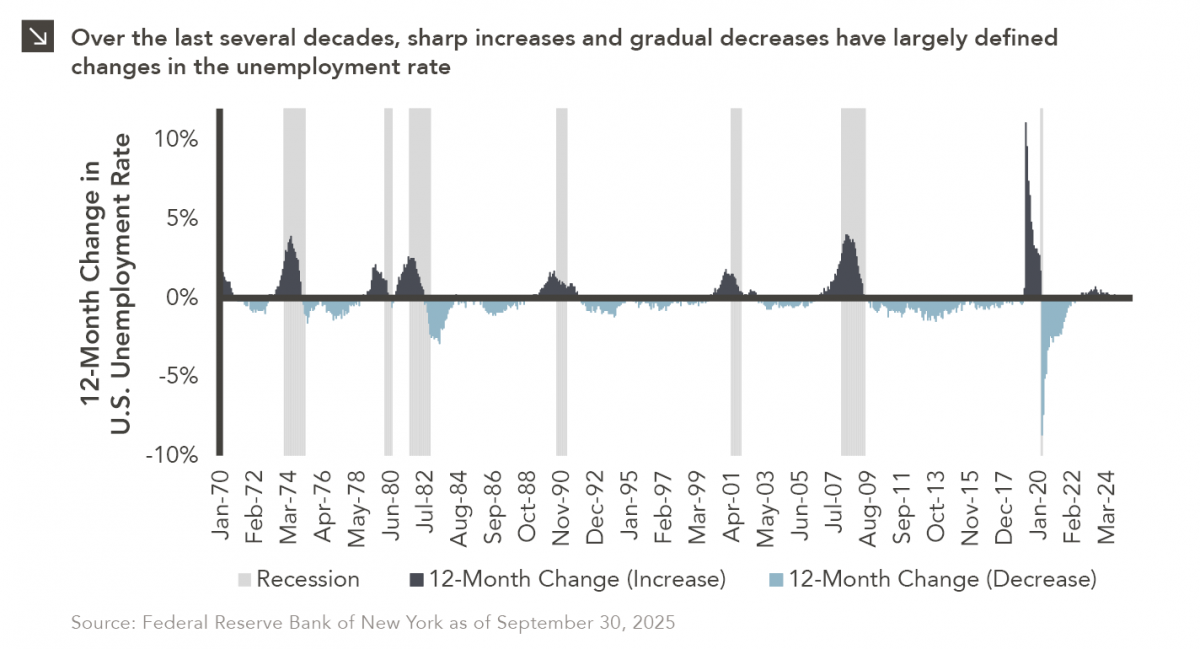

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

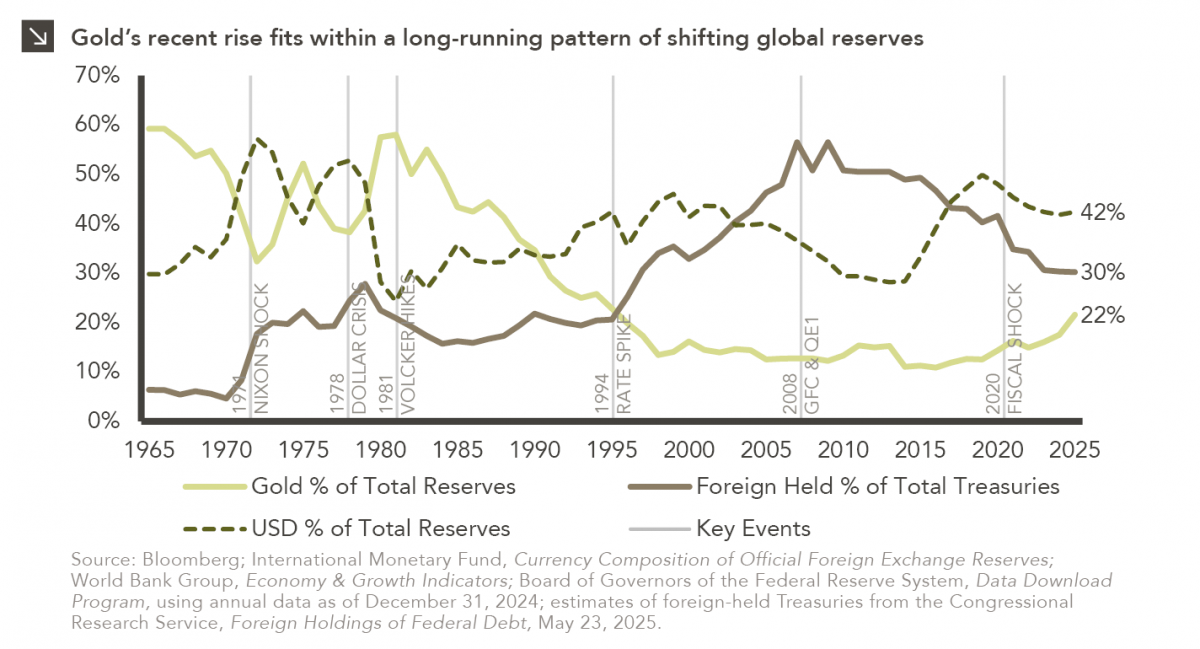

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

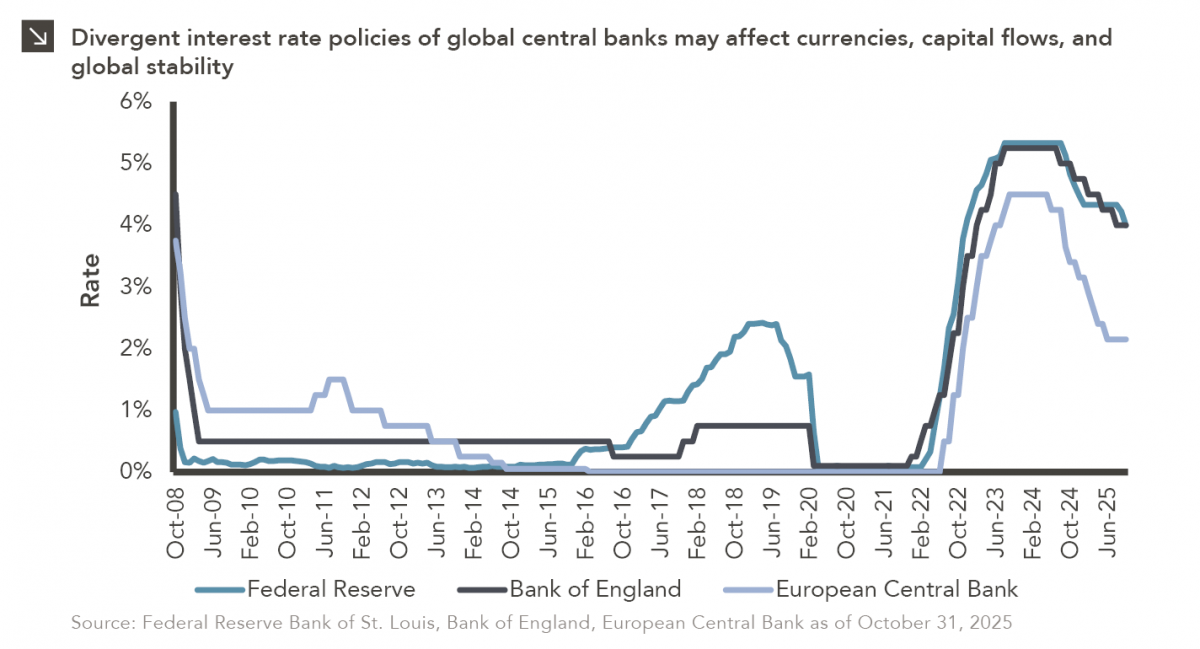

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

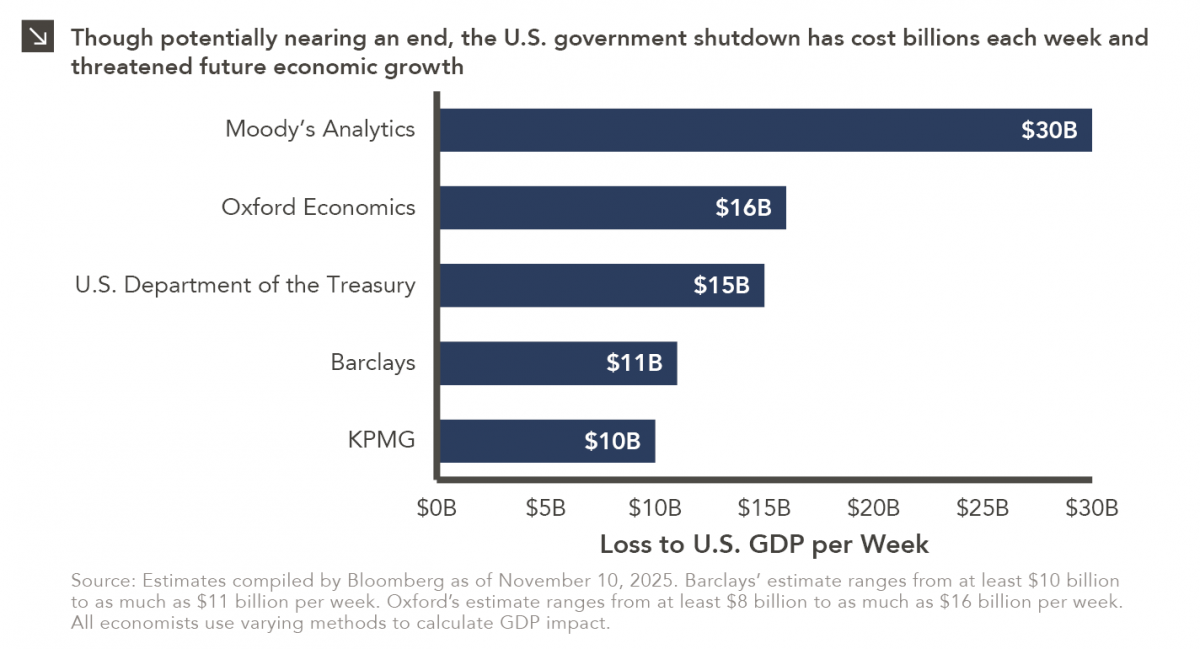

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >