Greg Leonberger, FSA, EA, MAAA, FCA

Partner, Director of Research

Here in Chicago, it has been a harsh spring. Below-average temperatures. Unrelenting rain. Snow flurries. Incessant clouds. Not the spring anyone was hoping for.

Investors would tell you the same thing, for different reasons. Stock market down 10% year to date.¹ Inflation at 8.5%, the highest in over 30 years. Bonds — the safe haven play in times of market volatility — down 9.5% year to date.² The ongoing conflict in Ukraine increasingly looks like a grinding war of attrition. Temporary yield curve inversion. Fed policy designed to slow inflation, though potentially at the expense of growth; either way, interest rates have more room to run. Not a lot of sunshine, indeed.

However, as April turns to May… hope springs eternal. Not all is lost for the year, and while most would agree that equity markets have not fully re-priced yet, there are hints — not unlike perennials sprouting each spring — that the worst of the market drop is behind us. Over time, markets have proven resilient and while the exact timing of market reversal is impossible to precisely call, one can look for signs of optimism. Here are some of the most compelling hints that we see.

In this edition:

Watch our Q1 2022 Market Insights Video for an in-depth analysis of the first quarter’s performance by Marquette’s research team.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.02.2026

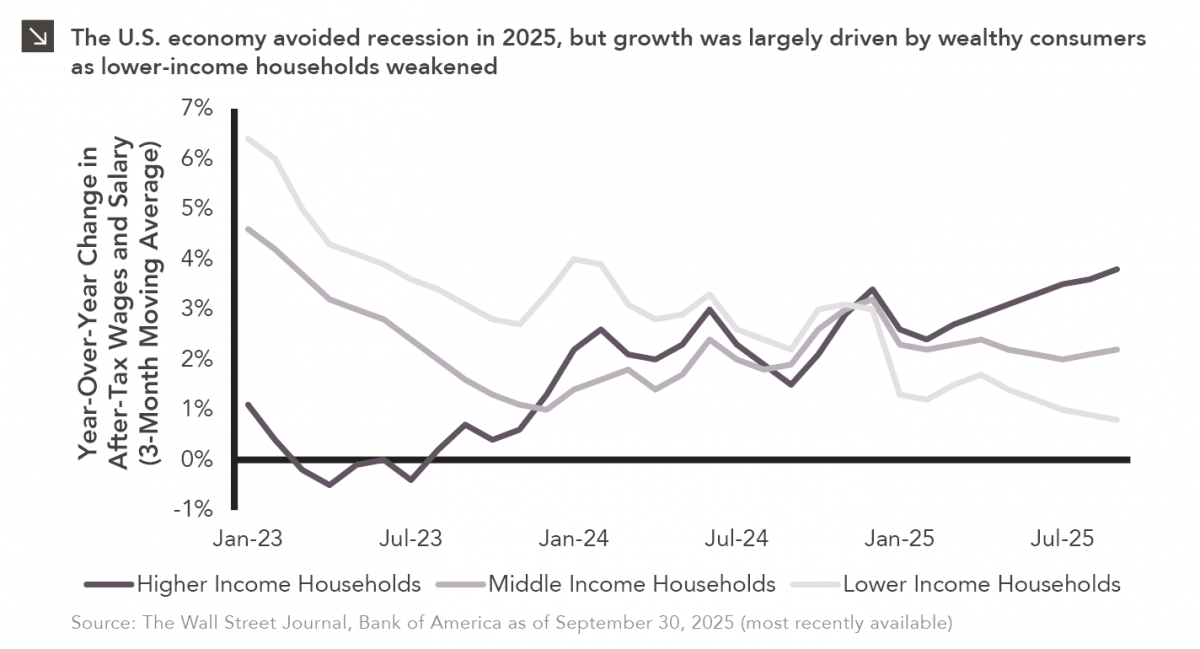

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

01.14.2026

Contrary to widespread belief, fixed income aggregate strategies offer a continuum of active risk and return profiles. While aggregate strategies…

01.12.2026

The capture of Venezuelan president Nicolás Maduro is a watershed moment for a country whose natural resource economy has been…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >