Thomas Neuhardt

Associate Research Analyst

Get to Know Thomas

With the first Federal Reserve rate cut of the current loosening cycle in the rear-view mirror, investors are now questioning how markets will react to a new era of macroeconomic policy. While each rate cycle is unique, examining how the S&P 500 and Bloomberg Aggregate indices have responded to prior instances of rate cuts can give investors some insight on what to expect going forward. To that point, this week’s chart highlights the returns of these benchmarks following the first cut of last six periods of easing by the Federal Reserve. Although rate cuts have historically portended higher near-term equity returns, there have been two instances of negative S&P 500 Index performance in the wake of Fed easing. Specifically, the 1- and 3-year returns following rate cuts in 2001 (the Dot Com Bubble) and 2007 (the Global Financial Crisis) were both negative. That said, performance of the Bloomberg U.S. Aggregate Bond Index was positive during both of those periods, as well as during the other four easing cycles shown in this week’s chart. Even during the 3-year period following July of 2019, which included six months of rate hikes in 2022, the fixed income benchmark returned 0.4% on an annualized basis. In summary, although Fed rate cuts have historically coincided with recessions in the U.S., investors can gain comfort from that fact that both equities and bonds have fared relatively well amid periods of monetary policy loosening.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

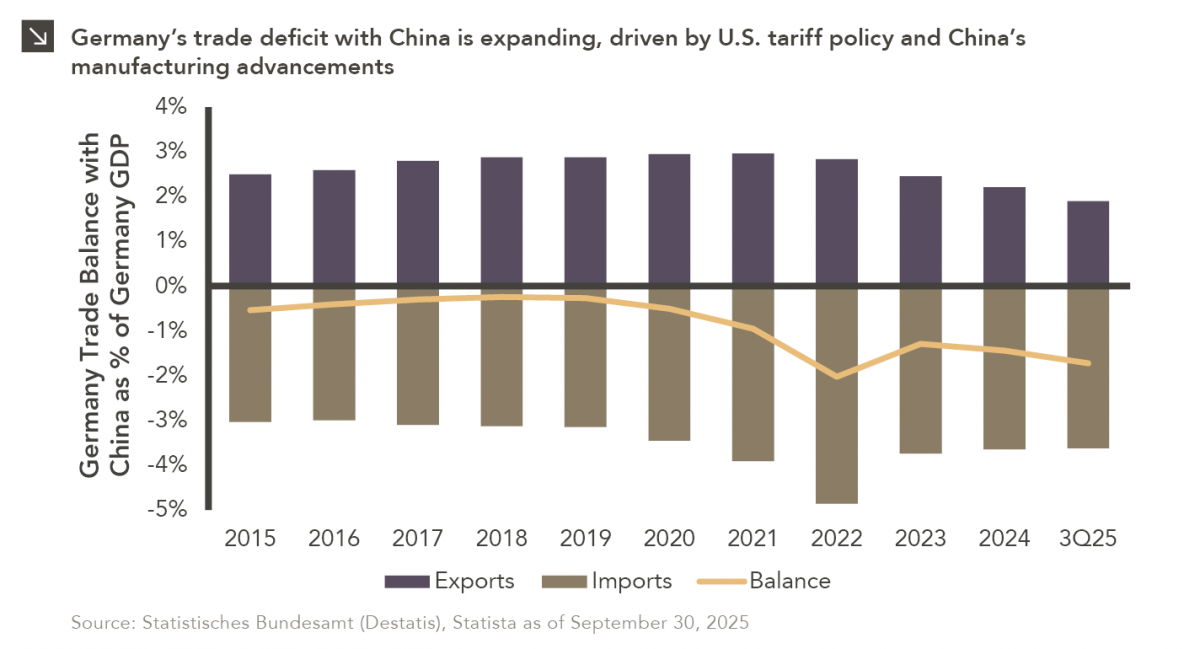

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >