01.07.2026

2026 Market Preview Webinar

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

The S&P Dow Jones Indices and MSCI Inc. announced the creation of a new real estate sector, formerly included in the financial sector, within the GICS system which became effective August 31, 2016. The new real estate sector marks the 11th GICS sector and the first time a new sector has been added to the GICS classification since its inception in 1999. The creation of a separate real estate sector recognizes the growth in both size and complexity of the asset class. Real estate, which began as two sub-sectors, has grown over time to now contain a total of 13 sub-sectors.

These sub-sectors are an area of differentiation when it comes to public REITs vs. private real estate investments.1 Private real estate investments typically fall into one of four main sub-sectors: industrial, retail, office, and multifamily. REITs, on the other hand, often carry significant exposures to “alternative” real estate which includes sub-sectors such as self-storage, hotel, and healthcare. Additionally, the risk and return profiles of the same sub-sectors between public (REITs) and private real estate can vary significantly — particularly from a risk perspective, as measured by standard deviation. The chart above not only shows the annual returns of each REIT sector — note the dispersion of returns between sectors each year as well as the annual volatility of each sub-sector — but the level of standard deviation over the nine years of sub-sector returns in the table. Critically, the private real estate risk (industrial: 6.3%; retail: 5.1%; office: 6.8%; multifamily: 6.6%) is materially lower than the equivalent sub-sectors from REITs (respectively: 44%, 31%, 28%, and 26% (residential)). So while both public and private real estate investments may appear to invest in similar assets, their respective risk profiles can vary significantly.

___________________

1Private real estate is measured by the NCREIF Property Index (“NPI”), a composite of real estate investment performance from a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

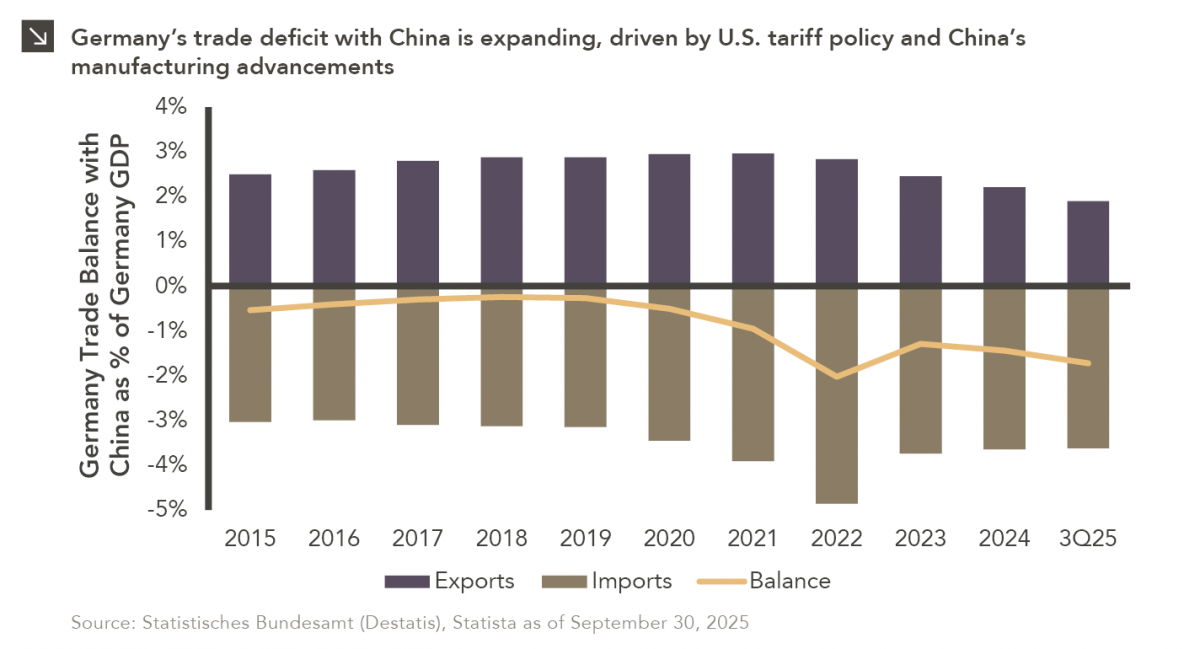

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >