Frank Valle, CFA, CAIA

Associate Director of Fixed Income

As the leaves change to autumn and the authors cheer on their Fighting Leathernecks, fall is the perfect time for investors to reassess their fixed income portfolios. Fixed income is a hybrid security that offers both offensive and defensive properties. Much like a good football team, a fixed income portfolio needs to combine a strong offense with a solid defense.

Some strategies provide more offensive characteristics while others are more defensive. Portfolios with too much offense act like the Greatest Show on Turf. They do well when the economy is strong, but falter in down markets. Conversely, a fixed income portfolio that is overly reliant on defensive strategies will do well in a risk-off environment but will struggle in a strong economy like the Super Bowl Shufflin’ ’85 Bears.

While those were great teams, they were not a dynasty that stood up to the test of time. To build an all-weather fixed income portfolio that will perform in multiple market environments, an investor needs to balance offense and defense.

Fixed income has three primary objectives: income, diversification, and liquidity. Income, or yield, is what an investor is paid for loaning money to another entity. Fixed income helps to diversify portfolios primarily through duration. When risk assets are selling off, interest rates are generally falling. Duration is what drives fixed income prices higher in such scenarios. Finally, fixed income assets can be a source of liquidity. The weight of these qualities is dependent on if the strategy is more offensive- or defensive-minded.

This white paper outlines offensive and defensive fixed income characteristics and strategies and considerations for investors when building a “gameplan” for their fixed income allocation.

Read > Are You Ready for Some Fixed Income?The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.17.2025

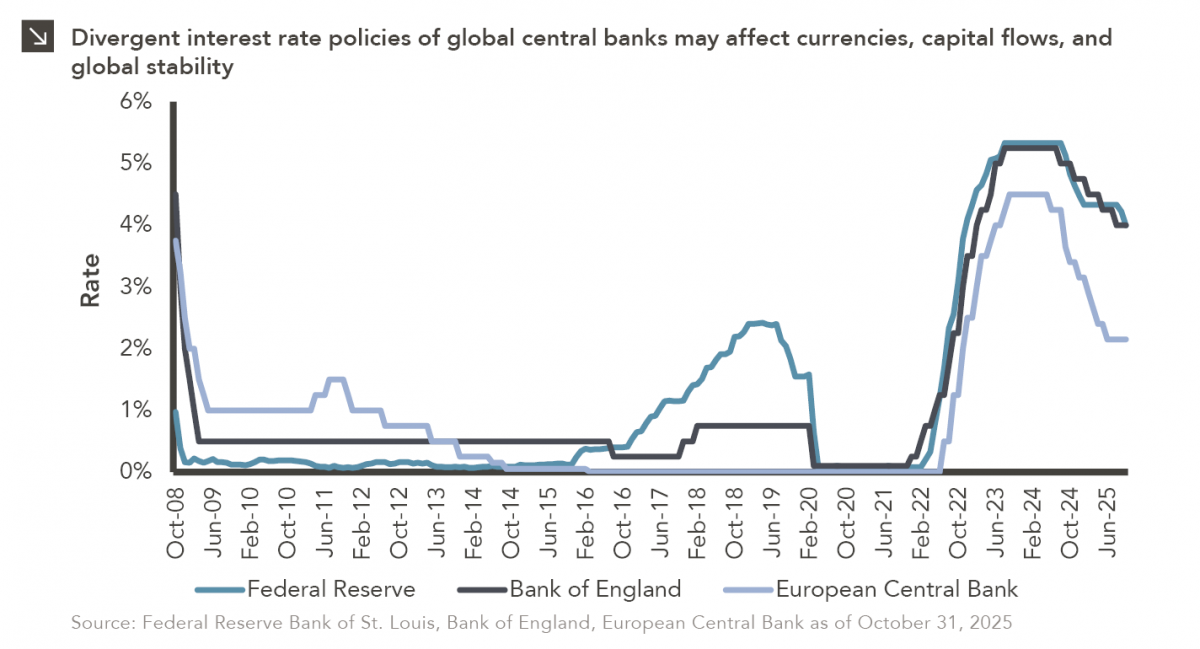

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.06.2025

This week’s chart compares realized and expected Market Revenue per Available Foot (“M-RevPAF”) growth within the industrial real estate space…

10.03.2025

Watch the flash talks from Marquette’s 2025 Investment Symposium livestream on September 26 in the player below — use the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >