01.07.2026

2026 Market Preview Webinar

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

Income and appreciation are the two main components of returns to any investment, including real estate. Core real estate returns, as measured by the NCREIF Property Index (NPI), have been driven by the appreciation component over the past several years, and this has naturally been accompanied by a compression in capitalization rates.

In this week’s Chart of the Week, we look at the income and appreciation components of core real estate returns and how they have contributed to total returns over the past twenty years. We can see that income has historically contributed approximately 60% to the total returns of core real estate.

The income component has been below this long-term average for most of the quarterly periods since real estate’s performance returned to positive territory in 2010, as appreciation and cap-rate compression have been the main stories since the rebound from the financial crisis. However, with the expectation for a rising-rate environment on the horizon and an end to cap rate compression looming near, we anticipate that income will start to represent a larger fraction of total returns over the medium term. This should provide comfort to investors with allocations to core real estate funds and even core-plus and value-add real estate funds that have meaningful exposure to healthy, stabilized, income-generating properties.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

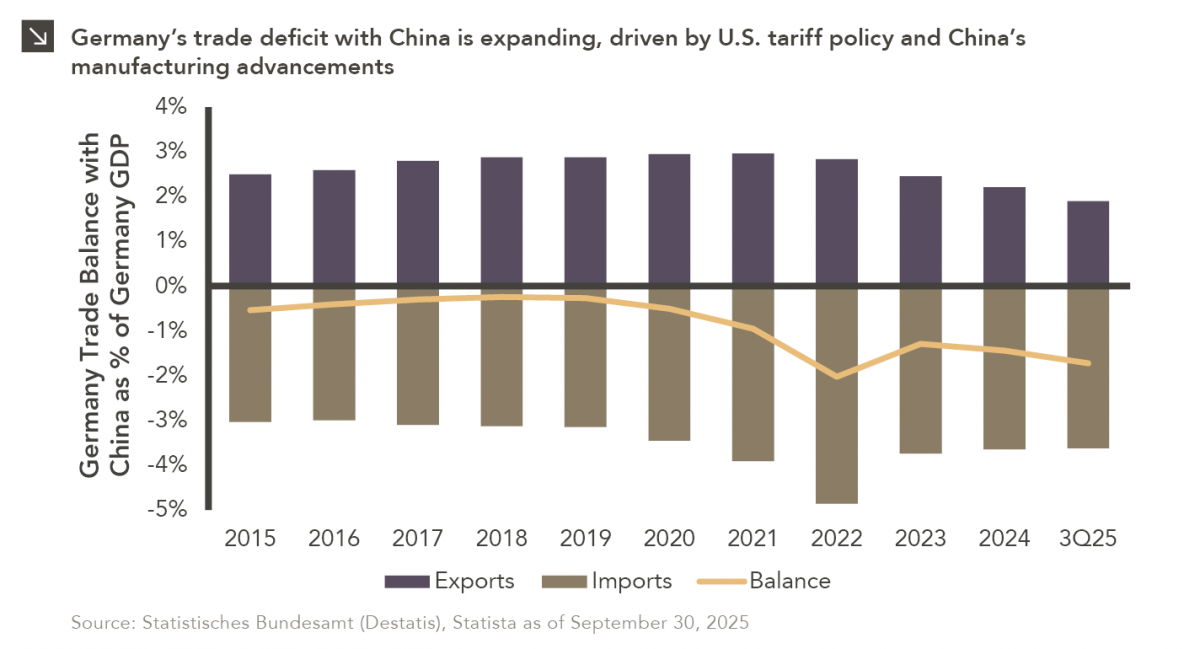

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >