James Torgerson

Senior Research Analyst

Leveraged loans have been the asset class of choice this year, with fixed income investors drawn to the floating-rate nature of these securities in a rising rate environment. Investors have piled into the asset class since the beginning of 2021 at the expense of other segments of the market, including high yield bonds. High yield bonds are typically the first to show signs of deterioration in stressed credit markets and tend to be subject to more volatile trading patterns. Below the surface, however, the overall quality of the loan market has deteriorated relative to high yield and changes at the issuer level have impacted the perceived safety of the asset class. Investors who have flocked to loans may need to pause and consider that it could be the loan market — not high yield — that signals trouble on the horizon.

This newsletter provides background on leveraged loans and analyzes historical and recent performance and flows, shifts in quality, and seniority and covenants.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.02.2026

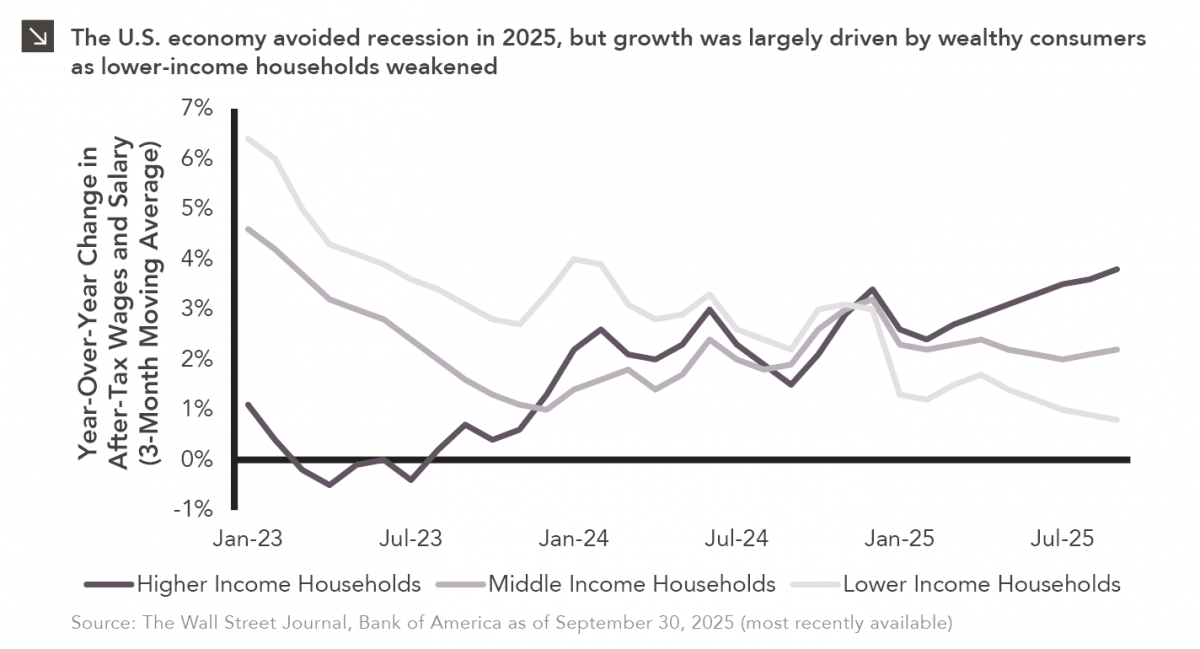

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

01.07.2026

This video is a recording of a live webinar held January 15 by Marquette’s research team analyzing 2025 across the…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >