Jesus Jimenez

Principal

This week’s Chart of the Week examines the relative performance of equity markets from a global perspective. Since January 1, 2013, U.S. large-cap stocks have returned a cumulative 10.03%, international large-cap stocks have returned a cumulative 4.38% and emerging market stocks have returned a disappointing -1.92% through March 31, 2013.

Many factors can be attributed to the underperformance of emerging markets including countries’ management of their monetary policies. With slowing global demand and inflationary pressure taking a toll on emerging markets, countries have been forced to adjust their monetary policies. Brazil has increased interest rates to combat inflation, which has impacted the Brazilian Real. More generally, a combination of slowing demand for their products and rising inflation has weakened the export market for emerging market countries. In contrast, Japan’s recent activity to devalue the Yen had made its exports significantly more attractive, thus boosting its competitiveness, a move that has benefitted returns for the MSCI EAFE index.

Currently, emerging markets trade at a price-to-earnings ratio of 12 compared to 15 for U.S. large-cap stocks. This favorable valuation level relative to U.S. stocks combined with superior long–term growth prospects continue to make emerging market stocks an attractive investment option, despite recent market struggles.

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.08.2025

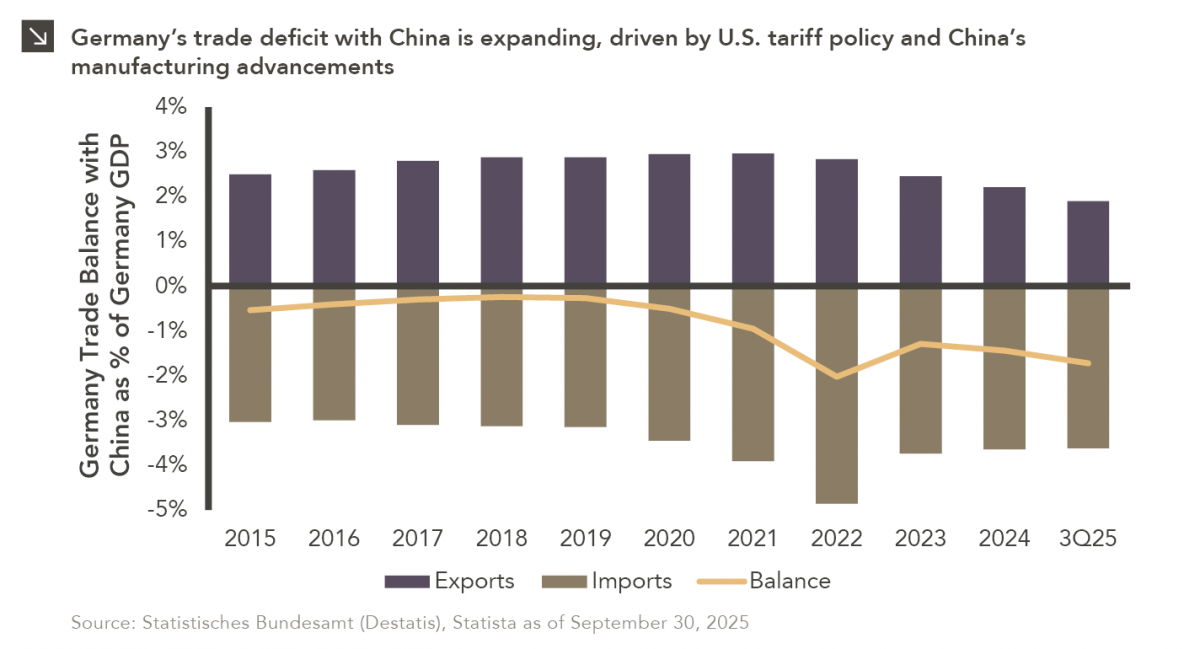

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

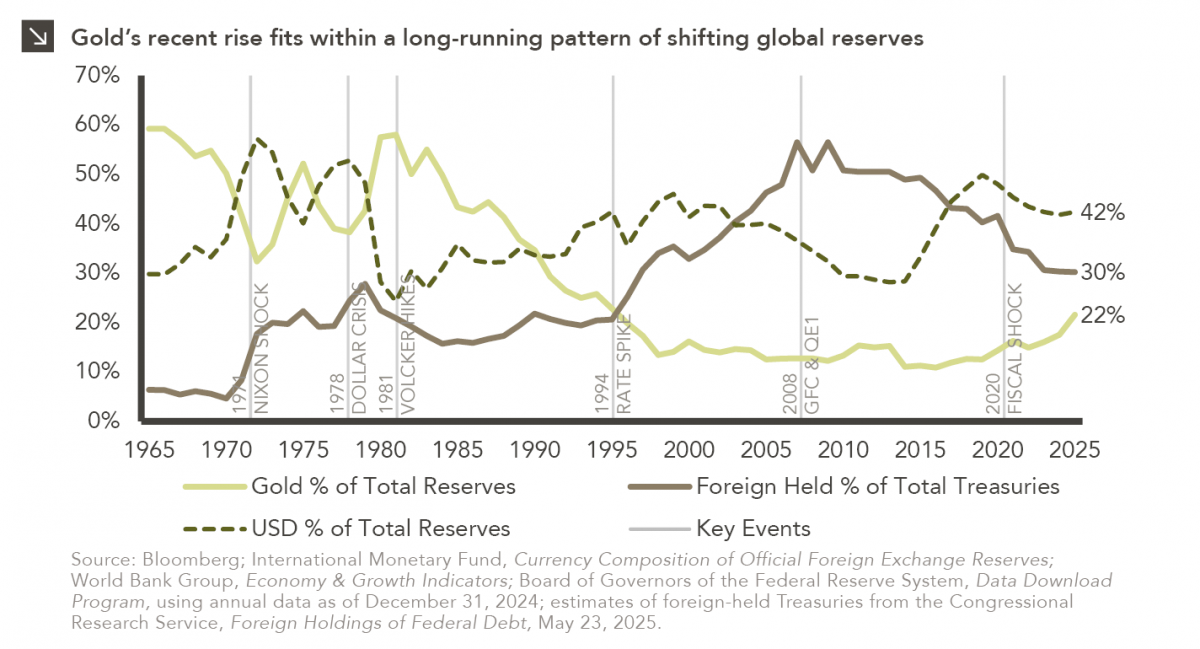

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

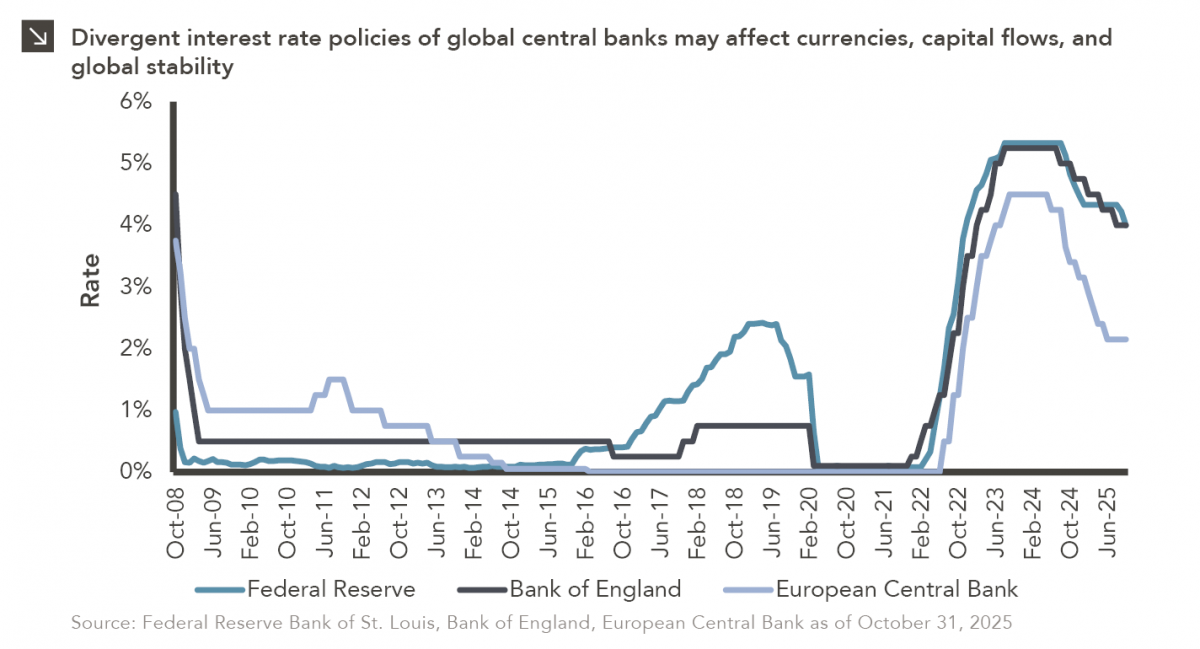

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >