Amy Miller

Associate Director of Private Equity

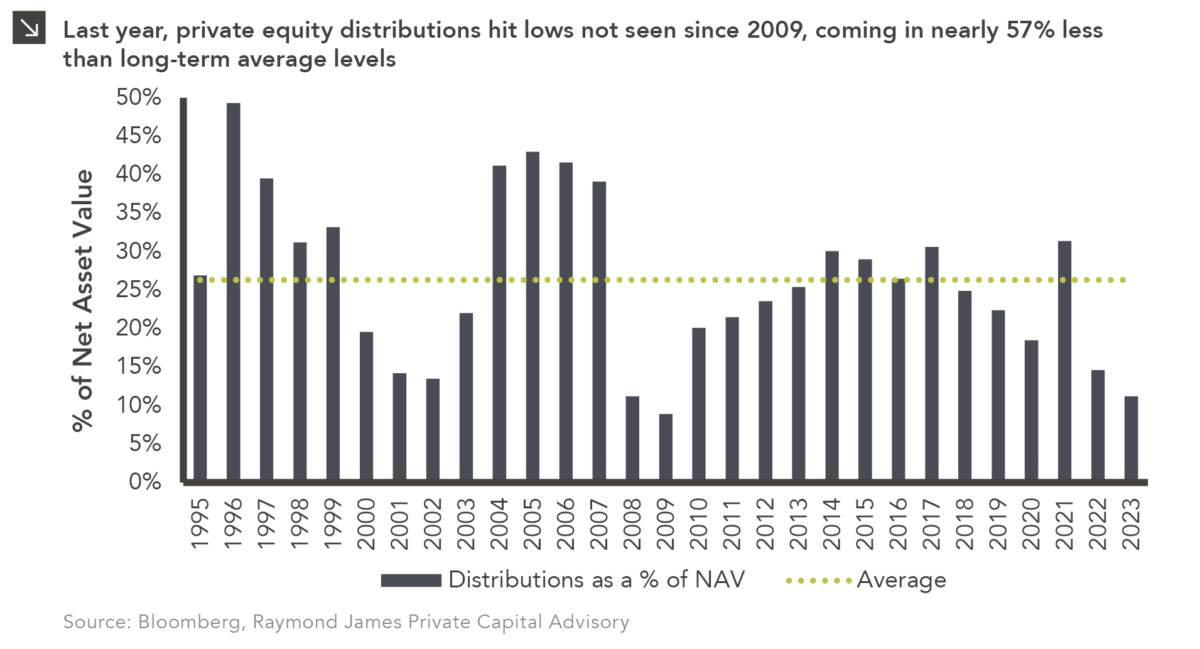

There are multiple ways to gauge how private markets managers are performing, such as benchmarking returns relative to their peers within their respective vintage years. Net internal rate of return (“IRR”), total value to paid in capital (“TVPI”), and distributed to paid in capital (“DPI”) are measurements that are among the most common. DPI is calculated as a ratio of cash returned to cash paid by the investors and is the one metric of the three that cannot be manipulated via subjective valuations. This metric is also not impacted by time. In effect, DPI does not lie… Or does it?

In 2023, distributions from private equity funds as a percentage of portfolio NAV stood at 11.2%, which represents the lowest figure since 2009. Given the slow exit environment over the past 18 months and the quick deployment pace of 2021 and 2022, many general partners are using creative methods to return capital to investors in advance of their next fundraise (absent a true exit). These methods include net asset value (or NAV) loans and continuation vehicles. Alternative methods of liquidity like these will engineer a boost in DPI in the short term but may increase risk and dampen overall returns as net capital outstanding contracts.

While deal activity remains depressed relative to 2021 and 2022, 2023 marked a return to normalcy relative to long-term average levels. This could mean that the pace of exits isn’t far behind, and DPI will remain private equity’s most veracious performance metric.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

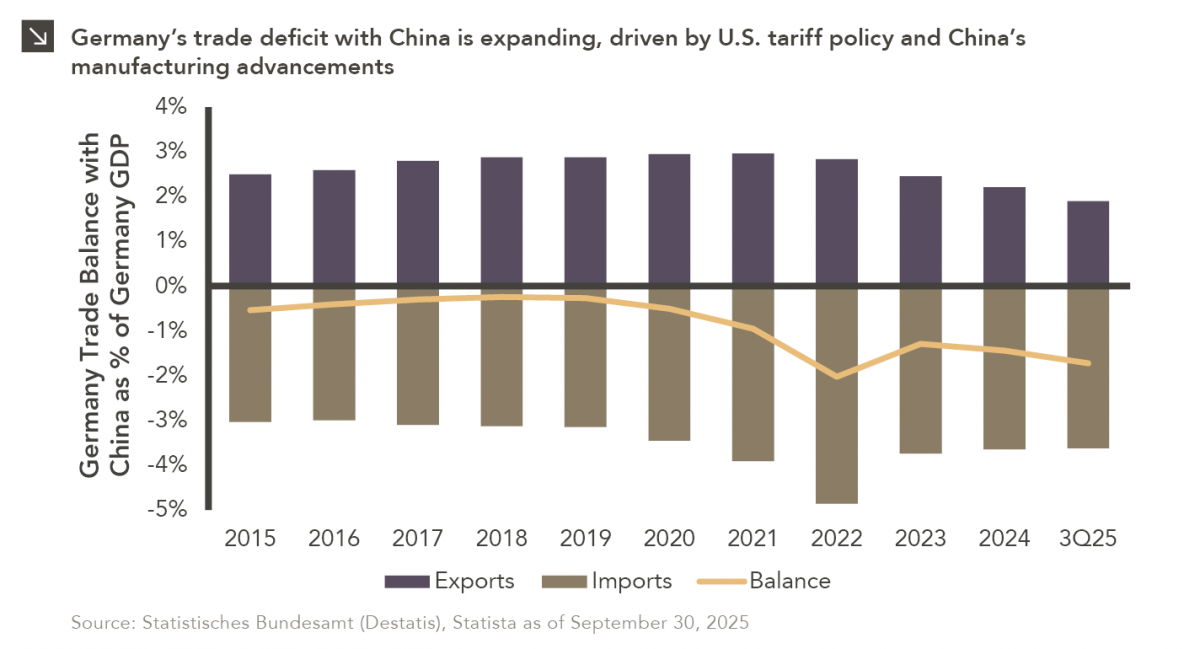

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

12.01.2025

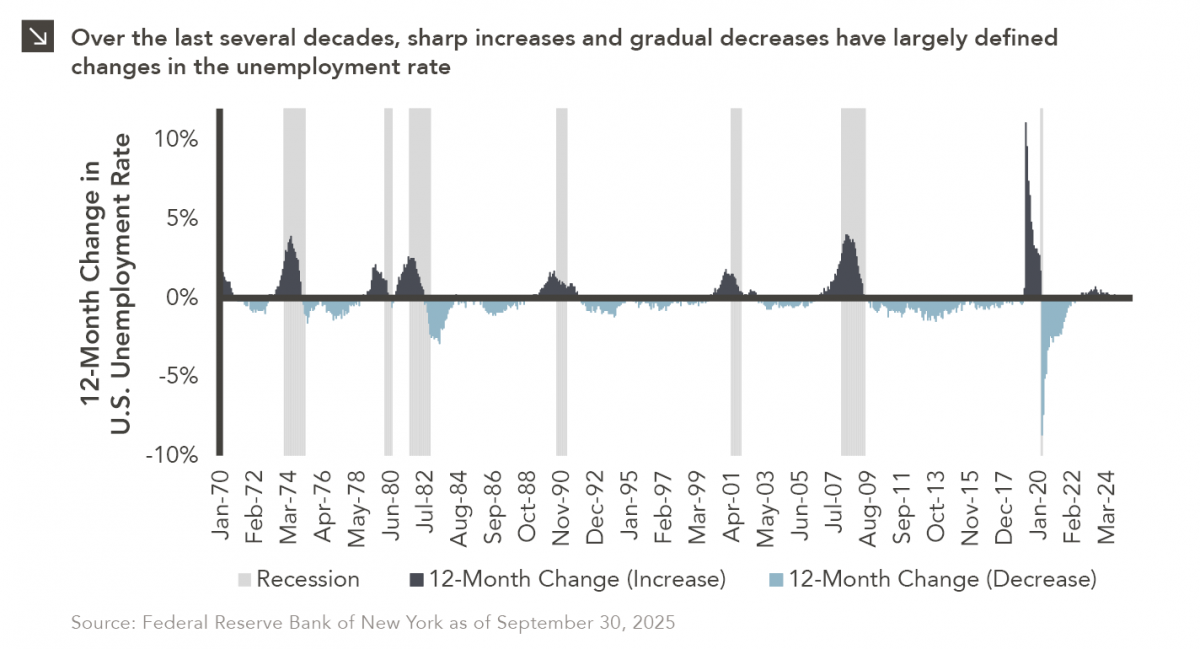

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >