Thomas Neuhardt

Research Associate

Get to Know Thomas

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National Association of Active Investment Managers (NAAIM) Exposure Index, which measures the average U.S. equity market exposure reported by NAAIM member firms (i.e., organizations that actively manage client portfolios). Reported exposures for this index include -200% (leveraged short) to -100% (fully short), 0% (market neutral), +100% (fully invested), and +200% (leveraged long), capturing the breadth of positioning from extremely bearish to highly bullish. Retail sentiment is represented by the American Association of Individual Investors (AAII) Sentiment Survey, which reflects the bullish-minus-bearish spread regarding the six-month outlook for stocks across individual AAII members (i.e., retail investors). When analyzed together, these indicators offer perspective on how both institutional and individual investors view the near-term prospects of equity markets.

Readers will note that these two indices have moved in tandem throughout most of the last several years but have diverged significantly in recent weeks as retail investor sentiment has plunged. It is not entirely clear what’s driving this latest divergence, but several factors likely play a role. Specifically, renewed U.S.–China trade tensions, the ongoing federal government shutdown, and interest rate uncertainty have likely weighed more heavily on retail investors, who tend to be more influenced by headline noise. Institutional money managers, on the other hand, appear to be maintaining confidence in healthy corporate fundamentals and the broader economic backdrop. Regardless of its exact cause, this divergence underscores the notion that sentiment data should be viewed as context-dependent rather than as a market timing signal.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

12.01.2025

A fundamental characteristic of U.S. labor markets is the pronounced asymmetry in unemployment dynamics, as joblessness rises anywhere from three…

11.24.2025

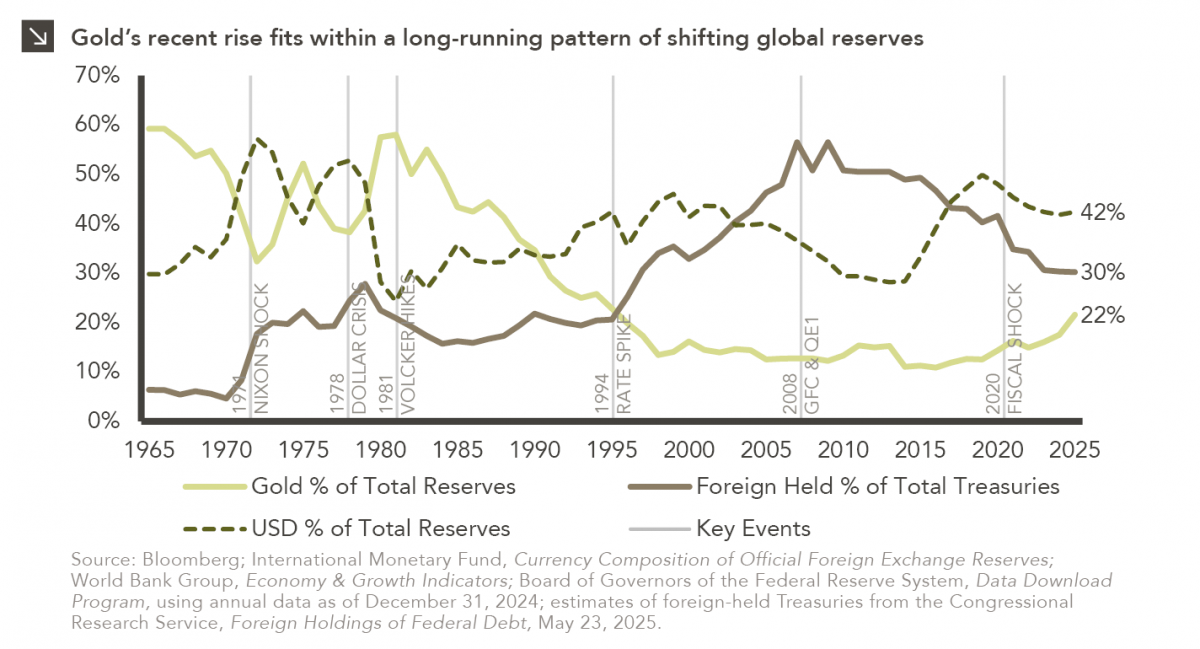

With gold now trading near $4,000 per ounce after a steady multi-year climb, investor attention has turned to the potential…

11.17.2025

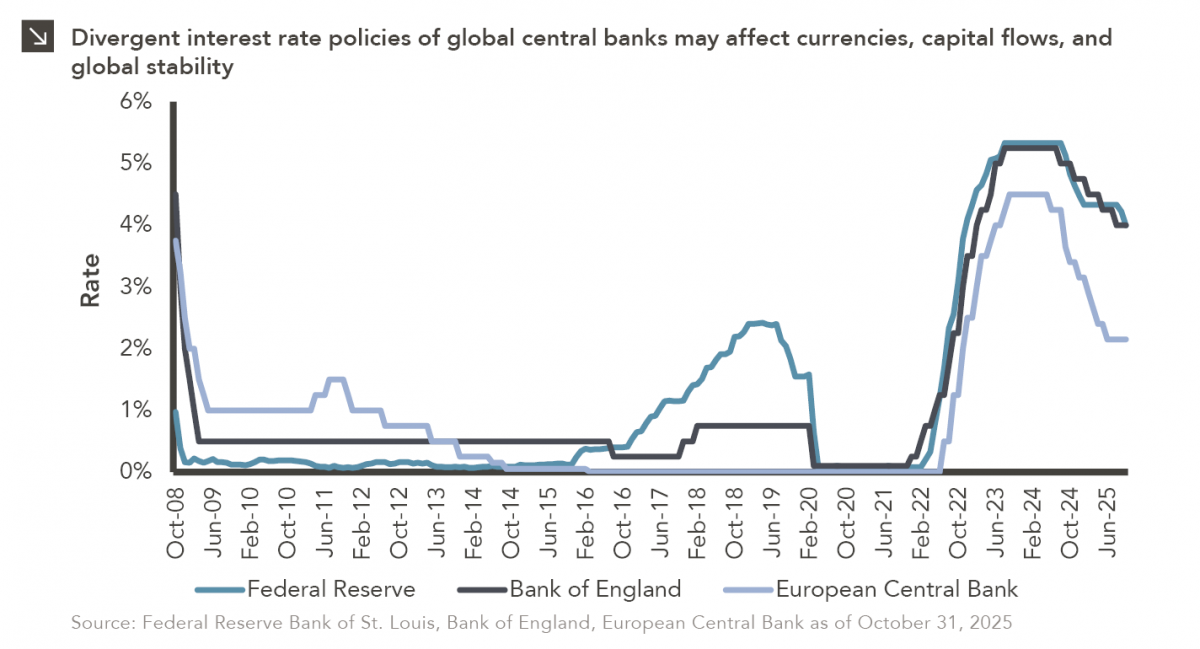

After a largely synchronized hiking cycle beginning in 2022, there has been a slight divergence in interest rate policies across…

11.10.2025

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >