Evan Frazier, CFA, CAIA

Senior Research Analyst

Earlier this week, Marquette published a newsletter detailing the ongoing market volatility caused by the Trump administration’s recent tariff rollout. Indeed, equity markets have reacted sharply to the new trade landscape, with the S&P 500 Index having fallen roughly 11.0% from its February peak as of this writing. While a significant portion of these losses came late last week, this week has seen even more extreme market fluctuations as investors struggled to assess the impact of new trade restrictions on security prices and the global economy. Specifically, the S&P 500 Index opened lower on Monday morning before surging amid rumors that the White House was considering a pause on its reciprocal tariff measures. The Trump administration quickly denied these rumors, and the benchmark would later turn negative before ending the day slightly up from its prior close. Markets opened sharply higher yesterday but steadily lost ground due to souring sentiment and a lack of progress on trade negotiations. Today, equity markets opened slightly lower before skyrocketing after an official announcement of a 90-day pause for reciprocal tariffs on non-retaliating countries. All told, Monday, yesterday, and today saw staggering intra-day price changes in the S&P 500 Index of roughly 8.5%, 7.3%, and 10.8%, respectively (in absolute value terms).

As this week’s chart indicates, price swings of this magnitude have only been exhibited during the most extreme periods in U.S. equity market history, including the Black Monday Crash of 1987 and the Global Financial Crisis. As such, it is imperative that investors navigate the current environment with a high degree of prudence and caution, especially given the likelihood of continued volatility as trade negotiations proceed. It is also helpful to remember that investors have historically been well compensated for bearing equity risk over multi-year periods, and that short-term fluctuations are the price of positive long-term returns. Marquette continues to closely monitor dynamics within global markets and will provide timely updates accordingly. Please reach out to us with any questions.

Print PDFThe opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

02.18.2026

Healthcare systems have faced an onslaught of challenges in recent years. They had to navigate the operational and financial headwinds…

02.17.2026

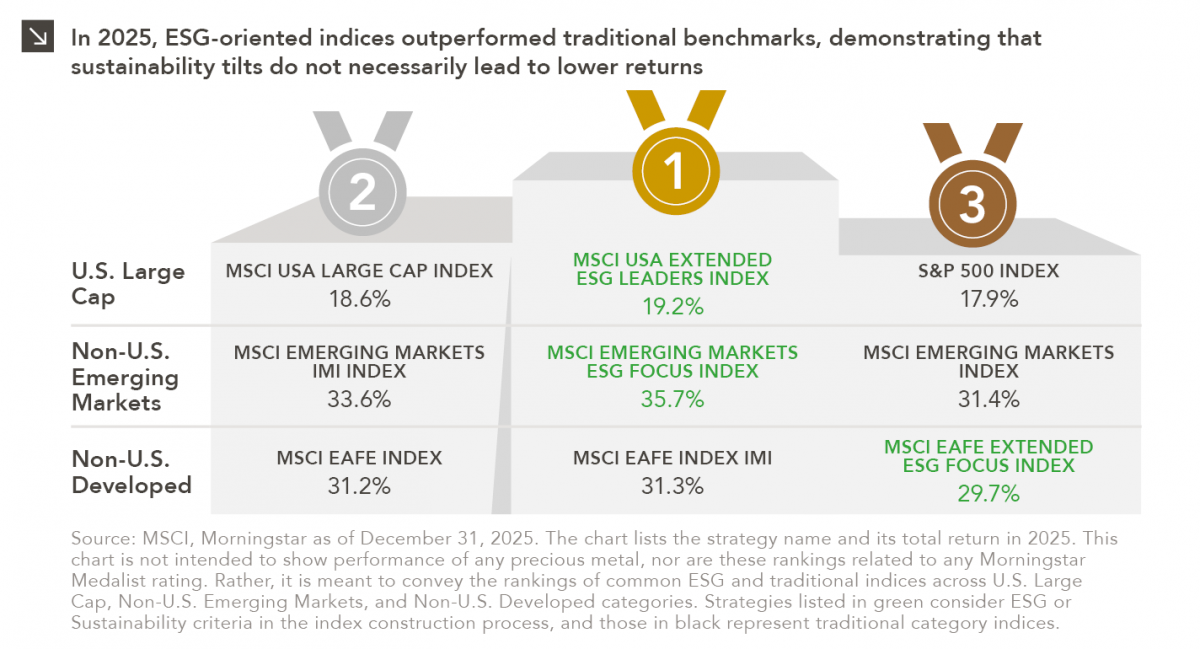

Performance is a key attribute of any investment strategy with a values-based or sustainability focus. As such, analyzing the 2025…

02.09.2026

Precious metals have been going on a magnificent run in recent years. Specifically, gold moved from $1,898/ounce at the end…

02.02.2026

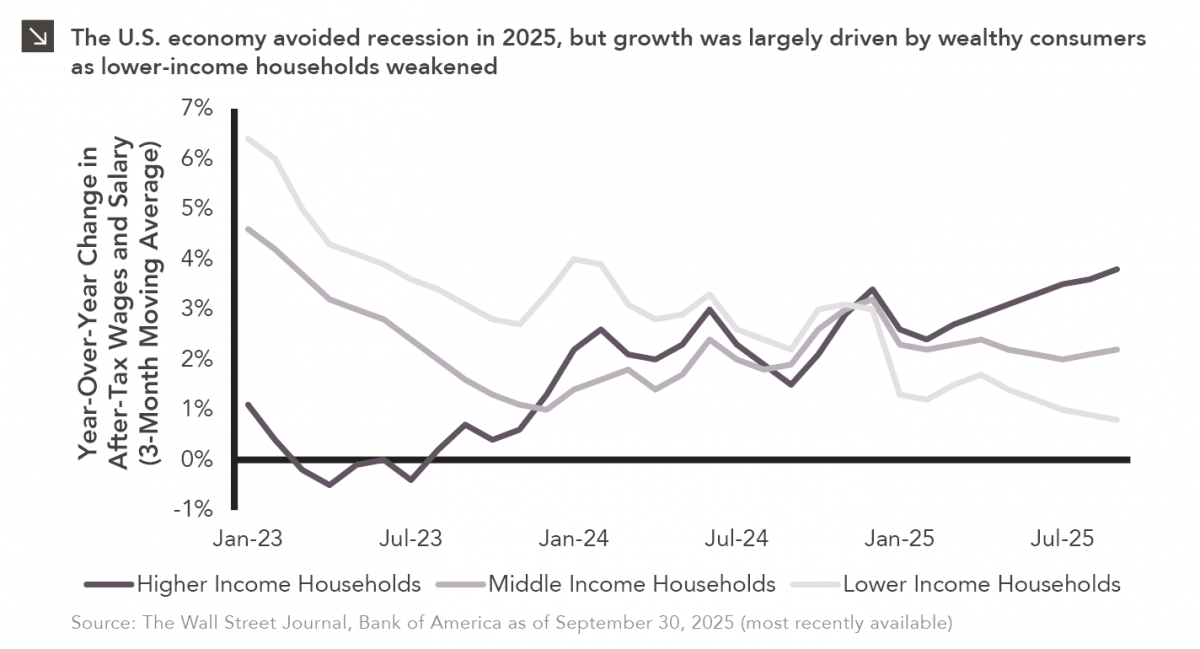

Macroeconomic forecasting is challenging in the best of times and proved downright impossible in 2025, which saw high levels of…

01.26.2026

In recent years, access to traditionally illiquid private markets has expanded through the rapid growth of evergreen funds, which provide…

01.22.2026

Anyone who has gone snowmobiling knows it can be simultaneously exhilarating and terrifying. Throttling across snow and through a forest…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >