David Hernandez, CFA

Director of Traditional Manager Search

The S&P 500 hit its recent peak on February 19th, 2020. Just sixteen trading days later it entered bear market territory and by March 23rd, the S&P 500 was down 33.2% from its all-time high. The intensity and speed of the sell-off surpassed both 1987 and 1929, two infamous years in investment history. Since March 23rd, the S&P 500 has rallied 27.4% through April 14th prompting the question: have we already seen the market bottom?

Identifying a market bottom is a near impossible task, one that is much easier with hindsight. Most bear markets see stocks rally 10% or more before falling back down and hitting a new bottom. The Global Financial Crisis produced five such bounces before finding its floor in March 2009. Near the turn of the century, the Tech Bubble produced three “false” rallies. Based on these data points, history would tell us that there are still further losses ahead. However, every bear market is unique and this one certainly fits that bill. Given the speed of the decline, might we see a faster recovery? The answer to that question is likely predicated on how well the spread of COVID-19 is controlled and whether we see a second wave of infections.

Print PDF > Was March 23rd the Market Bottom?

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

11.10.2025

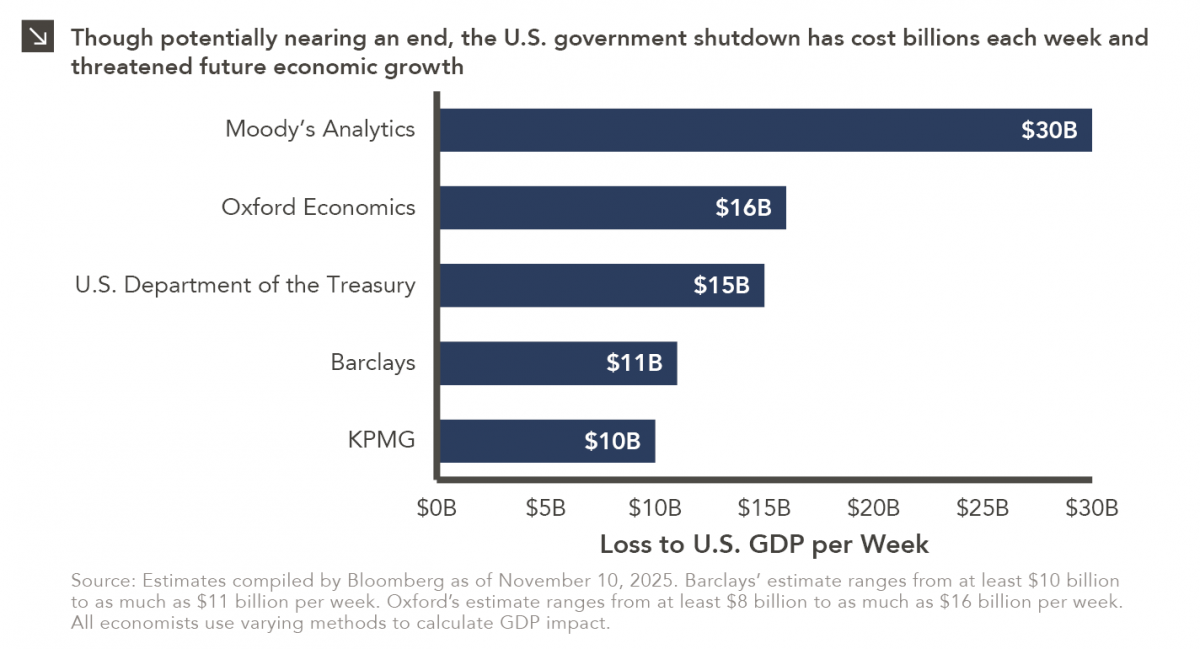

Over the weekend, the Senate overcame a key procedural obstacle in its attempt to end the record-breaking government shutdown, as…

11.03.2025

Small-cap equities are in a prolonged period of underperformance relative to large-cap stocks, but this trend has shown early signs…

10.27.2025

To paraphrase a quote from former President George W. Bush: “Fool me once, shame on… shame on you. Fool me…

10.22.2025

This video is a recording of a live webinar held October 22 by Marquette’s research team analyzing the third quarter…

10.22.2025

I spent the past weekend at my alma mater to watch them play their biggest rival. Football weekends there are…

10.20.2025

This week’s chart compares institutional and retail investor sentiment using two established indicators. Institutional sentiment is represented by the National…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >