Amy Miller

Associate Director of Private Equity

One of the oft-touted advantages of investing in private equity is the opportunity to buy in at a discount to public markets. This valuation discount, as measured by EV/EBITDA multiples, has persisted since 2012, widening to nearly 60% in 2020.¹ Since that peak, the discount has narrowed significantly as public market equities have sold off. While this may give some cause to pause, it is interesting to consider what transpired for investors between 2009 and 2012, on the heels of a near-meltdown of the financial system. With equities down sharply into 2009, the denominator effect boosted percentage allocations to private equity within investor portfolios. The instinctive reaction (and in some cases, forced action) may have been to abstain from new private equity investments beginning in 2009 so as not to exacerbate the over-allocation. This may sound familiar to private equity investors in 2022.

With hindsight being 20/20, these corrections to annual capital commitments ultimately resulted in an under-allocation to private equity, and thus underperforming portfolios over the next decade, as public markets and public market allocations snapped back. Furthermore, while private equity will likely not see the type of drawdown that public markets have seen, we do expect valuations to pull back, creating attractive entry points for managers with dry powder to deploy capital. While investors should be mindful of any liquidity constraints and maximum allocations to private markets, those that are able to remain steadfast in their annual commitment pacing schedules may find themselves in a better position once the public markets settle. Marquette believes that a successful private equity program is one that is consistently diversified by vintage year over time and highly selective in terms of manager partnerships.

¹Pitchbook, as of June 30, 2022

The opinions expressed herein are those of Marquette Associates, Inc. (“Marquette”), and are subject to change without notice. This material is not financial advice or an offer to purchase or sell any product. Marquette reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs.

01.07.2026

Please join Marquette’s research team for our 2026 Market Preview Webinar analyzing 2025 across the economy and various asset classes…

01.05.2026

The development of artificial intelligence is advancing along two largely distinct paths. The first centers on generative AI powered by…

12.29.2025

While the holiday season was once marked by bustling bars, readers may notice that nightlife isn’t what it used to…

12.22.2025

Private equity is known for being an illiquid asset class, with investments typically locked up for several years and limited…

12.15.2025

While technology-oriented firms have made their presence known in equity markets for several years, these companies have made waves in…

12.08.2025

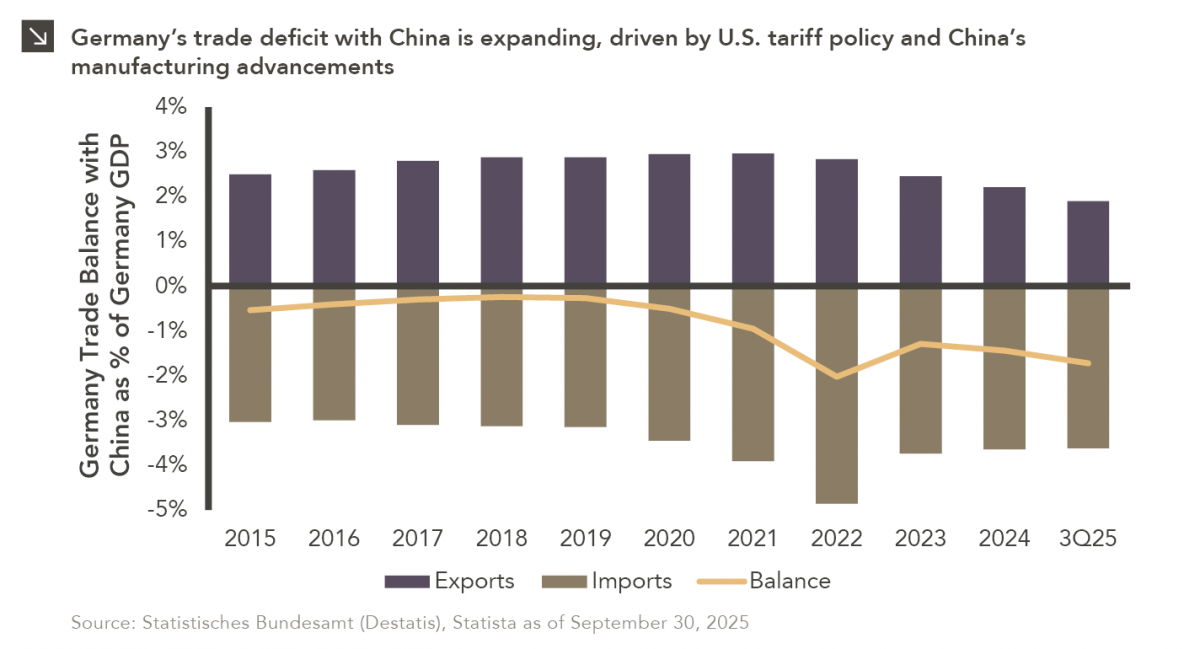

Germany is on pace for a record-breaking trade deficit with China this year, with Chinese exports originally intended for the…

Research alerts keep you updated on our latest research publications. Simply enter your contact information, choose the research alerts you would like to receive and click Subscribe. Alerts will be sent as research is published.

We respect your privacy. We will never share or sell your information.

If you have questions or need further information, please contact us directly and we will respond to your inquiry within 24 hours.

Contact Us >